Buy Marico Ltd For Target Rs. 775 by Motilal Oswal Financial Services Ltd

Embarking on the portfolio diversification journey

* We met with the management of Marico (MRCO) to discuss industry trends, the company’s growth across verticals, and its long-term strategies. MRCO is focused on achieving steady double-digit growth, driven by the gradually improving trajectory in its core categories, rapid scaling of new-age businesses, and stable growth in international markets. The company is shifting its focus towards value-added products, particularly in foods and premium personal care, with a target of 20-25% CAGR in these segments. Parachute and Saffola demand remain steady despite sharp price hikes (15-20%) implemented to mitigate input cost pressure. Within the Saffola franchise, Foods is expected to contribute more than half of the revenues (currently at ~30%) over the next 4-5 years. Marico’s Digital business is growing rapidly, with Plix and Beardo showing strong progress. The company is expanding its direct reach in General Trade (GT) through Project SETU and is benefiting from the growth of Quick Commerce (QC), which now accounts for ~3% of India sales. Despite challenges in urban demand, the company’s diversified portfolio and investment in digital channels are positions it for sustained healthy growth.

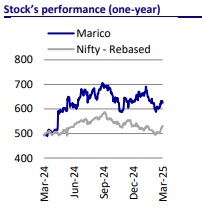

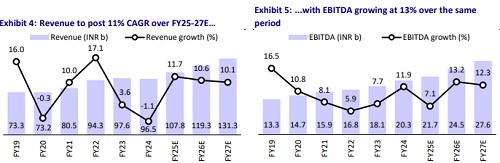

* The company expects double-digit revenue growth (missing for most peers) in FY26, driven by healthy volume growth, pricing, and continued momentum in the Foods and Premium Personal Care portfolios. While elevated input costs may weigh on margins in the near term, the long-term outlook remains positive, supported by a favorable product mix and premiumization. We reiterate our BUY rating on the stock with a TP of INR775 (based on 50x Mar’27E EPS).

Industry recovery slow but steady.

Management indicated that the FMCG sector is currently witnessing a stable demand landscape. Rural demand is gradually improving, while urban demand is expected to recover over the next few quarters as inflation eases. Tax relief benefits can help drive consumption spends, particularly urban consumption. FY26 could see the benefits of supportive government schemes and a healthy crop season, which are expected to aid consumption.

PCNO may deliver 5-7% volume growth over the medium term

Parachute Coconut Oil (PCNO) is expected to deliver 5-7% volume growth going forward, primarily driven by the continued loose to branded conversion in the coconut oil segment. With the anniversarisation of price hikes starting from 2QFY26 onwards, the volume-value gap is expected to narrow.

VAHO expects stabilization in Amla category; mid and premium segments perform well

MRCO’s Value-Added Hair Oil (VAHO) segment is expected to gradually recover moving forward. The volatility in the Amla category is expected to ease in the coming quarters. Within the VAHO category, the mid and premium segments continue to outperform the lower-end portfolio. This growth is supported by increased Above The Line (ATL) investments and brand activations by MRCO, along with continued improvements in rural consumption sentiment, which will help the company boost sales and market presence in these segments.

Foods to post 20-25% CAGR; innovation pipeline strong

Currently, Saffola brand sales are split, with ~70% coming from oils and the remaining ~30% from foods. However, MRCO expects the Foods segment to contribute ~50% to the brand's sales over the next 4-5 years, driven by a high sales growth of over 20-25% in foods, while edible oils are likely to record mid-high singledigit growth. Saffola Oats remains the top brand in the oats market and continues to see strong double-digit growth. Additionally, MRCO’s performance in honey and soya chunks has been healthy. These categories are expected to break even at EBITDA level once they achieve higher scale. While MRCO’s Food category has a strong presence in Modern Trade (MT) and e-commerce channels, the company has the scope to achieve higher penetration in GT, a key area for potential improvement in its distribution strategy for the Foods segment.

New-age business to be the key growth driver for MRCO

The Foods and Premium Personal Care portfolios are expected to post 20-25% CAGR. Currently, these segments have an ARR of INR19b, contributing ~21% of total sales (9MFY25). Among these new businesses, Plix is expected to become an INR5b+ business in FY26, with positive margins. Beardo is on track to achieve double-digit EBITDA margins in FY25. MRCO is targeting double-digit EBITDA margins for its digital-first businesses by FY27. True Elements and Just Herbs continue to show strong growth momentum, and MRCO has successfully reduced cash burn in these brands. The digital-first portfolio is expected to reach an ARR of ~INR6b by FY25-end and scale to 2x the FY24 ARR in FY27. As a result, Foods and Premium Personal Care are expected to contribute ~25% of domestic revenue by FY27.

International business on steady growth trajectory

MRCO’s international business posted 7% growth in INR terms for 9MFY25 compared to the previous year, with around 13% growth in constant currency growth terms, backed by broad-based growth across markets. The segment continues to perform well, and MRCO expects this momentum to continue with double-digit constant currency growth in the future. It also anticipates stable margins at current levels for the international business, signaling sustained profitability and strong market performance globally.

QC accounts for ~3% of sales, while GT continues to dominate

The company has seen impressive growth in QC, which is growing at 50+% YoY and now accounts for ~3% of MRCO’s India sales. Along with e-commerce and modern trade, QC has helped MRCO further strengthen its new business segments by expanding its reach and tapping into evolving consumer preferences. Project SETU now covers 11 states and MRCO continues to drive efficient coverage across all geographies, ensuring a broader reach and more effective market penetration. In terms of domestic revenue mix, organized channels contribute ~30%, Canteen Stores Department (CSD) accounts for 6-7%, and GT remains the dominant channel, contributing 63-64%.

Double-digit growth aspirations with greater focus on value-added offerings

MRCO’s product portfolio is gradually shifting its focus from traditional high-salience categories, like Parachute coconut oil and Saffola edible oils, towards a stronger emphasis on value-added products in the food segment, premium personal care, and its growing digital business. This strategic transition aligns with MRCO’s medium-term aspiration of double-digit sales growth for its India business, alongside a similar trajectory for profitability. Additionally, the company remains open to inorganic growth opportunities in the food and personal care segments, provided these acquisitions are a strong brand fit and have the potential to drive profitable growth for the company.

Price anniversarisation to begin from 2QFY26

In response to the steep rise in input cost inflation, MRCO has implemented price hikes across its core portfolios, with PCNO seeing an increase of ~15% and Saffola edible oil witnessing ~20% price hike. Most key raw material prices have increased in recent months. However, copra is at the peak of the inflationary cycle and MRCO expects the prices to ease once the flush season begins in early Q1FY26. The company anticipates strong pricing growth in 4QFY25 and 1QFY26, with partial anniversarisation beginning 2QFY26 onwards for PCNO. The company has maintained its operating margin guidance at ~20% for FY25

Valuation and view

* MRCO is well-positioned for sustained growth, driven by several key factors. The company is experiencing consistent market share gains in its core portfolios, accelerated growth in Foods and Premium Personal Care, and healthy performance in its international business, all of which are expected to strengthen its revenue trajectory in FY25-26. To expand its distribution reach, the company has launched Project SETU, a transformative initiative aimed at enhancing its direct reach in GT. This project is designed to drive growth by deepening market penetration and strengthening MRCO’s presence across India. With these strategic initiatives in place, the company is focused on ensuring long-term profitability and further diversifying its business portfolio.

* We model 11%/13% revenue and EBITDA CAGR during FY25-27E and reiterate our BUY rating on the stock with a TP of INR775 (based on 50x Mar’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412