Neutral Exide Ltd for the Target Rs.379 by Motilal Oswal Financial Services Ltd

Margin improvement led by cost control

Replacement, solar and industrial UPS are key growth drivers

* EXID's 1QFY26 PAT of INR3.2b came in ahead of our estimate of INR2.8b, aided by better-than-expected margins even as revenue was in line.

* While the market appears to be upbeat on EXID’s lithium-ion foray, we remain cautious about the returns from the business. Besides, the stock at ~25.5x/23x FY26/27E EPS appears fairly valued. Reiterate Neutral with a TP of INR379 (based on 20x Jun’27E EPS).

Better-than-expected operational performance

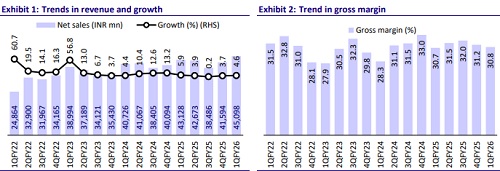

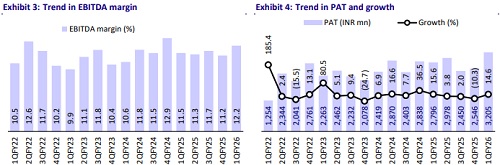

* Standalone revenue grew 4.6% YoY to INR 45.1b (in line), while EBITDA/adj. PAT rose ~11%/15% YoY to INR 5.5b/INR3.2b (est. INR5.1b/INR2.8b).

* Solar business proved to be the fastest-growing segment, supported by various government programs.

* 2W and 4W replacement segments remained buoyant, with double-digit growth in the mobility business.

* Industrial UPS posted strong growth amid increasing demand for critical power backup solutions in several sectors. Industrial infrastructure also improved YoY as order inflow and execution picked up in sectors like power, railways, tractions, etc.

* Auto OEM business continued to be impacted by lower demand from vehicle manufacturers in both PV and 2W segments. Automotive exports also declined amid geopolitical disruptions.

* Gross margin remained largely flat YoY (down 40bp QoQ) at 30.8% (in line).

* Employee expenses came in much lower than our estimate at 3.4% (down 280bp YoY/290bp QoQ). Even other expenses were about 30bp lower than our estimate at 12.6% of revenue.

* As a result, EBITDA margin improved 70bp YoY to 12.2% (vs. est. 11.4%).

* Adj. PAT at INR3.2b came in ahead of our estimate of INR2.8b.

* EXID invested INR3b in 1Q and additional INR1b in Jul’25 in the Exide Energy Solutions project site. Total equity investment till date stands at INR37b. Equipment installation and construction work are nearing completion and production is expected to begin toward FY26 end.

From the Press Release

* Total sales growth was marginal in 1Q due to a slowdown in manufacturing sector growth, decline in most of the auto OEM segments and lower international business due to global tariff uncertainties. The auto replacement, solar and industrial UPS verticals showed promising doubledigit growth.

* The near-term outlook remains positive, supported by an improved product mix, innovative products and cost efficiencies in manufacturing facilities.

* Construction for the lithium-ion cell manufacturing project is progressing rapidly, with the team focusing on timely completion. Commercial operations are targeted to begin in FY26.

Valuation and view

* Given the significant imminent risk to its core business, EXID has forayed into the manufacturing of lithium-ion cells in partnership with S-Volt at a total investment of INR60b in two phases. While the market appears to be upbeat on EXID’s lithium-ion foray, we remain cautious about the returns from the business. Besides, the stock at ~25.5x/23x FY26/27E EPS appears fairly valued. Reiterate Neutral with a TP of INR379 (based on 20x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)