Buy InterGlobe Aviation Ltd for the Target Rs. 6,375 by Motilal Oswal Financial Services Ltd

Robust earnings; global scale-up to boost growth

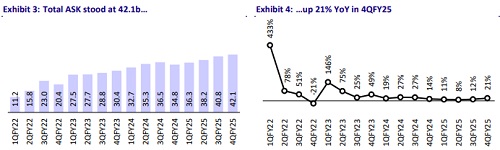

* InterGlobe Aviation (INDIGO) reported a 59% YoY growth in EBITDA to INR60.8b and a PAT of INR30.7b (vs. our est. of INR13.3b) in 4QFY25. Revenue passenger kilometers (RPK) stood at 36.8b. The passenger load factor (PLF) was 87.4% with available seat kilometers (ASK) of 42.1b (est. of 41.8b) and yield of INR5.32 (vs. est. of INR5.14, up 3% YoY) in 4QFY25.

* In 4QFY25, INDIGO carried 32m passengers, driven by a strong 30% YoY growth in international traffic, Mahakumbh festivities, and a prolonged wedding season. It added a net of 67 aircraft in FY25 (vs. 58 in FY24) and enhanced its operational performance, maintaining robust on-time metrics. The network expanded to 41 international destinations, with international ASKs at 30%, supported by the damp lease of six B787s and new routes like Amsterdam and Manchester from Mumbai.

* To enhance its loyalty ecosystem, Indigo entered partnerships with Accor and Swiggy. The airline also sees multiple tailwinds ahead in FY26, including hosting the IATA AGM in India after 42 years in CY25 and the upcoming second airport in both Delhi and Mumbai (first test flights done by INDIGO). Margins improved in 4QFY25, aided by better unit revenue and a favorable crude environment. The grounded aircraft (AOG) situation has been improving steadily, from a peak in early CY24 to the mid-40s currently.

* While Apr’25 saw healthy yields and growth, cancellations since late Apr’25 until a few days back have dampened momentum, though recovery is likely in Jun’25. The Pakistan airspace closure had minimal impact, affecting just 34 of 2,200 daily flights. Indigo launched its “Stretch” product on the Delhi– Bangkok route as well and plans a wider rollout as deliveries continue in CY25. Capacity is expected to grow in the mid-teens YoY in 1QFY26.

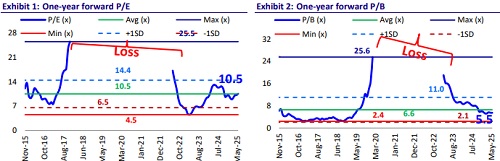

* Management continues to work towards its key promises with a customer-first approach. We retain our estimates for FY26/27 as of now. The stock is trading at 20.5x FY27E EPS of INR265.7 and 9.1x FY27E EV/EBITDAR. We reiterate our BUY rating with a TP of INR6,375 (based on 10x FY27E EV/EBITDAR).

Beat led by lower-than-expected employee costs and opex

* Yield stood at INR5.32 vs. our estimate of INR5.14 (up 3% YoY). RPK was 36.8b (our est. of 37.9b, +23% YoY), with PLF at 87.4%. ASK was 42.1b (our est. of 41.8b, +21% YoY).

* Thus, INDIGO’s revenue stood at INR221.5b (-3% est., +24% YoY), which includes compensation from International Aero Engines, LLC (IAE) for the Aircraft on Ground (AOG) situation due to the unavailability of engines. Certain reimbursements have also been netted off against expenditure for the quarter.

* EBITDAR stood at INR69.5b (est. of INR46.2b, +59% YoY) with EBITDA at INR60.8b (our est. of INR38.8b, +53% YoY). The company has paid IGST of INR939m in 4QFY25 on the re-import of repaired aircraft, which is under dispute right now. PAT stood at INR30.7b (est. of INR13.3b, +62% YoY).

* For FY25, revenue was INR808b (+17% YoY), EBITDA was INR180b (+11% YoY), and PAT stood at INR72.5b (-11% YoY). The BoD declared a final dividend of INR10/share for FY25.

Valuation and view

* INDIGO has adopted a completely different operational strategy after Mr. Pieter Elbers joined the company as the new CEO in Sep’22. He has over 30 years of experience working at different positions at KLM Royal Dutch Airlines. His wealth of experience has not only helped INDIGO compete with global majors but also consistently increase its market share in the domestic market. However, this could also pose a ‘key man’ risk.

* INDIGO serves over 100m passengers and adds one aircraft a week (on average). It has expanded its international share to ~30% in FY25 of Available Seat Kilometers (ASK) through strategic airline partnerships. The company focuses on strengthening its global presence via loyalty programs and proactive brandbuilding efforts while continuously refining schedules to enhance reliability and attract a larger share of international travelers.

* The stock is trading at 20.5x FY27E EPS of INR265.7 and 9.1x FY27E EV/EBITDAR. We reiterate our BUY rating with a TP of INR6,375 (based on 10x FY27E EV/EBITDAR). Key downside risks: 1) delays in wide-body aircraft deliveries or rising AOGs; 2) sharp volatility in crude or rupee could pressure margins if not passed on; 3) a higher share of business-class seating or premium fleet may dilute INDIGO’s cost advantages.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)