Sell Thermax Ltd for the Target Rs. 3,100 by Motilal Oswal Financial Services Ltd

Legacy projects continue to hurt profitability

Thermax (TMX)’s 4QFY25 performance reflected improved execution while order inflows remained weak. Its 4QFY25 revenue/EBITDA/PAT grew 11.6%/10%/5% YoY. Revenue and EBITDA growth was slightly better than estimates, while a higher-thanexpected tax rate resulted in a miss at the PAT level. The industrial product division continued to outshine other divisions, while the industrial infra, and green solutions division remained hit by higher costs of low-margin legacy projects in FGD, Bio-CNG, and Sulphur recovery areas. Ordering remained adversely impacted by delays in inquiry finalizations, while the pipeline remained strong. We believe that lower ordering and continued cost pressures from legacy projects will have an impact on execution and profit growth for the company. We trim our estimates by 5% each for FY26/FY27. We reiterate our Sell rating with a TP of INR3,100, based on core business valuation at 40x Mar’27E EPS and the addition of subsidiary valuations.

Results affected by cost overruns

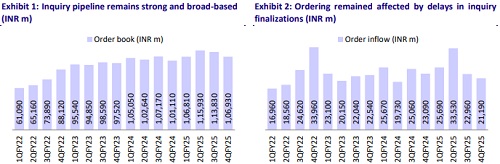

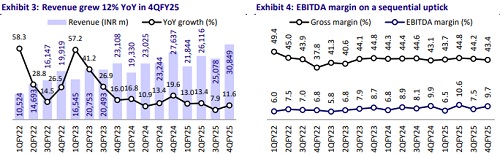

TMX’s 4QFY25 revenue/EBITDA/PAT grew 11.6%/10%/5% YoY. Revenue and EBITDA growth was slightly better than estimates, while a higher-than-expected tax rate resulted in a miss at the PAT level. Its revenue of INR30.8b (+11.6% YoY) (MOFSL est. INR29.1b) was led by 18%/4%/4%/36% YoY growth in Industrial Products/Industrial Infra/Green Solutions/Chemical segments. EBITDA margin stood at 9.7% for 4QFY25 and 8.7% for full year FY25. Gross margin contracted ~85bp QoQ but expanded ~40bp YoY to 43.4%, owing to an adverse mix in industrial infra and chemical segments. This, along with operating deleverage, led to an EBITDA margin contraction of ~20bp YoY to 9.7%, while EBITDA at INR2.9b beat our estimate by 5%. With a neutral operational performance and higher other income (up 39% YoY), adj. PAT at INR2.05b increased 5.3% YoY but was 8% below our estimates due to a higher tax rate. Order inflows for the quarter stood at INR21b (-8% YoY), and the overall order book was INR106.9b (+6% YoY).

Segment-wise performance led by the Industrial Product and Chemical division

Across segments, the industrial product and chemical segment’s revenue grew 18%/36% YoY, while growth remained weak in the industrial infra and green solutions segments. Segment-wise, EBIT margin performance was strong only in the industrial product and chemical segments. EBIT margin improved to 14.4% for the industrial product segment (from 11.7% in 4QFY24). Margin in the industrial infra segment continued to remain weak at 2.8% in 4QFY25 vs. 6.1% in 4QFY24. Another disappointment came from the negative EBIT margin in the green solutions segment, as this segment’s results were affected by the recognition of higher technology intervention costs amounting to INR660m in Bio-CNG projects under the Industrial Infra segment. The chemical segment’s EBIT margins remained strong at 16.6%.

Base ordering weak during the quarter

Though the base ordering was weak during the quarter, the company’s inquiry pipeline is strong and broad-based. Order inflow for the full year grew 11% YoY. The company expects a few projects in steel, power, waste-to-energy, and Bio CNG to be finalized in the coming months, while projects in refining, petrochemical, and cement sectors will be finalized in 2HFY26. Pipeline of projects is healthy in the industrial infra and chemicals division too, and the green solution segment has been steady. We bake in order inflows to post a CAGR of 19% over FY25-27.

Margins remain affected by low-margin projects taken in the past

TMX’s margins remained quite strong for the industrial product division, but margins for the industrial infra and green solutions segment were hit by higher costs. For the industrial infra segment, the company had taken a hit of nearly INR850m for the full year on cost overruns in the bio-CNG project. There is an outstanding OB of INR3.4b left from this project, which will be over in FY26 and FY27. From the low-margin FGD projects, the outstanding order book is currently INR4.5b, which will also be over mainly in FY26 (INR3.5b) and FY27 (INR1b). The low-margin Sulphur recovery project, too, will continue until the beginning of FY27. We thus expect industrial infra segment margins to remain volatile and weak until FY27 due to a low-margin order book. The green solution segment’s margins were affected by continued losses in FEPL, which can come down from FY27E, as the company hopes to realize insurance claims. TMX expects margins in the chemical segment to remain in the mid-teens despite a higher share of specialty chemicals, as the company is continuously investing in new products in the chemical segment.

Financial outlook

We expect a CAGR of 12%/21%/18% in revenue/EBITDA/PAT over FY25-27. We build in 1) 19% CAGR in order inflows, 2) a gradual recovery in EBIT margins of the Industrial Product and Chemical divisions to 11.5% and 17.0%, respectively, by FY27E, and 3) control over working capital and NWC (at 10 days).

Valuation and view

The stock is currently trading at 50.2x/42.4x FY26E/FY27E EPS. We reiterate our Sell rating with a TP of INR3,100 based on 40x Mar’27 EPS. With the value of investments in subsidiaries, we believe that stock is currently factoring in a possible revival in order inflows as well as margin improvement.

Key risks and concerns

A slowdown in order inflows, a spike in commodity prices, a slower-than-expected revival in private sector capex, and increased competition are the key risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412