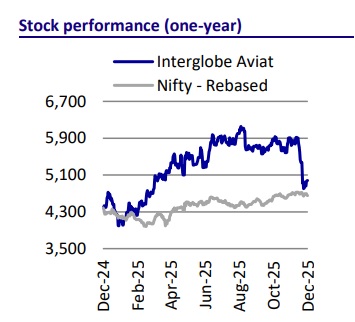

Buy Interglobe Aviation Ltd for the Target Rs.6,300 by Motilal Oswal Financial Services Ltd

Short-term disruption; longer-term opportunity

* India is emerging as a key beneficiary of global aviation growth, underpinned by rising long-haul demand, expanding connectivity, and robust outbound tourism. Faster international traffic growth for Indian carriers, strong diaspora-led routes, and income-tourism correlations comparable to China position India for a sustained multi-year travel upcycle.

* Interglobe Aviation (INDIGO) has been proactively positioning itself to capture this opportunity. Its accelerated international pivot—evident from the rise in overseas passenger mix to 13.5% in FY26 YTD (vs 7.3% in FY19), the doubling of destinations to 43, and a 14.5% increase in winter schedules—reflects a deliberate push towards long-haul expansion. This momentum is further reinforced by the doubling of its A350 order to 60 aircraft, the addition of B787 capacity via damp leases, and the development of an INR10b MRO facility in Bengaluru (in the next 3-4 years), all of which collectively enhance scale, operating economics, and FX resilience.

* However, this expansionary trajectory was temporarily disrupted by operational constraints, as the airline’s aggressive winter schedule misaligned with the new Flight Duty Time Limitation (FDTL) norms effective 1st Nov’25. The resulting crew shortage turned an otherwise contained November disruption into a full-scale operational breakdown in the first week of December, prompting regulatory intervention, fare caps, mandated schedule rationalization, and extensive refunds. Management has consequently lowered its FY26 guidance, and we have revised our estimates to reflect this impact.

* Nonetheless, we believe INDIGO’s long-term structural thesis remains intact. Its scale advantages, improving on-time performance, and disciplined pricing strategy should enable the airline to sustain market leadership and remain a core beneficiary of India’s travel and tourism boom.

* Factoring the recent disruption, revised guidance and rising fuel cost, we have reduced our Revenue/EBITDAR/PAT estimates by only 2%/6%/18%, as we had already incorporated lower available seat kilometer (ASK) and revenue passenger kilometer (RPK), along with higher cost per available seat kilometer (CASK) post our 2QFY26 results. We have also reduced our FY27/FY28 PAT estimates by 15%/11%, considering the higher employee costs stemming from the new FDTL rules and increasing fuel costs.

* We reiterate BUY with a TP of INR6,300, valuing it at 9x FY28E EBITDA (implied P/E on FY28E is 26x). We have rolled over our target to FY28 and reduced our EV/EBITDA multiple to 9x from 11x on FY27E.

India stands at the center of a global aviation opportunity

* India is well-positioned as a key beneficiary of global aviation growth, with rising long-haul demand, expanding international connectivity, and increasing outbound tourism. ? India’s international passenger traffic has clocked a 4.1%/4.9% CAGR over the past 10/five years, while domestic airlines’ international passenger traffic has grown at a faster pace of 6.9%/8.5%, respectively, indicating increased connectivity to neighboring countries and regions with higher Indian diaspora.

* Of the top 10 destinations (to and from), nine are neighboring countries, accounting for 70% of the international traffic in FY24. UAE tops the list with a 30% traffic share.

* While neighboring destinations account for a larger share, long-haul destinations have seen higher growth over the past six years. Australia recorded an 18.3% CAGR over the past six years, followed by the Maldives/Turkey/Canada at 16.5%/11.7%/11.3%. This trend indicates a rising preference for longer holidays, relocations, and higher travel spending.

* India’s domestic tourism is expected to mirror China’s growth trajectory, driven primarily by rising GDP per capita and improving purchasing power. China provides a relevant benchmark given the similarities in population size, geographic diversity, and cultural depth. India is now at an inflection point similar to where China was in CY07, with a GDP per capita of USD2,698; India’s current GDP per capita is ~USD2,820. (Refer to Exhibits 9 and 10).

* As China’s economy expanded at ~10% CAGR over CY07–25, rising GDP per capita drove a sharp rise in domestic tourism, with spending increasing at an 18% CAGR and accounting for the majority of total tourism expenditure.

* A strong correlation between economic growth and domestic tourism spending is evident in both countries. While China’s domestic tourism spending per capita rose rapidly over the past two decades, India’s remains significantly lower but is steadily increasing. India’s GDP per capita has grown at a healthy pace over the last 20 years (~6% CAGR), and tourism spending shows a high positive correlation with income growth.

* Rising incomes, higher travel spend, and faster growth in long-haul demand are structurally expanding India’s international aviation opportunity, mirroring China’s trajectory. This evolving demand profile creates a strong, sustainable runway for Indian carriers—particularly INDIGO—to scale and deepen its international network.

INDIGO building India’s global aviation franchise]

* To capitalize on growing international opportunity, INDIGO has increased its international flight mix, with passenger share rising to 13.5% as of FY26 YTD vs 12% in FY25 and 7.3% in FY19. (Refer to Exhibit 13). INDIGO has also doubled its A350 widebody order to 60 aircraft vs 30 aircraft order earlier, strengthening its ability to add new long-haul international routes and connect India with major global markets.

* Ahead of its own widebody deliveries from CY28, INDIGO has added four B787 aircraft on damp lease, with two more to be inducted shortly, supporting nearterm capacity growth on routes such as Amsterdam, Manchester, Copenhagen, and London Heathrow.

* The international network has expanded sharply, with destinations doubling to 43 currently from just over 20 destinations three years ago.

* According to Cirium, a global aviation analytics company, INDIGO has increased its international winter schedule by 14.5%, with up to 44,035 flights this season (Oct to Mar), while airlines such as Air India have seen a decline in their international winter schedules (by 9% YoY). (Refer to Exhibit 14).

* Structural benefits of longer-haul flying remain intact, with lower yields per ASK offset by a decline in CASK, supporting overall unit economics as scale builds.

* The company’s MTM exposure to currency movements remains material, with every INR1 depreciation implying an estimated ~INR9b impact.

* INDIGO’s FX exposure is largely driven by USD-denominated lease liabilities and maintenance costs, with over 60% of total expenses (including fuel and maintenance) either directly or indirectly dollar-linked.

* As international operations scale up and the brand gains global traction, we expect higher USD inflows from overseas revenue to create a natural hedge, providing incremental protection against currency volatility.

* Moreover, in 2QFY26, INDIGO commenced the development of a state-of-theart MRO facility in Bengaluru, entailing capex of ~INR10b over the next 3–4 years for a 12-bay MRO capable of servicing both narrowbody and widebody fleets. Once operational, the facility is expected to enable in-house heavy maintenance for widebodies, reduce turnaround times, lower dependence on third-party MROs, and partially mitigate FX exposure.

* Currently, ~90–95% of maintenance activity is outsourced, with a significant portion undertaken by international MROs. The in-house facility should meaningfully rebalance this mix over time.

Short-term meltdown; returning to normalcy, albeit with a guidance cut

* The expansionary trajectory was temporarily disrupted by operational constraints, as the airline’s aggressive winter schedule misaligned with the new Flight Duty Time Limitation (FDTL) norms effective 1st Nov’25.

* However, by 9th Dec’25, INDIGO reported ‘full stabilization’, with operations improving significantly. Flight count increased from 700 on Dec 5th to ~2,000 by Dec 11Th .

* On-time performance (OTP) recovered to 91% by Dec 8th, while network connectivity was restored to 137 out of 138 destinations.

* However, the disruption, coupled with a further 10% reduction in the winter schedule, is expected to reduce 3QFY26 revenue by 10-12%, with a higher impact on EBITDA due to lower capacity.

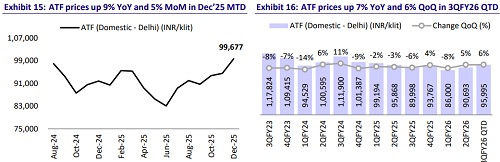

* Lower capacity and higher costs due to cancellations, refunds, passenger monetary support, DGCA fines, depreciating INR/USD, and increasing ATF prices (up 9% YoY/5% MoM to INR99,677/kltr in Dec’25) will lead to high CASK.

* Consequently, INDIGO has reduced its 3QFY26 guidance. Capacity (in terms of ASKs) is now expected to grow in high single digits to low double digits YoY vs the high-teens growth anticipated earlier. PRASK is likely to decline by midsingle digits YoY vs flattish to slight growth expected earlier.

* This disruption has not only impacted the company’s short-term financials but also dented customer sentiment, which, we believe, could have longer-term implications. Additionally, the DGCA has intensified scrutiny of INDIGO’s flights to prevent future failures.

* Factoring this in, we have reduced our Revenue/EBITDAR/PAT estimates by only 2%/6%/18%, as we had already incorporated lower ASK/RPK and higher CASK (based on the increasing ATF) post our 2QFY26 results. We have also reduced our FY27/FY28 PAT estimates by 15%/11%, considering higher employee costs stemming from new FDTL rules and increasing ATF costs.

* INDIGO continues to command over 60% market share. However, such disruptions create opportunities for other airlines to capture market share and strengthen their position in the growing domestic travel industry. Despite this, in our opinion, INDIGO will remain the market leader (at the current share) over the long term, supported by its fleet expansion pipeline, addition of new destinations (domestic and international), efficient OTP, and competitive pricing.

Valuation and view

* Despite near-term challenges from operational disruptions and rupee depreciation, we remain confident in the company’s long-term growth strategy. INDIGO’s domestic network remains the backbone of its operations, supporting India’s travel and tourism evolution, while expanding international connectivity provides a natural hedge and enhances margins.

* We expect its revenue/EBITDAR/Adj. PAT to clock a CAGR of 12%/13%/9% over FY25-28. We reiterate BUY with a TP of INR6,300, valuing at 9x FY28E EBITDA (implied P/E on FY28E is 26x). We have rolled over our target to FY28 and reduced our EV/EBITDA multiple to 9x from 11x on FY27E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)