Neutral Bajaj Housing Finance Ltd for the Target Rs. 120 by Motilal Oswal Financial Services Ltd

Beyond brick and mortar: Playing the major league

Well-positioned to drive market-leading growth with pristine asset quality

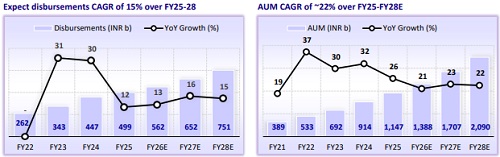

* Bajaj Housing Finance (BHFL) is the fastest-growing and the second-largest HFC in India, with a five-year AUM CAGR of ~29% over FY20-FY25. It had an AUM of INR1.2t as of Jun’25. BHFL is the most diversified HFC in the country, offering a comprehensive suite of mortgage products that cater to a broad spectrum of customers, ranging from individual homebuyers to large-scale developers. To further strengthen its presence, BHFL has also introduced an affordable housing segment, positioning itself to serve the entire housing finance ecosystem.

* BHFL maintains one of the strongest asset quality profiles among its peers, driven by its strategic focus on large, prime-ticket loans, coupled with stringent underwriting standards and prudent risk management practices. GNPA and NNPA have remained consistently benign, ranging between 0.30-0.35% and 0.1- 0.2%, respectively, over the past five years, highlighting the resilience and stability of its loan portfolio.

* BHFL enjoys a credit rating of AAA/stable credit rating from CRISIL and India Ratings for its long-term debt, highlighting its strong financial position.

* BHFL is the strongest franchise in the HFC sector, backed by: 1) robust AUM growth trajectory, 2) strong parentage of the Bajaj Group, 3) a focused, granular, and low-risk business model, 4) a relatively diversified AUM mix with high-yield growth engines, and 5) a tech-driven,scalable distribution.

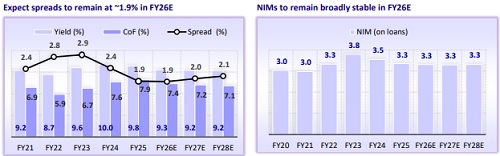

* We expect BHFL’s AUM growth to moderate over the medium term due to a larger balance sheet size and stronger competition from banks. In the near term, however, levers (such as increasing the share of construction finance in the AUM mix and gradually scaling up the affordable business) could help mitigate NIM contraction in a declining interest rate cycle. Eventually, though, BHFL is likely to settle at a lower blended spread/NIM profile.

* RoE is expected to remain moderate in the near-term, at ~12-14%, due to intense competition and relatively low yields in the prime home loan segment. While Bajaj Group’s strong execution capabilities add credibility, the current premium valuations, when weighed against the modest RoE profile, may result in subpar stock returns going forward.

* BHFL trades at 3.6x P/BV and ~29x FY27E P/E, which is a ~60% premium to its IPO price. We model AUM/PAT CAGR of ~22% each over FY25-28E, with an RoA/RoE of 2.3%/14% in FY28E. We initiate coverage on BHFL with a Neutral rating and a TP of INR120 (premised on 3.6x Sep’27E P/BV).

Granular and low-risk business model

* BHFL has carved out a unique niche in the mortgages segment by focusing on affluent salaried borrowers with high credit scores (~77% of customers have CIBIL scores above 750 in home loans), and ~84% of its home loans are extended to salaried individuals, leading to a more predictable, low-risk loan book.

* The company maintains a low-risk, sustainable balance sheet, with its loans against property (LAP), lease rental discounting (LRD), and Construction Finance books also being granular (relative to the industry). A significant margin of safety is ensured through conservative LTV at origination. With guided gross NPAs of 0.6-0.8% and minimal credit costs, BHFL is positioned as a high-quality, lowvolatility player in an otherwise competitive mortgage sector.

Best-in-class sourcing, underwriting, and collection framework

* BHFL has established a best-in-class framework for sourcing, underwriting, and collections, enabling it to maintain superior asset quality while driving robust AUM growth.

* The company has adopted an omnichannel sourcing strategy to maximize customer reach. It sources a reasonable portion (~ 7-10%) of its home loans from Bajaj Finserv's digital channels, which helps reduce costs (lower expense ratio) and enhance risk-adjusted spreads. BHFL has transitioned to in-house originations, resulting in lower customer acquisition costs, increased retention, and improved credit quality.

* The company has a well-defined credit evaluation and underwriting process that ensures risk performance across all product segments remains well within defined thresholds. It implements separate, dedicated underwriting structures for salaried and self-employed retail loans, along with specialized structures for commercial loans (LRD/CF).

* BHFL also has a robust four-tier collections framework comprising tele-calling, field collections, legal recovery, and settlements. This structure ensures effective loan recoveries, with an in-house debt management team handling retail loan collections and leveraging SARFAESI, where required, for efficient legal resolution.

Declining rate cycle to weigh on NTI despite stable spreads

* BHFL operates in a highly competitive market, facing strong competition from banks and other large HFCs. This competitive intensity is expected to exert pressure on yields as the company seeks to sustain its loan growth momentum. This may lead to a transitory contraction in NII over the very near term.

* Despite a growing share of non-housing loans (which rose from ~38% in FY22 to ~44% in FY25), BHFL's spreads have contracted ~90bp over the past three years due to rising borrowing costs, since the company has been unable to pass these costs to customers amid intense competition.

* We expect BHFL to maintain stable NIMs and spreads in FY26, as the impact of lower lending yields from rate cuts is likely to be offset by a commensurate reduction in the cost of borrowings. We expect its NIM to remain broadly stable at ~3.3% over FY26-27.

* While NIM and spreads are likely to stay broadly stable, non-interest operating income is likely to soften this year. This moderation will be led by 1) a lower investment income: FY25 investment income was boosted by surplus capital from the fundraise and higher reinvestment yields, whereas FY26 will have a relatively smaller investable surplus at lower rates, and 2) muted assignment income, as heightened competition is expected to limit loan growth, resulting in fewer assignments during the year. Collectively, these factors are likely to weigh on overall operating income, even as core spreads remain steady.

Tech-driven distribution and room for improvement in operational efficiency

* BHFL operates a fully digital loan lifecycle—from onboarding to servicing—which enhances customer experience while keeping operating costs under control. The company leverages e-agreements, Aadhaar-based KYC, and data analytics to underwrite efficiently and personalize offerings.

* With ~216 branches and a growing semi-urban and rural presence through the hub-and-spoke model, BHFL is expanding its distribution reach while keeping operating expenses in check. As BHFL scales further, operating leverage is expected to drive improvement in cost ratios. We estimate BHFL’s cost-toincome ratio to decline from ~21% in FY25 to ~16.5% by FY28.

Asset quality resilient; expect benign credit costs of ~15bp over FY26-28

* BHFL has demonstrated robust asset quality performance over the years, which is attributed to: 1) a focus on low-risk salaried and mass affluent segment, wherein ~85% of its customers were salaried as of FY25, 2) centralized underwriting processes augmented by digitized credit processes and collection teams, 3) tight commercial underwriting and a focus on low-risk LRD within the wholesale segment, and 4) close tracking of early warning signals (EWS) and portfolio monitoring. This has translated into significantly lower credit costs. Over the past three years, the company’s GS3 remained in the range of ~0.2%- 0.3%, outperforming peers whose GNPA ranged between ~1.5% and 8.2% during the same period.

* While the share of non-housing loans in the loan mix has risen, the majority of these loans continue to be low-risk. Given the evolving risk profile of the company’s loan book, it guides for normalized credit costs of ~20-22bp and GNPA in the range of ~40-60bp over the medium term. We estimate credit costs of ~15-16bp over FY26-FY28.

Valuation and view

* BHFL has posted strong AUM growth, delivering ~29% AUM CAGR over FY20- FY25, supported by a diversified product suite and robust asset quality. However, we expect a gradual moderation in its AUM growth, given BHFL’s increasing scale and rising competition from banks.

* BHFL trades at 3.6x FY27 P/BV, and we model AUM/PAT CAGR of ~22% each over FY25-FY28E, with steady-state RoA/RoE of ~2.3%/14.2% in FY28E. We initiate coverage on BHFL with a Neutral rating and a TP of INR120 (premised on 3.6x Sep’27E P/BV). Key downside risksinclude: 1) higher competition in the prime home loan segment, 2) increasing exposure to non-housing loans, 3) NIM pressure from sustained high competitive intensity in the sector, and 4) any slowdown in the real estate or economy.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412