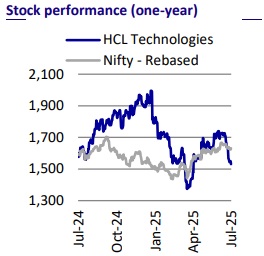

Buy HCL Technologies Ltd for the Target Rs.2,000 by Motilal Oswal Financial Services Ltd

Becoming future ready

Takeaways from the NDR

We hosted the management of HCL Technologies (HCLT) for a two-day NDR in London on 16th-17th Jul’25. Discussions focused heavily on GenAI, delivery model evolution, and margin outlook. Management clearly outlined its strategy of investing in GenAI without sacrificing its financial discipline. It expects margins to recover to its earlier run rate by FY27. Utilization pressures from delayed rampups should ease soon, whereas restructuring-linked costs are expected to fade in FY27. The company believes GenAI tools are not usable without enterprise-level customization, and its “AI force" platform helps enterprises do exactly that. GenAI adoption is still building up toward boardroom-level urgency, and HCLT sees this happen over the next 12-24 months.

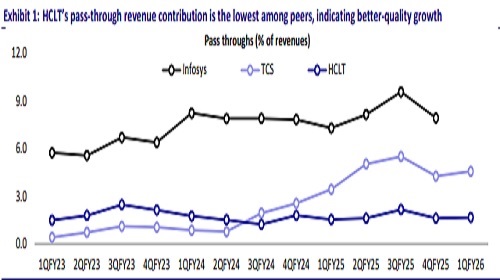

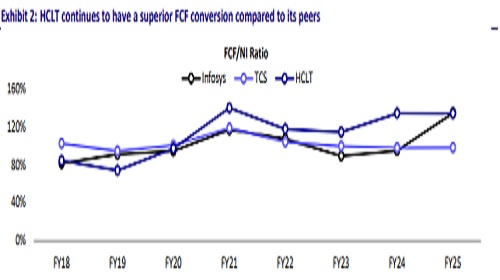

We continue to like HCLT for its best-in-class cash conversion, consistent organic CC revenue growth, and the highest quality of revenue mix in the sector, with the lowest exposure to pass-through and BPO-linked deflation. The company's allweather portfolio gives it stability during tech transitions and better margin resilience as GenAI disruption accelerates. Reiterate BUY with a TP of INR2,000 (based on 26x FY27E EPS).

Key takeaways from our meetings

* Margin headwinds should moderate in FY27: The 1Q margin drag was partly due to proactive hiring for a large deal that did not ramp up on time — this is expected to be resolved. Additionally, restructuring costs tied to consolidating onsite delivery centers (from past acquisitions) should taper during FY26.

* GenAI SG&A spends being front-ended: Management remains clear that GenAI-linked costs are strategic, not reactive. Training and reskilling are being absorbed upfront, and while SG&A expenses remain elevated due to sales (e.g., OpenAI partnership), management expects them to moderate over the next 12-18 months. Importantly, HCLT is not chasing revenue at the cost of margin, as visible from its low pass-through revenue.

* Enterprise GenAI tools require system integrators: Technologies like GitHub Copilot or OpenAI’s tools improve developer productivity, but enterprises need partners to embed them across operations, integrate governance/ compliance layers, and train teams. HCLT and other vendors will be an integral part of this implementation, just as seen in earlier cycles.

* AI Force deployment: HCLT’s “AI Force” serves exactly this purpose – it has already deployed this for 35 clients and aims to deploy it for 100 accounts by FY26 end.

* GenAI deflation is real but varies significantly across service lines – HCLT is relatively better positioned: BPO and testing are seeing 40-70% productivity potential, while infra and application support are at ~10-25%. For app development, most enterprises with some level of machine learning/AI already implemented should have limited gains (10-15%), whereas enterprises starting from scratch could see slightly higher gains. HCLT's limited exposure to BPO (unlike peers) cushions the deflation.

* Client budgets not shrinking despite productivity pass-through: HCLT argued that despite productivity gains, client budgets are not shrinking and are tracking GDP growth. Eight out of nine renewal deals for HCLT had higher revenue as compared to the earlier contract value, validating the point that gains are being immediately reinvested in the business.

* Board-level urgency for GenAI is still building up, but full-scale adoption is seen as inevitable: Current deployments are at the POC-stage or departmentled. A broad transformation is likely to follow once boardrooms start asking: “What is our AI strategy?” HCLT expects this tipping point over the next 12-24 months.

* Financial Services and Hi-Tech are strong demand verticals: These verticals are showing the strongest demand momentum for AI-led transformation. In HiTech, GenAI spend is linked to new capex. In Financial Services, it is tied to legacy modernization and efficiency mandates.

* Legacy modernization cycles are compressing, now within CTO time horizons: Mainframe and infra transformation projects that earlier took 7-8 years are now executable in 3-4 years, thanks to automation and GenAI. This makes modernization more feasible for clients, and HCLT expects a pick-up in demand here.

Valuations and View

* We continue to like HCLT for its best-in-class cash conversion, consistent organic CC revenue growth, and the highest quality of revenue mix in the sector, with the lowest exposure to pass-through and BPO-linked deflation. The company's all-weather portfolio gives it stability during tech transitions and better margin resilience as GenAI disruption accelerates. Reiterate BUY with a TP of INR2,000 (based on 26x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412