Buy Godrej Agrovet Ltd for the Target Rs.980 by Motilal Oswal Financial Services Ltd

Capitalizing on crop protection and palm oil momentum

Godrej Agrovet (GOAGRO), a leading agribusiness company with a diversified presence across multiple segments, is well placed to leverage the growing domestic crop protection industry and the increasing realizations in the palm oil segments.

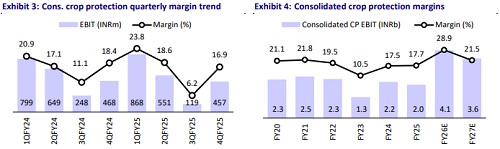

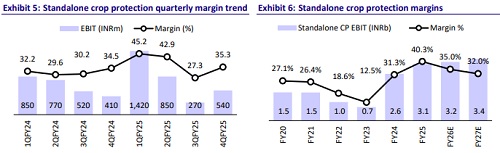

* Despite a challenging macroeconomic environment, the company’s domestic crop protection segment delivered a strong performance in FY25, led by robust growth in the in-house portfolio, particularly the Hitweed herbicides. With a favorable monsoon outlook for CY25 and a planned expansion into new crops and geographies, we expect this momentum to continue in FY26.

* With improving price trends, the normalization in volumes across geographies and management’s strategic initiative to increase the revenue contribution of the CDMO business, Astec is well on its recovery path and is expected to turn EBITDA positive in FY26.

* GOAGRO’s palm oil segment is positioned for robust growth, supported by recent investments in crude palm oil refinery and Kernel palm oil refinery, along with the introduction of value-added products. With palm oil prices projected to increase by 6% in CY25, we expect margin to expand going forward.

Domestic crop protection outlook steady with expansion on track

* The domestic agrochemical sector experienced a challenging FY25, led by subdued farmer demand due to erratic weather patterns and a decline in prices of key agricultural crops.

* Despite a challenging macroeconomic environment, GOAGRO’s standalone crop protection business delivered a resilient performance in FY25, achieving a higher margin of ~40%. This was primarily driven by strong growth of the in-house portfolio, particularly the Hitweed range of herbicides, which witnessed substantial volume expansion during the year.

* The outlook for Indian agriculture remains positive, driven by favorable monsoon forecasts and improving rural demand. The IMD has projected "above-normal" rainfall, supporting expectations of a strong recovery and potential record-high food grain production.

* Looking ahead, the company intends to expand its presence across new geographies and additional vegetable crops.

* However, this expansion is expected to result in a contraction in margin to ~30% — still likely to remain among the highest in the industry. The management anticipates these growth initiatives to drive ~30% growth in revenue in FY26E.

* Additionally, the company maintains a healthy product pipeline, with plans to launch around five molecules over the next three years.

Turning the corner with volume-led recovery of Astec

* During FY24 and FY25, Astec faced significant headwinds due to a decline in volumes of key active ingredients and intermediates amid high industry inventory levels, widespread de-stocking, and a persistent demand-supply imbalance.

* Additionally, price corrections in enterprise and contract manufacturing portfolios (deferment of orders), coupled with challenges from high-priced inventory in the enterprise segment, further pressured profitability. The company has since responded by strategically liquidating high-cost inventories to realign with market conditions.

* With better raw material availability, favorable pricing, and a likely volume recovery from 2QFY26 amid improving demand in key markets like the US, the enterprise business appears to have moved past its challenging phase.

* Alongside the ongoing recovery in the enterprise business, management is focusing on improving profitability by increasing the contribution of the CDMO segment. Currently, CDMO contributes around 60% to Astec’s revenue, and the company plans to raise this share to 70-75% over the medium term, which is expected to result in a more favorable margin profile.

* With the normalization of raw material dynamics, a recovery in key endmarkets, and a strategic shift toward a higher-margin CDMO portfolio, Astec is well-positioned to deliver improved and sustainable performance. We estimate Astec to achieve ~35% YoY revenue growth in FY26 and transition to positive EBITDA.

Better realizations and investment initiatives to support palm oil outlook

* FY24 was a subdued year for the vegetable oil segment, as volume growth of ~6% was offset by an ~11% decline in realization due to the volatility in prices of CPO and PKO (down 20% and 30% YoY, respectively).

* The pricing scenario changed in FY25, with higher average realizations in both CPO and PKO (up 32% and 43% YoY, respectively). The palm oil segment delivered revenue growth of ~17% and margin expansion of ~170bp.

* While the prices have begun to soften since 4QFY25, we expect them to remain stable, driven by steady demand.

* The monthly average prices of CPO/PKO in Jul’25 are currently standing at USD925/USD1,860 per MT (as per World Bank commodities price data) compared to USD1,067/USD2,063 per MT in Mar’25 and USD873/USD1,155 per MT in Jul’24.

* With the additional investment in PKO refining and the sale of associated valueadded products, management anticipates this initiative to contribute an incremental 1%-1.2% to overall profits, subject to product price realizations. Combined with the earlier investments in CPO refining capacity, the cumulative increase to overall profitability is expected to be in the range of 2%-2.5%.

* Going forward, GOAGRO plans to manufacture shortenings, bakery fats, and cocoa butter substitutes, which would add another 1-2% to the overall profitability once the company starts these products, for which the company has already set up an R&D facility in Rabale, Navi Mumbai.

* With the palm oil prices projected to rise by 6% in CY25 (as per World Bank data), led by favorable demand-supply dynamics, we expect the palm oil segment’s revenue to grow by 20% YoY and EBITDA margins to pick up going ahead.

Valuation and view

* On the back of a strong FY25, we expect GOAGRO to witness healthy revenue growth and margin expansion in the near term. Growth will be led by i) the improving outlook for the domestic crop protection segment, ii) the strategic shift toward the CDMO business in Astec, and iii) the improving pricing scenario in the palm oil segment.

* Moreover, with the VAP mix expected to cross ~40% in the dairy segment, along with price hikes and stabilization in live bird prices in the poultry segment, we expect a CAGR of 12%/21%/28% in revenue/EBITDA/PAT over FY25-27. We reiterate our BUY rating on the stock with an SOTP-based TP of INR980.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412