Buy Swiggy Ltd for the Target Rs. 550 by Motilal Oswal Financial Services Ltd

Turning a corner

Incrementally positive outlook for QC

We upgraded Swiggy to BUY (see our report dated, 4th September, Internet: A buffet of tailwinds), reflecting an inflection in growth of the food delivery (FD) business and improved unit economics in the quick commerce (QC) business. In this note, we highlight the evolving narrative around Swiggy. The company’s improved execution and rising average order value (AOV) in QC are enhancing its growth visibility. With easing competitive intensity and a pause in dark store expansion, the path to breakeven appears increasingly achievable. Swiggy’s strategy of optimizing its existing infrastructure while selectively adding new dark stores to strengthen coverage positions it well for steady growth and contribution margin expansion in the coming quarters.

The company has also doubled down on FD segment propositions such as Bolt (10-minute meals), Snacc (snack meals), and ’99 Store’ (affordable, fast-prep offerings), which together are helping Swiggy expand its monthly transacting user (MTU) base and defend its market position. The 10-minute food delivery service has emerged as a clear differentiator; Eternal's decision to exit the 10- minute food delivery gives Swiggy a clear field to innovate and gain market share in the quick food delivery market.

We believe Swiggy’s pivot from the earlier land-grab phase to a more costconscious operating model should drive steady margin expansion ahead. The combination of steady FD growth, rising Instamart AOV, and easing fixed-cost drag enhances the visibility of positive unit economics. We value the FD business at 35x FY27E adjusted EBITDA and QC using DCF. We maintain BUY on Swiggy with a TP of INR550, implying a potential upside of 26%.

Food Delivery: 10-min delivery a clear differentiator

* Swiggy’s FD GOV rose 18.8% YoY in 1QFY26, its second-best performance in nine quarters, supported by continued traction in Tier-2/3 markets.

* Bolt (10-minute meals) now contributes 10-12% of total FD orders, with unit economics close to the platform average due to tighter delivery radius and lower delivery fees. We expect continued GOV momentum as Swiggy scales new formats and penetrates deeper into Tier-2 cities.

* Recently launched Snacc and ’99 Store’ offerings aim to tap new consumption occasions, expanding the MTU base and order frequency.

* FD GOV has clocked a 16% CAGR over FY22-25, with Swiggy’s share stabilizing at ~43%. FD GOV growth, which slowed to 17-18% recently, could accelerate beyond 20% in the next 2-4 quarters, aided by the upcoming festive season and the recent GST reforms.

Quick Commerce: Measured expansion, efficiency preferred

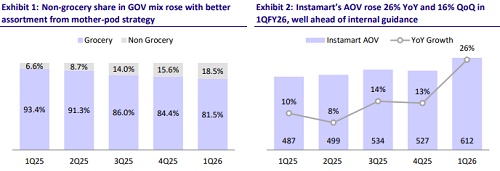

* Instamart’s AOV rose 26% YoY and 16% QoQ in 1QFY26, narrowing the gap with Blinkit to 9% from ~30% earlier, aided by the elimination of low-value orders, a higher adoption of Maxxsaver, and an increased share of non-grocery items (18.5% of GOV vs. 6.6% a year ago).

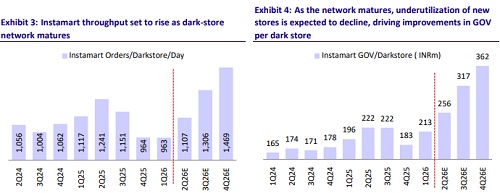

* With 4.3m sqft of network capacity across 1,000+ dark stores, Swiggy has paused further expansion, focusing on improving utilization and throughput. This footprint can support up to 100% YoY GOV growth and accelerate margin expansion, aided by operating leverage and reduced fixed costs.

* Contribution margin improved ~100bp QoQ to -4.6% of GOV in 1QFY26. Mature dark stores in core cities are already positive (~2-4%), supporting management’s guidance of achieving a breakeven in QC contribution margin between 3QFY26 and 1QFY27.

* The broader QC industry has entered a rationalization phase after the Sep’24- Apr’25 expansion cycle, easing discount intensity and improving customer acquisition costs (CAC) – key enablers of a sustainable margin recovery.

A buffet of tailwinds: More favorable sectoral outlook

* FD growth moderated in the past few quarters, impacted by subdued consumer sentiment and broader macro pressures. We believe this phase is now bottoming out.

* Festive season tailwinds and the recent GST reforms should support a recovery in discretionary spending, boosting order frequency and value across platforms.

* In QC, competitive intensity is easing as new entrants struggle to scale operations, while leading players have slowed dark store expansion after reaching a peak in 4QFY25.

* A sharper focus on cost discipline and lower discounting by the top players should help to rationalize CAC and improve contribution margins.

* We remain constructive on the sector recovery and now expect FD GOV growth to accelerate beyond 20-21% over the next 2-4 quarters and QC adoption to strengthen further in non-metro markets, aided by GST-led formalization.

Valuation and view

* We believe Swiggy is entering a phase of profitability, supported by operating discipline and improving network efficiency. The combination of steady FD growth, rising Instamart AOV, and easing fixed-cost drag enhances the visibility of positive unit economics.

* Steady improvements in AOV, dark store throughput, and take rates could lead to a material re-rating in profitability, prompting a more constructive stance on the stock.

* We value the FD business at 35x FY27E adjusted EBITDA and QC using DCF. We have brought forward our profitability assumptions for Instamart (see our report dated 4th September, Internet: A buffet of tailwinds). We maintain BUY on Swiggy with a TP of INR550, implying a potential upside of 26%.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)