Sell Hitachi Energy Ltd for the Target Rs. 18,000 by Motilal Oswal Financial Services Ltd

Strong margins result in sharp PAT beat

Hitachi Energy’s 2QFY26 results beat our estimates on the back of a sharp recovery in EBITDA margins and higher other income. Order inflow was healthy for the quarter, and the bid pipeline also remains strong for the company. Over the last few quarters, we note that the company’s order book cycle is turning longer but margin improvement is now visible. The company’s capacity expansion too will help meet the upcoming demand across segments. We increase our estimates by 12%/5% for FY27/28 to bake in increased margin, capex and other income and roll forward our TP to INR18,000. The stock is currently trading at 103x/78x/62x P/E on FY26E/27E/28E earnings. We reiterate our Sell rating on the stock on account of pricey valuations. Our estimates bake in 29% revenue CAGR and 63% PAT CAGR over FY25-28 and an implied target multiple of 60x on two-year forward earnings.

PAT boosted by better-than-expected EBITDA margin and other income

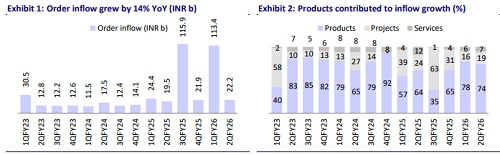

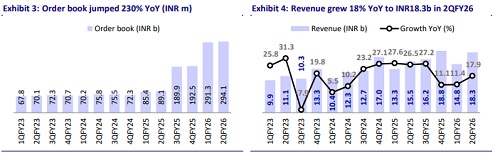

2Q revenue was 12% lower than our estimate as execution remained weaker than our expectations. However, with a better-than-expected EBITDA margin of 16.3%, higher other income, and a lower tax rate, reported PAT came in 42% ahead of our estimate. Revenue grew 18% YoY to INR18.3b (12% below our estimate). EBITDA at INR3.0b (vs. our estimate of INR2.5b) grew 172% YoY. EBITDA margin at 16.3% was 430bp above our expectation of 12%, driven by lower-than-expected operating expenses. PAT increased 406% YoY to INR2.6b, 42% above our estimate. Order inflows grew 14% YoY to INR22.2b, taking the order book to INR294b. Growth in inflows was led by the large orders for GIS and AIS stations, and locomotive transformers. Among segments, industries and renewables were the key contributors to the order book, followed by transmission and transport. For 1HFY26, revenue/EBITDA/PAT growth stood at 15%/188%/531% YoY. OCF came in at INR8.7b vs. an outflow of INR0.8b in 1HFY25. FCF stood at INR807m in 1HFY26 vs. an outflow of INR118.1m in 1HFY25.

Prospect pipeline building up well for the sector

HVDC continues to be a major growth engine for Hitachi Energy across both domestic and international markets. Of the total order book of INR294b, ~INR100b comes from base orders, with the rest linked to HVDC projects. The domestic pipeline remains strong, with one HVDC project tariff-based bidding already completed and another 6GW LCC project expected to be tendered out soon. Management expects two to three HVDC projects to come up for bidding each year over the next few years in India. The company also expects to benefit from demand in India’s DC market, where Hitachi Energy’s addressable opportunity stands at ~15-20%. With India’s rapid renewable expansion, rising industrial and transmission investments, and ongoing metro and rail modernization, the company’s focus on capacity expansion, services, digital solutions, and new areas like energy storage places it on a future-ready growth path.

Exports continue to be one of the key growth levers

Exports continued to play a meaningful role in Hitachi Energy’s inflows in 2Q, contributing nearly 30% (excluding HVDC). Inflows in 2Q increased 59% YoY, driven by a well-diversified customer base across utilities, renewables, data centers, and industrial segments spread over multiple geographies. The export order book remains healthy and continues to benefit from Hitachi Energy’s global supply network and localization initiatives.

Key export orders received by the company in 2QFY26 are:

* 114 Nos IMB 800kV CTs to Canadian utilities

* 12 Nos 800 kV Breakers to Ukrainian utilities

* 17 Nos. 245kV PASS and 8 Nos. 145kV PASS to Thailand

* 132 KV AIS package to Babek, Azerbaijan

* Power Quality Products to Transco in Dubai

Margin resilience to sustain going forward

Hitachi Energy delivered a strong margin of 16.3% during the quarter. This was mainly led by 1) operating leverage, as higher execution volumes helped spread fixed costs more efficiently, 2) an improved product mix, with a larger share of highmargin products contributing to revenue, 3) increasing share of exports in the total order book, which are usually short-cycle orders with high margins, 4) increasing share of service orders, with current levels at high single-digits, and 5) lower royalty cost during the quarter due to the timing effect of revenue recognition. We expect the increasing share of exports and services and a better product mix to support the company’s target of sustaining double-digit margins over the long term. We have factored in margin of 14.5%/15%/15% for FY26/27/28E in our estimates.

Financial outlook

For FY27/FY28, we raise our estimates by 12%/5% to factor in higher margins and slightly lower revenue to bake in the longer-gestation order book. We thus expect revenue/EBITDA/PAT CAGR of 29%/52%/63% over FY25-28E. Our estimates currently bake in nearly one HVDC win for the company every year and consistent expansion in margins. This results in EBITDA margin expansion to 14.5%/15%/15% for FY26/27/28.

Valuation and view

The stock is currently trading at 102.7x/78.4x/62.4x P/E on FY26E/27E/28E earnings. We reiterate our Sell rating with a revised TP of INR18,000 (vs. INR16,500 earlier) based on 60x two-year forward earnings.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)