Buy Cyient DLM Ltd for the Target Rs. 550 by Motilal Oswal Financial Services Ltd

Favorable business mix supports margin expansion

Operating performance in line with estimates

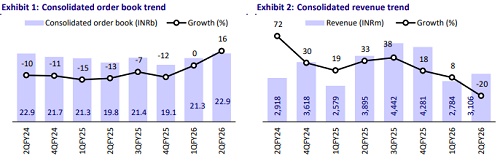

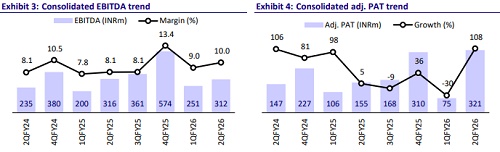

* Cyient DLM’s (CYIENTDL) 2QFY26 consolidated revenue/EBITDA declined ~20%/1% YoY to INR3.1b/INR312m. However, EBITDA margins expanded 190bp YoY to 10% (est. 9.7%), led by a better business mix (higher Aerospace mix of 37%).

* The order book rose 16% YoY/7% QoQ to INR23b, boosted by an order intake of ~INR5b. About 1/4th of this order inflow is executable in FY26. With this addition, the company’s book-to-bill ratio stands at ~1.6x, and it aims to maintain the ratio at ~1.4-1.5x in FY26.

* We reduce our FY26 revenue estimate by 9% due to slower execution of new orders and a higher base of BEL orders. Consequently, we lower our FY27/FY28 revenue/earnings estimates by 10%/12% and FY26 adjusted PAT estimate by 20%. We reiterate our BUY rating on the stock with a TP of INR550 (27x Sep’27E EPS).

Increasing order inflow enhances growth visibility

* Consol. revenue declined 20% YoY to INR3.1b (est. in line) in 2QFY26 due to a high base of 2QFY25, which included a large order from BEL (completed in 4QFY25).

* Excluding the defense segment (down 90% YoY due to the completion of BEL orders), other segments showcased strong growth. Aerospace grew 49% YoY, while the inclusion of Altek drove ~3.6x/2.2x YoY growth in the Industrial/Medtech segments.

* EBITDA margin expanded 190bp YoY to 10% (est. 9.7%). EBITDA declined 1% YoY to INR312m (est. in line). EBITDA margin expansion was largely led by a favorable business mix. Gross margin expanded 20.6pp to 41.2%.

* Reported PAT grew 2x YoY to INR321m (est. INR115m), led by a one-off earn-out reversal of INR196m (had to be paid to Altek on fulfillment of some performance obligations). Adj. PAT declined 19% YoY to INR126m.

* For 1HFY26, revenue/adj. PAT fell 9%/23% YoY, whereas EBITDA/adj. PAT grew 9%/52%. Gross debt stood at INR1.6b vs. INR2.4b in Mar’25.

* CYIENTDL generated free cash flow of INR270m. After adjusting for onetime land acquisition costs of INR190m, normalized FCF was INR460m.

Highlights from the management commentary

* Outlook: The current book-to-bill ratio is ~1.6x and the company aims to maintain it around ~1.4-1.5x by the end of FY26. Further, it expects growth in 4QFY26, largely led by growth in industrial segment (as 3QFY25 had large order execution of BEL).

* Order flows: CYIENTDL secured two global logos in 2QFY26: 1) a Japanese EVOTL company that focuses on future of mobility; 2) an EV charging company with focus on EV solutions. The company is optimistic about a multi-million-dollar opportunity from them in the near future.

* Inorganic acquisitions: The company is actively looking for inorganic acquisition targets in NAM and EMEA to drive growth in the medical and industrial segments and new industries like EV.

Valuation and view

* The revenue decline in 2Q was offset by margin expansion. We expect margin expansion momentum to continue going ahead, driven by an improved product mix and increasing orders of box-build and build-to-spec. Macro tailwinds such as the end of the Israel-Gaza conflict, opportunities in the EV space, and B2S customer additions will drive growth in the medium term.

* For CYIENTDL, we estimate a CAGR of 14%/27%/37% in revenue/EBITDA/adj. PAT over FY25-28. We reiterate our BUY rating on the stock with a TP of INR550 (27x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412