Buy Cholamandalam Inv. & Finance Ltd For Target Rs.1,475 by Motilal Oswal Financial Services Ltd

Weak macro plays spoilsport; credit cost guidance raised

Deterioration in asset quality more pronounced in newer businesses

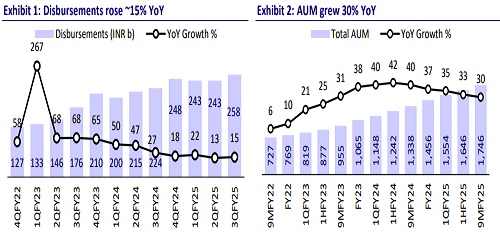

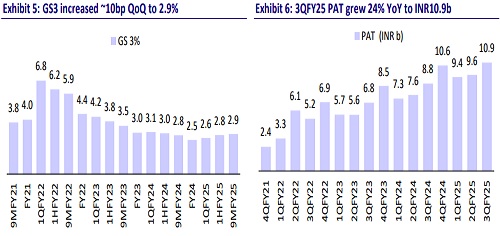

* Cholamandalam Inv. & Finance (CIFC)’s 3QFY25 PAT grew ~24% YoY to INR10.9b (in line). NII grew ~33% YoY to ~INR28.9b (in line).

* Other income grew ~60% YoY to~INR6.5b (~14% higher than MOFSLe). This was primarily driven by upfront assignment income of ~INR650m wherein CIFC undertook an assignment transaction after almost 4-5 years.

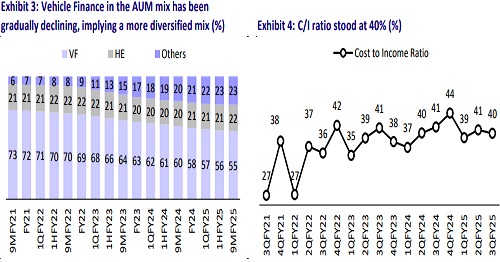

* Opex rose ~33% YoY to ~INR14.1b (in line) and the cost-to-income ratio declined ~70bp QoQ to ~40% (PQ and PY: ~41% each). PPoP grew ~40% YoY to INR21.3b (in line). Management shared that opex will remain elevated at ~3% for the next two years since the company will be investing in incubating newer businesses, technology, and branch additions.

* Yields (calc.) improved ~15bp QoQ to ~14.65% while the CoF (calc.) rose ~10bp QoQ to ~8.1%. NIM rose ~3bp QoQ to ~6.8%.

* Management shared that capacity utilization, which was subdued during 1HFY25, has exhibited signs of improvement in Oct/Nov’24. However, it also highlighted that because of weak macros, the utilization levels in 2HFY25 remained lower compared to 2HFY24.

* Management anticipates NIM expansion in a declining rate environment and has guided for improvement in vehicle finance (VF) margin in FY26. We expect NIM to expand to ~7.1%/7.2% in FY26/FY27 (vs. ~6.9% in FY25E). We estimate a CAGR of 17%/24%/29% in disbursement/AUM/PAT over FY24- 27.

* CIFC will have to utilize its levers on NIM (and fee income) to offset the impact of moderation in AUM growth and potentially higher credit costs. We estimate RoA/RoE of ~2.6%/21% in FY26. Reiterate BUY with a TP of INR1,475 (premised on 3.6x Sep’26E BVPS).

* Key risks to our TP are: 1) weak macros translating into weaker vehicle demand and sustained lower capacity utilization; and 2) deterioration in asset quality, especially in the newer businesses, which could keep the credit costs higher than usual.

AUM rises ~30% YoY; share of new business loans at ~13% of total AUM

* Business AUM grew 30% YoY/6% QoQ to INR1.75t, with newer businesses now forming ~13% of the AUM mix. Total disbursements grew ~15% YoY and ~6% QoQ to ~INR258b. Newer lines of business contributed ~21% to the disbursement mix (PQ: ~24%). VF disbursements grew ~16% YoY.

* Except for Vehicle Finance, none of the other product segments have exhibited any acceleration in disbursements. In addition, the company shared that it is exiting the partnerships business in its CSEL segment, which will result in a loss of business volumes in the segment. Management guided for disbursements growth of ~18% and AUM growth of ~25% in FY26.

Minor deterioration in asset quality; GS3 rises ~8bp QoQ ? GS3/NS3 increased ~8bp/6bp QoQ to 2.9%/1.65%, while PCR on S3 declined ~40bp QoQ to ~44%. ECL/EAD increased to 1.86% (PQ: ~1.84%).

* Asset quality deterioration was more pronounced in the CSEL business, with higher NCL primarily stemming from partnership-sourced loans.

* CIFC’s 3QFY25 credit costs stood at ~INR6.6b. This translated into annualized credit costs of ~1.6% (PY: 1.1% and PQ: ~1.6%). Write-offs (including repo losses) stood at ~INR4.4b, translating into ~1.3% of TTM AUM (PY: ~1.4% and PQ: 1.1%). Management raised its credit cost guidance to ~1.4% in FY25 (vs. ~1.3% earlier). We estimate credit costs of ~1.35%/1.3% in FY26/FY27.

Key highlights from the management commentary ? Within CSEL, CIFC has already dialed down to three partners (vs. ten partners around two years back). The number of partners will come down further, and it will completely exit all partnerships in CSEL within the next one year.

* CIFC will be introducing consumer durables, and the company has also developed its digital platform, where it is doing personal loans/business loans.

* At an industry level, the early delinquencies have started inching up in HCVs. It will take 3-4 quarters for things to improve in HCVs, but the improvement will be gradual. By choice, CIFC has a small presence in HCVs and will not be much impacted.

Valuation and view

* CIFC reported subdued disbursements across most of its product segments except vehicle finance. Asset quality deteriorated and credit costs remained elevated, which prompted the company to raise its credit cost guidance for FY25. If the macros do not improve, CIFC could be headed for a slowdown in vehicle loan growth and face further asset quality challenges. Having said that, CIFC has a diversified product suite, which it can leverage to deliver a healthy AUM CAGR of ~24% over FY24-27E.

* The stock trades at 2.9x FY27E P/BV. For these premium valuation multiples to sustain, the company will have to keep providing higher confidence in its execution capabilities in the newer product lines. Further, it will have to navigate any cyclicality (if at all) in vehicle demand to deliver healthy AUM growth and asset quality through its diversified product mix. Reiterate BUY with a TP of INR1,475 (premised on 3.6x Sep’26E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412