Neutral Tata Steel Ltd for the Target Rs. 155 by Motilal Oswal Financial Services Ltd

In-line operating performance; lower tax outgo boosts APAT

Standalone performance

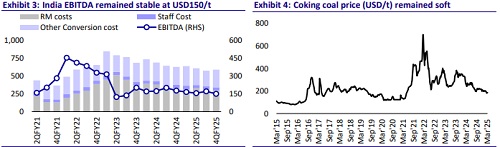

* 4QFY25 revenue at INR344b (-6% YoY and +5% QoQ) came in line with our estimate. The QoQ increase was driven by seasonally higher volumes and a marginal increase in realizations.

* During the quarter, steel production stood at 5.24mt (flat YoY) and deliveries stood at 5.6mt (+3% YoY), which came in line with our estimates. 4Q ASP was flat QoQ but declined 9% YoY to INR61,427/t.

* EBITDA stood at INR69.8b (-13% YoY and -7% QoQ), in line with our estimate. EBITDA/t came in at INR12,470/t (-16% YoY and -12% QoQ) vs. our estimate of INR12,370/t.

* 4Q APAT stood at INR37b (-21% YoY and -8% QoQ) vs. our estimate of INR36b.

* For FY25, revenue declined 6% YoY to INR1,325b, EBITDA was down 7% YoY at INR279b, and APAT fell 19% YoY to INR149b.

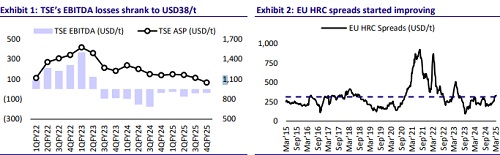

European operations

* Consolidated steel deliveries stood at 2.38mt (+12% YoY/+13% QoQ), in line with our estimate.

* Revenue stood at INR208b (flat YoY and +6% QoQ) and EBITDA loss stood at INR7.5b (flat YoY and QoQ), in line with our estimates.

* EBITDA loss per ton declined to USD38/t in 4QFY25 vs. USD42/t in 3QFY25 and USD38/t in 4QFY24 (vs. our estimate of USD40/t). UK operation fixed costs declined by ~GBP230m annually.

Consolidated performance

* Revenue of INR562b (-4% YoY and +5% QoQ) was in line with our estimate. Sales volume stood at 8.3mt (+4% YoY and +8% QoQ), which was offset by muted ASP of INR67,489/t (-8% YoY and -3% QoQ) in 4QFY25.

* Adjusted EBITDA stood at INR65.6b (-1% YoY and -8% QoQ), in line with our estimate of INR64.4b, translating into EBITDA/t of INR7,874 (-5% YoY and - 15% QoQ) in 4QFY25.

* 4Q APAT stood at INR16.9b (+40% YoY and +128% QoQ) against our estimate of INR6.5b, aided by a lower tax outgo.

* For FY25, revenue declined 5% YoY to INR2,185b, EBITDA grew 19% YoY to INR259b, and APAT rose 41% YoY to INR42b.

* The board recommended a dividend of INR3.6 per share. ? Capex stood at INR32b (INR157b in FY25). Net debt stood at INR825b.

Highlights from the management commentary

* In 1QFY26, India prices are expected to rise by INR3,000/t and Europe prices by EUR20-30/t. Deliveries for FY26 are expected to increase by 1.5mt, primarily from Kalinganagar’s ramp-up in India.

* Management aims for cost savings of INR115b in FY26: a) INR40b from India (conversion costs reduction of INR1,000-1,200/t) via contract optimization and technology-driven procurement; b) UK fixed cost reduction by 29% (GBP220m out of GBP540m cost reduction target); and c) EUR500m in the Netherlands via operational improvements and volume maximization.

* Coking coal costs (on a consumption basis) for India operations would be USD10/t lower QoQ in 1QFY26, although spot prices increased QoQ. For the Netherlands operation, coking coal prices may also fall by USD10/t QoQ and iron ore prices might be higher by USD10/t QoQ.

* The company spent INR157b in capex in FY25 and plans to spend INR150b in FY26, primarily for Indian growth projects (e.g., Kalinganagar, Ludhiana EAF).

Valuation and view

* India business posted a decent performance, driven by healthy volume and lower costs. Steel prices are expected to be higher in 1QFY26, driven by the imposition of safeguard duty and lower imports. Management expects EBITDA losses of the Europe operation to decline in the coming quarters on account of its cost-restructuring measures. The capacity ramp-up in the Netherlands and lower fixed cost should also support the overall EBITDA performance.

* Though there are near-term challenges related to price volatility due to trade tension, the long-term outlook remains strong for TATA. While India business is expected to continue its strong performance, improving performance in Europe business would support overall earnings.

* We have reduced our EBITDA estimates by 4%/6% for FY26/FY27, owing to slower-than-expected growth in volumes. TATA is trading at 6x FY27E EV/EBITDA and 1.6x FY27E P/B. We reiterate our Neutral rating with a revised SOTP-based TP of INR155 per share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412