Metals & Mining Sector Update : Steel`s gatekeepers Electrode producers facing Darwin`s test by Emkay Global Financial Services Ltd

We initiate coverage on the Indian graphite electrode sector with BUY on both GRIL and HEG, assigning target price of Rs700 to each. The graphite electrode sector is in a Darwinian reset—a deep trough forcing consolidation, exposing weak cost positions, and realigning supply. As the steel cycle stabilizes, survivors enter the next upcycle with cleaner balance sheets, firmer procurement discipline, and structurally higher earnings resilience. This is a rare moment, of cyclical weakness creating a long-duration opportunity. GRIL and HEG are well-positioned to lead the next global cycle—one that is forming through China’s anti-involution shift, Europe’s CBAM rollout, and a globally coordinated policy resolve aimed at lifting the steel industry out of a prolonged downturn through rising protectionism.

Our central view The graphite electrode (GE) industry is navigating one of its deepest cyclical troughs in a decade—prices under pressure, underutilized capacity, and profitability compressed across regions. After five years of falling GE prices, inconsistent procurement economics, and intermittent shutdowns, the industry is reshaping itself—not through expansion, but via subtraction. High-cost capacity is retreating. Balance sheets are being classified into two types: those that can sustain during cyclical troughs and those that cannot. The competitive field is becoming narrower, not broader. The winners of the next cycle will not be the largest producers, but the most resilient—those with cost integrity, qualification depth, and the balance sheet strength to endure a long trough. The current setup resembles the classic conditions at the bottom of commodity cycles—when the market looks its darkest, but fundamentals quietly begin to turn.

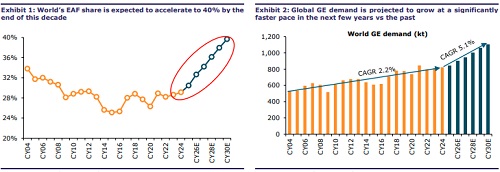

Demand is not the debate; decarb direction is irreversible Demand is not the debate, in our view. EAF steelmaking continues its slow and uneven, albeit ultimately irreversible, rise. Scrap availability, policy backing, and decarb economics all push in the same direction. The long-term demand line slopes upward, with 110mt (~15% of current capacity) of new EAF capacity under construction, implying ~150kt of incremental GE demand against the existing ~650kt, ex-China market. EAF growth is driven by forces outside the electrode industry—carbon policy, scrap economics, regulatory pressure—and graphite electrode consumption follows mechanically. Timing can be debated, direction cannot. Which is why the real question for this sector is no longer demand, but the shape of the industry that will meet it—how much capacity remains, who can operate through a prolonged trough, and whose balance sheets will still be functional when recovery arrives.

Graphite India and HEG – Likely structural winners Within this narrowing industry, Graphite India (GRIL IN) and HEG (HEG IN) represent two distinct forms of endurance. GRIL enters a trough with the sector’s cleanest balance sheet, conservative capital philosophy, and a cost structure built for stability rather than peak-cycle capture. It may not offer the highest beta, but it is the least disrupted—able to absorb prolonged weakness without compromising strategic optionality. HEG, by contrast, carries more operating leverage, reflecting a business model historically geared to cycle amplitude. Yet, this structure gives it disproportionate upside if the supplytightening thesis plays out and the cycle turns. The contrast is instructive—GRIL survives because it can wait; HEG survives because it moves fastest when the upcycle arrives. Both are positioned to benefit, but for different reasons—and in a thinning industry, both models have value. We initiate coverage on the Indian graphite electrode sector with BUY on both GRIL and HEG, assigning target price of Rs700 to both.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354