Neutral Torrent Pharma Ltd for the Target Rs.3,580 by Motilal Oswal Financial Services Ltd

Robust Brazil and DF growth drives earnings

Valuation caps upside

* Torrent Pharma (TRP) delivered in-line revenue/EBITDA for the quarter. However, there was a miss on earnings due to lower other income. Despite geographic headwinds, the company has managed to maintain consistent profitability.

* TRP has shown robust, better-than-industry growth in the Brazilian market in FY25 as well as in 1QFY26, led by new launches and market share gains. However, part of the growth was offset by currency headwinds.

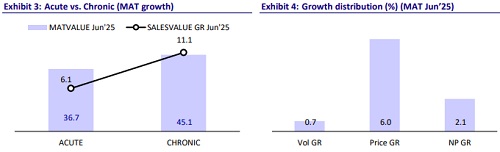

* The strong growth in the consumer health segment, supported by the addition of MRs and a focused approach on chronic therapies, has driven improved performance in the domestic formulation (DF) segment.

* The German business continues to face adverse factors, dragging constant currency growth in this segment.

* New launches are expected to drive the momentum of the US generics segment.

* We largely maintain our earnings estimate for FY26/FY27. We value TRP at 40x 12M forward earnings to arrive at a TP of INR3,580. We expect 10%/14% revenue/EBITDA CAGR over FY25-27, led by superior execution in the DF/Brazil/US market. The JB Chemicals & Pharma acquisition is expected to enhance TRP’s chronic portfolio with limited overlap. It will also strengthen TRP’s existing MR base, increasing reach and deepening presence.

* Having said that, we believe the current valuation factors in the earnings upside adequately. Hence, we reiterate our Neutral stance on the stock.

Sales growth; stable margins; lower tax drives 19% YoY earnings growth

* Sales grew 11.2% YoY to INR31.8b (in-line).

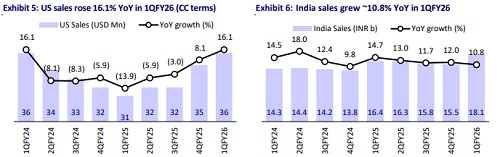

* DF revenue grew 10.8% YoY to INR18.1b (57% of sales). US generics grew 19% YoY to INR3.1b (10% of sales).

* Germany sales grew 8.5% YoY to INR3.1b (10% of sales). In CC terms, sales were stable on a YoY basis.

* Brazil business grew 11.2% YoY to INR2.2b (7% of sales). In CC terms, sales grew 16% YoY for the quarter.

* US generics sales grew 19% YoY (+16% in CC terms) to INR3b (USD36m) in 1QFY26. RoW sales grew 10% YoY at INR5.3b (17% of sales).

* Gross margin was stable YoY at 75.6% for 1QFY26.

* There was a one-time impact of INR150m related to acquisition costs.

* Adj. for the same, EBITDA margin expanded 60bp YoY to 32.9% (our est: 33.3%), driven by an 11% YoY increase in gross profit, partially offset by a rise in employee costs and other expenses of 10%/9% YoY.

* Accordingly, EBITDA grew 13.3% YoY to INR10.5b (vs our est: INR10.7b).

* Adj. PAT grew 18.7% YoY to INR5.6b (our est: INR6b).

Highlights from the management commentary

* TRP has guided to maintain its FY26 EBITDA margin at the 1QFY26 level.

* The company plans to add 800 MRs in FY26, bringing the total count to ~7,000.

* The acquisition process for JB Chem is largely on track, with CCI approval currently awaited.

* In the Brazilian market, TRP aims to launch 8-10 products annually.

* Approximately 10 launches are also planned for the US market, alongside market share gains in existing products to drive growth.

* Strict prescription guidelines for Ozempic are expected to keep off-label use in check in the Brazilian market. Annual Ozempic sales in Brazil stand at around USD150m and have declined 14-15% over the past year. Wegovy is currently tracking sales of USD150m per quarter. However, a generic version of this product is expected only after a couple of years.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412