Bloomberg Commodity Index (BCOM) Rebalancing 2026 by Kedia Advisory

The Bloomberg Commodity Index (BCOM) Rebalancing is an annual process in which the Bloomberg Commodity Index-a widely followed benchmark tracking the performance of 23 physical commodities across sectors like energy, metals, and agriculture-adjusts its weightings to maintain diversification. This rebalancing typically occurs in January each year and ensures that no single commodity or commodity group becomes too dominant in the index.

Key Features of BCOM Rebalancing:

* Diversification and Weight Caps: To maintain balance, each commodity in the index

is capped at 15% of the total weight. No group of commodities (such as metals. energy, or agriculture) can exceed 33% of the index. This helps reduce overexposure to any one commodity that could skew the index's performance.

* Portfolio Adjustments: As part of the rebalancing process, passive funds that track

the BCOM index (with over $100 billion in assets under management) must adjust their portfolios to match the new weightings. This involves buying and selling futures contracts in commodities that have either gained or lost weight in the index.

* Impact on Market Liquidity: Since passive funds must sell commodities that have

become overweight (like gold and silver after a strong performance year) and buy those that are underrepresented (like copper or cocoa), the rebalancing process can lead to significant market movements and short-term volatility. The process generally takes 6-10 business days, with daily adjustments to minimize market disruption.

* Why It Matters: The BCOM index is a key tool for investors and traders in the commodities market. The rebalancing ensures that the index reflects the current market conditions and provides a diversified exposure to commodities, avoiding overconcentration in any one sector.ynamics.

The BCOM rebalancing is a mechanical adjustment designed to maintain the index's diversified structure, ensuring no single commodity exceeds the 15% weight cap. This process has short-term market implications as passive funds realign their portfolios, influencing commodity prices, trading volumes, and market behavior. The rebalancing ensures the index reflects current market conditions and commodity fundamentals. For investors and traders, it creates both risks and opportunities, particularly due to the volatility in affected commodities and potential shifts in market sentiment. The adjustments help maintain diversification while responding to evolving market dynamics.

2026 Bloomberg Commodity Index (BCOM) Rebalancing

The 2026 Bloomberg Commodity Index (BCOM) Rebalancing is set to occur from January 8-15, 2026, with significant implications for global commodity markets. The rebalancing, a routine process designed to maintain the index's diversification, enforces a 15% cap per commodity and ensures no single commodity group exceeds 33% of the index's weight. With BCOM's $109 billion assets under management (AUM), passive funds tracking the index are required to adjust their portfolios, triggering large-scale buying and selling in commodity futures.

Highlights

* Gold weight cuts from 20.4% to 14.9%, ~$7B sell-offs.

* Silver drops from ~9.6% to ~1.45-4%, ~$7.18 sales.

* Copper weight rises to ~6.4%, attracting ~+$1B inflows.

* BCOM'S AUM-$109B driving heavy rebalance flows.

Silver Ol could shrink ~13-17% amid selling pressure.

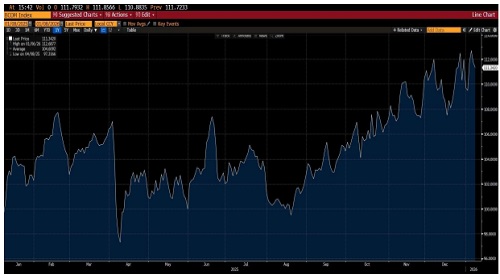

Gold and silver, which posted massive gains in 2025 (65% and 148%, respectively), are undergoing the most significant adjustments. Gold's weight will drop from 20.4% to 14.9%, and silver's weight could fall drastically from 9.6% to as low as 1.45-4%. This will lead to an estimated $14 billion in selling pressure, with gold accounting for approximately $7 billion in futures sales and silver facing up to $7.1 billion in sales. These mechanical sell-offs, driven by the need for passive funds to realign their holdings, will likely trigger short-term volatility in both metals.

Conversely, copper, which sees an increase in weight from 5.4% to 6.4%, and cocoa, added to the index after more than 20 years, are expected to receive a combined $1 billion in buying flows. Other energy commodities, such as Brent crude, are also set to see inflows, while WTI crude and natural gas will face selling pressure.

This rebalancing coincides with market holidays in Japan and China, likely contributing to thinner liquidity and heightened volatility. While the mechanical nature of these adjustments will create short-term market noise, analysts suggest that the long-term fundamentals for commodities like copper and cocoa remain strong, presenting potential opportunities for traders in the post-rebalance period.

Above views are of the author and not of the website kindly read disclaimer