Neutral Bajaj Finance Ltd for the Target Rs. 10,000 by Motilal Oswal Financial Services Ltd

Healthy quarter; strong visibility on earnings ahead

Higher credit costs from ECL refresh offset by tax provision reversals

* Bajaj Finance (BAF)’s PAT grew 19% YoY to ~INR45.5b in 4QFY25 (in line). Adjusted PAT, after excluding the one-offs in credit costs and tax provisions, grew ~17% YoY. BAF’s FY25 PAT increased 16% YoY to INR167.6b.

* The company’s 4QFY25 NII grew 23% YoY to ~INR98.1b (in line). Non-interest income stood at ~INR21.1b (up 24% YoY), driven by an improvement in fee income and income from the sale of services.

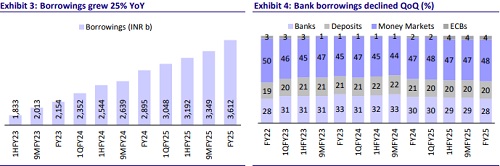

* BAF’s 4QFY25 NIM contracted ~10bp QoQ to ~9.65%. Management guided that margins will remain stable in FY26, supported by an expected 10-15bp decline in the cost of borrowings (CoB). However, a steeper decline in CoB could lead to a minor NIM expansion as well. We estimate NIMs to remain largely stable at ~9.9% in each of FY26/FY27.

* BAF did its annual ECL model refresh, and in light of the elevated flowforward rates and higher credit costs over the previous three quarters, it made an additional ECL provision of INR3.6b, primarily against Stage 1 assets.

* Management indicated that it was witnessing improving asset quality trends in early vintages across the portfolio. BAF guided credit costs of ~1.85-1.95% for FY26. We model credit costs (as a % of loans) of 1.9%/1.85% in FY26/FY27E.

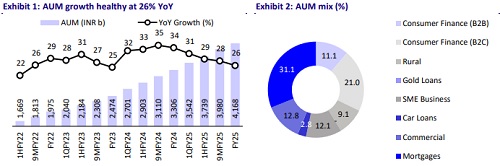

* For FY26, BAF guided an AUM growth of ~24-25%, aided by new business launches in the last 2-3 years. NIM to remain stable YoY with a 40-50bp decline in the cost-to-income ratio. Management targets an RoA/RoE of ~4.4-4.6%/~19-20% in FY26.

* Our FY26/FY27 PAT estimates are broadly unchanged, and we believe that the credit costs have now peaked and will remain below the upper end of the guided range. We estimate a CAGR of ~25% each for AUM/PAT over FY25- FY27 and expect BAF to deliver an RoA/RoE of ~4.1%/21.0% in FY27.

* The stock trades at 4.1x FY27E. Despite a healthy PAT CAGR of ~25% over FY25-FY27E and an RoA/RoE of 4.1%/21% in FY27E, we see limited upside catalysts given the rich valuations and lack of near-term re-rating triggers. Consequently, we reiterate our Neutral rating on the stock with a TP of INR10,000 (premised on 4.5x Mar’27E BVPS).

AUM rises ~26% YoY; healthy new customer acquisitions

* BAF’s total customer franchise rose to 101.8m (up 22% YOY/5% QoQ). New customer acquisitions stood at ~4.7m (vs. ~3.2m YoY and ~5.03m QoQ). New loans booked rose ~23% YoY to ~10.7m (vs. ~8.7m in 4QFY24).

* Total AUM grew 26% YoY and ~5% QoQ to INR4.17t. The sequential AUM growth was driven by Urban B2C (+5%), Rural B2C (+7%), SME (+7%), and Commercial (incl. LAS) (+10%). However, the Auto finance business continues to unwind and declined ~9% QoQ, given that the company has stopped doing Bajaj 2W/3W financing.

Improvement in asset quality; GNPA declines ~15bp QoQ

* BAF’s asset quality improved, with GNPA declining ~15bp QoQ to ~0.96% and NS3 declining ~5bp QoQ to ~0.44%. PCR dipped ~350bp to ~53.7%.

* Credit costs stood at ~INR23.3b (vs. MOFSLe of INR21b). Annualized credit costs stood at ~2.3% (PQ: ~2.1% and PY: ~1.6%). This included an additional ECL provision of INR3.6b because of the ECL model refresh. Excluding this, credit costs stood at INR19.7b (~1.97%).

Highlights from the management commentary

* Auto Finance majorly consists of the captive 2W/3W portfolio, which is currently being wound down. This segment is expected to run off and decline to ~INR45b by Mar’26. Run-down of this portfolio will be accretive to the credit costs.

* For nearly a year, the company has been holding surplus liquidity from its equity capital raise and the subsequent stake sale in Bajaj Housing. Over the next two years, it is required to reduce its shareholding in BHFL to 75%, which will further generate additional excess capital.

Valuation and view

* BAF delivered a healthy performance during the quarter, supported by robust AUM growth. Despite a sequential rise in credit costs due to the ECL model refresh, asset quality showed notable improvement. BAF will look to accelerate its growth in the unsecured segments in FY26, as the stress in its B2C segments gradually dissipates.

* The stock trades at 4.1x FY27E. Despite a healthy PAT CAGR of ~25% over FY25- FY27E and RoA/RoE of 4.1%/21% in FY27E, we see limited upside catalysts given the rich valuations and lack of near-term re-rating triggers. Consequently, we reiterate our Neutral rating on the stock with a TP of INR10,000 (premised on 4.5x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412