Buy Macrotech Developers Ltd For Target Rs.1,568 by Motilal Oswal Financial Services Ltd

Highest quarterly pre-sales; on track to achieve FY guidance

Achieved 90% of guided BD

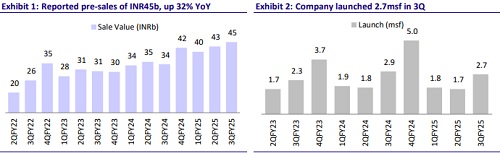

* LODHA achieved 3QFY25 bookings of INR45b (2% below our estimate), up 32% YoY. Among key markets, south and central regions, extended eastern suburbs, and western suburbs outperformed with 2x YoY growth in presales.

* Average price growth is 4% YTD (3% as of 2QFY25).

* In 3Q, LODHA launched 2.7msf of new area worth INR42b in MMR and Pune.

* Another large land deal was executed in Palava at INR210m/acre which is more than the future guidance which was given in Q2FY25 of INR200m/acre.

* In line with its medium-term target, the company expects to deliver 20% growth in pre-sales to INR175b in FY25 and 20% ROE. Growth will be largely driven by ready and ongoing inventory and 4.3msf of launches with a GDV of ~INR75.2b from 4QFY25.

* Financial Performance: LODHA reported revenue of INR41b, up 39% YoY (5% above estimate). EBITDA (excl. other income) rose 48% YoY to INR13b, 27% above our estimate. Reported EBITDA margin expanded 186bp YoY to 32%. According to management, the embedded EBITDA margin for pre-sales stood at ~35%/~34% for 3QFY25/9MFY25. Adjusted EBITDA (excluding interest charge-off and capitalized interest) stood at INR16b, with a margin of 40%. Adjusted PAT came in at INR9.4b, up 65% YoY, with a margin of 23%.

* For 9MFY25, revenue grew 52% YoY to INR95.5b (69% of FY25E), adjusted EBITDA stood at INR32.5b (up 56% YoY), and adjusted PAT came in at INR18.4b (up 94% YoY).

* For 4QFY25, we estimate LODHA to clock revenue of INR42.7b (31% of FY25E), which is achievable given the 3Q performance. Accordingly, we expect EBITDA of INR8.9b and PAT of INR3.3b.

Reduction in net debt despite continued BD spending

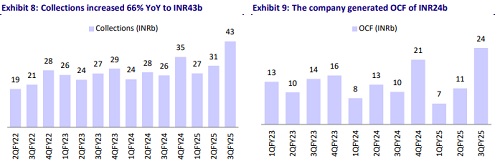

* Collections increased 66% YoY to INR43b. LODHA also reported 135% YoY growth in OCF to INR24.2b, aided by healthy collections from completed projects with higher margins.

* Additionally, LODHA spent INR13.3b on land acquisition and liaison (acquired 33 acres of land in NCR for warehousing) as it added GDV of INR28b (~93% of full-year guidance) in 3QFY25. With this, the company added GDV of INR195b across MMR, Pune, and Bangalore in 9MFY25.

* Net debt declined to INR43.2b (vs. INR49.2b in 2Q), with a net D/E of 0.22x.

Key highlights from the management commentary

* Demand: LODHA noted that demand has been robust, with consumers increasingly focusing on buying high-quality homes. Hence, the company believes that, even during a future slowdown or lean period, branded players will be in a good position.

* Bangalore’s growth phase to begin: The company has concluded its pilot phase and is moving to the growth phase in Bangalore, in line with the laid-down strategy. It added one new project with GDV potential of INR28b (achieving 93% of full year BD guidance). Currently, Bangalore accounts for 2-3% of total sales, which LODHA aims to increase to 15% in a decade.

* Township projects: LODHA has launched premium projects “Lodha Hanging Garden” and “Golf View” in Palava. The company has finally closed the land transaction of 33 acres in Palava for another global hyper-scale data center at INR210m/acres (INR25m/acres at the time of listing; INR120m/acre in 2QFY25). Land monetization will contribute regularly to sales. On average, 60-80 acres/annum of land sales will be executed, of which 70%-80% will be for the data center. The visibility of Palava is expected to increase further with the opening of the Airoli-Katai tunnel in the next 3-4 months, the Navi Mumbai Airport commencing operations in the next 12 months, and the completion of the Bullet Train project by 2029.

* Townships – Sales mix: In 3QFY25, sales stood at INR5b, of which ~INR1b sales came from the premium and luxury projects with realization of INR20,000/sqft on carpet and INR4b from casa and entry-level sales with realization of INR10,000/sqft on carpet.

* Launches: In 3QFY25, LODHA launched 2.7msft of new area worth INR42b. 4QFY25 is expected to see launches in Alibaug, Vikhroli, Palava, Pune, Bangalore and new phases in the existing projects, with total estimated area of 4.3msft and GDV of INR75.2b.

* Digital infrastructure: The company further leased 0.3msft under the digital infrastructure segment, with Skechers, Mitsui, Delhivery, etc. as tenants.

* LODHA aims to generate INR15b in annual rental income, with clear visibility of INR12b from the operational/under-construction projects by FY31 and INR5b by FY26 end. INR5b covers interest costs, so LODHA would be net debt free. Yield on cost is almost on rental asset and is in high-teens or better.

* Management update: Mr. Sushil Modi, earlier CFO, moves to a new role as Whole Time Director of the company and Mr. Sanjay Chauhan is appointed as CFO (earlier Dep. CFO)

* Trademark dispute with HOABL: A recent lawsuit has been filed against HOABL for their use of Lodha’s brand name. The management has clarified that there is no ongoing impact on the company’s operational performance due to this dispute.

Valuation and view

* LODHA has been delivering a steady performance across its key parameters of pre-sales, cash flows, business development, profitability, and return ratios over the last two years. Macrotech Developers 27 January 2025 3

* As it prepares to capitalize on the strong growth and consolidation opportunities, we expect this consistency in operational performance to continue.

* At Palava, the company indicates a development potential of 600msf on ~4,300 acres of land. However, we assume a portion of that land to be monetized as industrial land sales. We value 250msf of residential land to be monetized over the next three decades at INR528b.

* We use the DCF-based method for ex-Palava residential segment and arrive at a value of ~INR933b, assuming WACC of 12.5% and a terminal growth rate of 5%. Maintain BUY with a TP of INR1,586, indicating 43% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412