Buy Bharti Hexacom Ltd For Target Rs.1625 by Motilal Oswal Financial Services Ltd

A preferred play on India’s wireless growth story

Play on Airtel’s high-growth businesses with a longer runway for growth

Play on Airtel’s high-growth businesses with a longer runway for growth Bharti Hexacom (Hexacom), the licensed operator of wireless and fixed-line services under the Airtel brand in Rajasthan and North East circles, provides pure-play exposure to the two high-growth businesses of Airtel – India wireless and Home broadband. Moreover, given lower teledensity and lower internet penetration in Hexacom circles (vs. pan-India), we believe Hexacom can potentially grow a few percentage points faster than Airtel on both subscribers and ARPU. Further, with significantly lower penetration of fixed broadband in Hexacom’s circles and the recent ramp-up of Fixed Wireless Access (FWA) offerings, we believe Hexacom’s wired broadband business could also grow at a faster clip. We initiate coverage on Hexacom with a BUY rating and a TP of INR1,625, premised on 13x FY27E EV/EBITDA (on par with our Airtel’s India wireless multiple). Our preference for Hexacom over Airtel is largely driven by lower capital misallocation concerns

Presence in under-penetrated circles offers a longer runway for growth

Hexacom provides wireless, fixed broadband, and Enterprise services in Rajasthan and North East Circles. Hexacom’s circles account for ~6% of India’s GDP and ~7% of India’s population. However, wireless telephony penetration in Hexacom circles is a few percentage points lower than pan-India levels. Further, internet penetration (both wireless and fixed broadband) is also lower than pan-India levels, which provides a longer runway for growth through higher subscriber growth, ARPU improvements, and non-data-to-data upgrades.

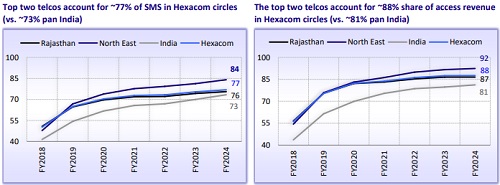

Lower competitive intensity in Hexacom circles to improve margins

Given Vi’s cash constraints, it had to de-prioritize spends in the North East circle, making it an effective duopoly with the top two telcos accounting for ~84% subscriber market share (SMS) and higher ~92% access revenue market share (RMS). Overall, Hexacom circles are more consolidated, with the top two telcos accounting for ~77% SMS (vs. 73% pan-India share) and ~88% RMS (vs. ~81% pan-India). Higher consolidation of market share theoretically provides better pricing power and lower customer acquisition costs, thereby boosting margin. However, on the flip side, the scope of growth from further SMS gains would be lower in Hexacom circles

Lower capital misallocation worries drive our preference for Hexacom

Driven by tariff repair, FCF has improved significantly (~5% yield) for both Airtel and Hexacom. With the repayment of high-cost debt largely behind and leverage ratios in a comfortable range, we believe the biggest investor worry about Airtel's story is around capital allocation (link). Recently, Airtel’s Chairman indicated that the company could look for overseas acquisitions in the medium term. We note that Airtel’s past track record on overseas acquisitions has been a mixed bag, as it took them nearly a decade to turn around the Africa operations, while the company could not scale up forays into South Asia. We note Airtel has no immediate plans for any acquisition, but we would be wary of any potential overseas acquisition.

Conversely, given limited avenues for inorganic growth opportunities, we expect Hexacom’s FCF deployment to be restricted to deleveraging the balance sheet and improving shareholder returns. Lower capital misallocation worries drive our preference for Hexacom (vs. Airtel), even at a slight premium as Hexacom trades at ~15% premium to Airtel’s India business (excluding Indus), on our estimates. We ascribe a 13x FY27 EV/EBITDA to Hexacom (at par with our DCF implied ~13x FY27 for Airtel’s India wireless business) in our base case.

Hexacom in close competition with RJio on subscriber market share (SMS)

Given Bharti’s focus on improving rural connectivity, Hexacom is witnessing accelerated market share gains in both its circles. Hexacom is the undisputed leader on SMS in the North East with ~50%+ SMS, having gained ~500bp (vs. ~100bp for RJio) over the last three years. Similarly, Hexacom gained ~210bp SMS in Rajasthan (vs. ~140bp for RJio) over the last three years to boost its SMS to 35.5%. We note that Hexacom’s blended SMS at ~38% is significantly higher than Airtel’s pan-India SMS of ~33%. Put another way, compared to the ~700bp gap with RJio on SMS on a pan-India basis, Hexacom trails RJio by a modest ~150bp. Further, the gap between Bharti and RJio on the Visitor Location Registry (VLR or peak-active subs) is even lower at a modest ~70bp (vs. ~600bp on pan-India basis).

Industry-leading ARPU driven by premiumization of the subscriber mix

Bharti’s continued focus on premiumization, upgrading non-data subs to data, prepaid subs to postpaid subs, and ultimately to converged homes has led to industry-leading ARPU on a pan-India basis. Hexacom follows a similar strategy and is the market leader on ARPU in both its circles, benefiting from tariff repair and also a significant improvement in its data subscriber proportion to ~76% by 9MFY25 from ~56% in FY21

Hexacom poised to become the RMS leader by end-FY25

Driven by higher SMS gains, a boost from non-data to data upgrades, and superior execution on its premiumization agenda, Hexacom has been gaining market share in both Rajasthan (RMS up ~13pp over last five years) and the North East (undisputed leader with ~57% RMS). Over Sep’19-Sep’24, Hexacom’s AGR surged ~3.5x (vs. 2x for RJio and ~45% for Vi), which has led to a reduction in the RMS gap between Hexacom and RJio to a modest ~20bp in Sep’24 (vs. ~300bp gap with Airtel on a pan-India basis). Further, given Bharti’s outperformance over RJio for the past several quarters, we expect Bharti Hexacom to become the RMS leader in its circles by the end of FY25.

Valuation and view: Initiate coverage with a BUY rating

* We build in ~23% EBITDA CAGR over FY24-27 for Hexacom, driven by: 1) ~13% wireless ARPU CAGR on account of ~15% (or INR50/month) increase on the base plan from Dec’25, 2) continued market share gains, 3) robust ~75% incremental margins, and 4) ramp-up of FWA services, given the lower penetration of Home Broadband in Hexacom circles.

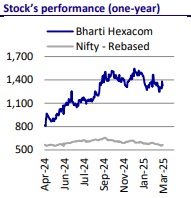

* Hexacom has been up ~2.3x from its IPO price (since Apr’24), led by inexpensive IPO valuations (~7x FY26 EV/EBITDA vs. ~9-10x multiple at that time for peers), wireless tariff hike, continued market share gains, and margin expansions.

* Since Hexacom’s listing day, it has typically traded at a premium to Bharti Airtel. The premium looks optically higher as Airtel’s EBITDA includes full EBITDA contribution from Airtel Africa and Indus Towers, but holds ~61.5% and ~50% stakes.

* Adjusting for Bharti’s stake in Airtel Africa and Indus Towers, we believe Hexacom’s average EV/EBITDA premium to Bharti’s India business has been ~15%.

* Currently, Hexacom trades at ~14.4x one-year forward EV/EBITDA (~15% premium to implied valuation for Bharti’s India business). Given its slightly higher growth, superior return ratios, and lower capital misallocation overhangs, we believe Hexacom could continue to trade at a premium to Bharti’s India business.

* We value Hexacom on an SoTP basis. We value the wireless business on a DCF (WACC: 10.5%, terminal growth: 4.5%) to arrive at an Enterprise value of INR822b, implying ~13x FY27 EV/EBITDA (on par with our DCF implied 13x FY27 EV/EBITDA multiple for Bharti’s India wireless segment). We use the same DCFimplied multiple for the homes & offices segment to arrive at our TPof INR1,625.

* Our scenario analysis indicates a favorable risk-reward for Hexacom with ~41% upside in our bull case TP of INR1,875, premised on a 20% tariff hike in Dec’25, followed by ~7% ARPU CAGR over FY27-34 and a modest ~13% downside in our bear case TP of INR1,150, which is premised on ~10% tariff hike in Dec’25, followed by ~5% ARPU CAGR over FY27-34. We initiate coverage on Hexacom with a BUY rating and a TP of INR1,625 (implying a 22% upside).

* Key risks: 1) increase in competitive intensity, 2) adverse regulatory environment, 3) concentration in select states, 4) dependence on the parent, Bharti Airtel, and 5) merger with Airtel at an unfavorable swap ratio.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412