Neutral Zee Entertainment Ltd for the Target Rs. 125 by Motilal Oswal Financial Services Ltd

Sustained recovery in ad revenue a key to re-rating

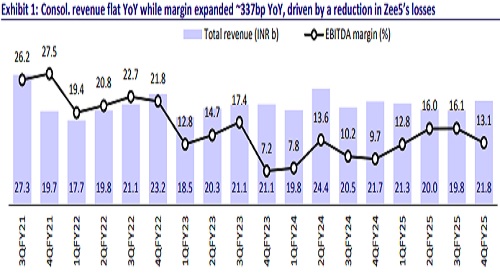

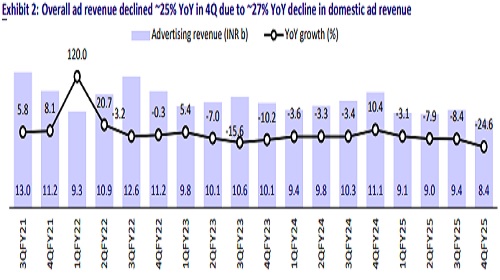

* Zee Entertainment’s (Zee) revenue was largely flat at INR22b (+10% QoQ, 5% beat) as the impact of weak domestic ad revenues (-27% YoY) was offset by a 3.2x YoY jump in other sales and services (movie releases).

* However, EBITDA was broadly in line (-10% QoQ), as margins are typically lower in the movie business and cost control benefits are largely realized.

* Zee5 losses declined to INR750m (from INR1.4b QoQ), led by higher syndication revenue.

* With the costs largely optimized, focus is now on: 1) driving 8-10% revenue growth through re-entry into Free-to-Air (FTA), focus on newgenres and regional languages, and 2) achieving guided EBITDA margins of 18-20% in FY26E.

* Our FY26-27E revenue and EBITDA estimates remain largely unchanged, while the increase in PAT is largely driven by higher other income and lower interest costs.

* Zee’s valuations have turned attractive. However, a sustained recovery in domestic advertisement revenue and a favorable outcome in ongoing litigation for ICC rights with Star remain the key drivers for a re-rating. We reiterate our neutral rating with a TP of INR125 (earlier INR115).

Largely in-line 4Q; sharp dip in domestic ad revenue (-27% YoY)

* 4Q consol. revenue grew 10% QoQ (flat YoY) to INR21.8b (~5% beat), led by a stronger growth (6.5x QoQ, 3.3x YoY) in other sales and services.

* Advertisement revenues declined 25% YoY to INR8.4b (in line), as domestic ad revenues dipped ~27% YoY (vs. -11% YoY in 3Q) due to weaker-than-anticipated rural demand recovery, busy sports calendar (CT, IPL), and YoY higher base (due to elections in FY24).

* Subscription revenue grew 4% YoY to INR9.9b (flat QoQ), with domestic subscription revenue rising ~4.5% YoY (vs. 8.4% YoY in 3Q), driven by a pick-up in both Linear subscription and ZEE5.

* Revenues from other sales and services grew sharply to INR3.6b, driven by a higher number of movie releases and higher syndication revenue.

* Zee continued to demonstrate good cost control, with total operating expenses declining ~3% YoY to INR19b. However, expenses rose 14% QoQ and were 6% higher than our estimate, primarily due to higher movie production and syndication costs.

* Employee costs declined ~10% YoY, and other expenses were also lower due to provision reversals.

* As a result, EBITDA increased 36% YoY to INR2.85b (-10% QoQ, in line), as margin expanded 335bp YoY to 13.1% (though -300bp QoQ, 50bp miss).

* Adj. PAT grew 9% YoY to INR1.9b (9% beat) on account of lower depreciation and finance costs.

Zee5: Revenue growth and lower losses driven by movie syndication

* Zee5 revenue grew 14% QoQ to INR2.75b (+16% YoY), driven by healthy trends in usage and engagement metrics and higher syndication revenue.

* Operating loss declined to INR750b (from INR1.4b QoQ and INR2.7b YoY).

* Adjusted for Zee5, linear TV business revenue declined 1% YoY, while EBITDA grew 6% YoY to INR3.6b.

Sluggish ad revenue impacts growth; Zee5’s loss reduction boosts margin

* Consol. revenue at INR83b dipped 4% YoY, as sluggish domestic ad revenue (- 13% YoY) and lower other sales and services (on a high base in FY24) were partly offset by a 9% increase in domestic subscription revenue.

* However, Zee’s superior cost control led to ~32% YoY growth in EBITDA to INR12b, as margin expanded ~390bp YoY to 14.4%. Adj. PAT was up 3.5x YoY.

* Zee5’s revenue grew ~6% YoY to INR9.8b in FY25, while operating losses declined to INR5.5b (vs. INR11b YoY), driven by robust cost rationalization.

* Adjusted for Zee5, linear TV revenue declined ~5% YoY to INR73.2b, while linear TV EBITDA dip ~13% YoY to INR17.4b as margin contracted ~225bp YoY to 23.8%

* Zee generated OCF of ~INR11.9b in FY25 (up 66% YoY) and FCF of INR10b (~2.2X YoY) driven by improved profitability, favorable WC changes and tax refunds.

* Zee’s cash position improved to INR23b (vs. INR12b YoY).

* With 16.8% share, Zee lost ~30bp YoY in All India TV network viewership share.

Key highlights from the management commentary

* FY25 review: FY25 was a mixed bag for the media industry, underpinned by sluggishness in ad. revenue, with some offset from improvement in subscription revenue on the back of price revisions. Zee’s focus remained on enhancing profitability and generating robust cash flows through cost control and a reduction in Zee5’s losses.

* Ad revenue trends and outlook: Management indicated that the momentum in rural recovery did not sustain as per the expectations. Further, a busy sports calendar in 4Q also impacted ad revenue for Zee (GEC in general). While macroeconomic challenges persist in FY26, management is targeting improvement in ad revenue through re-entry into FTA, launch of new genres such as mini-series, and a focus on regional languages. The company remains hopeful of a high single-digit growth in ad revenue in FY26.

* Zee5: Management indicated that the sharp QoQ reduction in Zee5’s losses was driven by a higher syndication revenue in 4Q. However, even without the boost from syndication revenue, Zee5 would have achieved revenue growth and a reduction in operating losses. Going forward, further reduction in Zee5’s losses will be on the back of pick-up in revenue growth as cost efficiencies are already realized. Management believes Zee5 can break even in the next three years.

Valuation and view

* Zee aspires to deliver a revenue CAGR of 8-10% with its current portfolio and improve EBITDA margins to an industry-leading range of 18-20% by FY26. We believe that a sustainable recovery in ad revenue remains key to achieving these aspirations and driving a potential re-rating of multiples.

* Our FY26-27E revenue and EBITDA remain largely unchanged, while the increase in PAT is largely driven by higher other income and lower interest cost.

* We build in a CAGR of 4%/7%/8% in revenue/EBITDA/PAT over FY25-27E.

* Zee’s valuations have turned attractive. However, a sustained recovery in domestic advertisement revenue and a favorable outcome in ongoing litigation for ICC rights with Star remain key for rerating. We reiterate our neutral rating with a TP of INR125 (earlier INR115).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412