Buy Hindalco Industries Ltd for the Target Rs. 920 by Motilal Oswal Financial Services Ltd

Earnings beat led by favorable pricing; Novelis to see muted performance in near term

Consolidated performance

* Consolidated net sales stood at INR660.6b (+14% YoY and +3% QoQ) against our est. of INR637.4b, driven by favorable pricing and a better product mix.

* Consolidated EBITDA stood at INR89.7b (+14% YoY and +13% QoQ) against our est. of INR74.6b, driven by higher aluminum prices, a better product mix and benefits from a cost mitigation plan.

* Adj. PAT came in at INR48.7b (+14% YoY and +22% QoQ) against our est. of INR36.4b. The beat was primarily led by a better operating profit from both India and Novelis businesses.

* Consol. net debt-to-EBITDA ratio stood at 1.23x as of 2QFY26 vs. 1.02x as of 1QFY26.

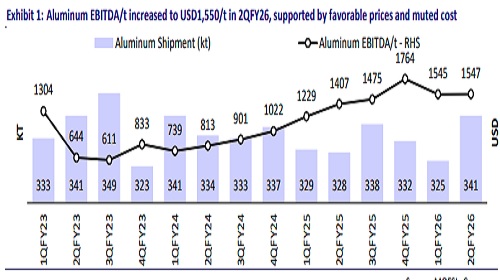

Aluminum business

* Upstream revenue stood at INR100.8b in 2QFY26 (+10% YoY), led by higher average aluminum prices. Aluminum upstream EBITDA stood at INR45.2b (+22% YoY; USD1,521/t), driven by higher volume and favorable pricing.

* Downstream revenue stood at INR38.1b (+20% YoY) on account of higher shipment and favorable pricing. Downstream EBITDA stood at INR2.6b (+69% YoY) led by better product-mix. This translates into EBITDA/t of USD265 (+49% YoY) in 2QFY26 (flat QoQ).

* Upstream aluminum sales stood at 341kt (+4% YoY) and downstream aluminum sales stood at 113KT (+10% YoY) in 1QFY26.

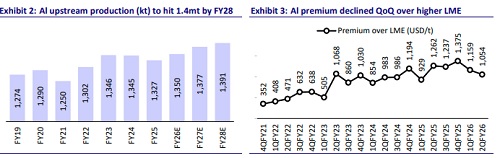

* HNDL has announced Phase-II of Aditya Aluminum expansion (193KT), with a project cost of INR102.25b and expected commissioning in FY29.

Copper business

? Copper business revenue stood at INR145.6b (+11% YoY), aided by higher average copper prices.

? EBITDA for copper business came in at INR6.3b in 2QFY26, down 24% YoY, led by a sharp decline in TCs/RCs, offset by higher sulphuric acid prices.

? Copper metal sales were at 113KT (-3% YoY) and CCR sales were at 97KT (+8% YoY).

Novelis’ 2QFY26 performance

* Shipment volume stood at 941kt (flat YoY and -2% QoQ) and was in line with our estimate. Higher automotive and aerospace shipments were offset by lower beverage packaging and specialty shipments.

* Revenue stood at USD4.7b (+10% YoY and flat QoQ) against our estimate of USD4.4b. The beat was due to higher ASP for the quarter at USD5,041/t (+11% YoY and +3% QoQ), driven by favorable aluminum prices.

* Adjusted EBITDA stood at USD422m (vs. our estimate of USD374m), declining 9% YoY (+1% QoQ), primarily due to net negative tariff impacts and higher aluminum scrap prices, partially offset by higher product pricing and cost efficiencies. Adj. EBITDA/t for the quarter stood at USD449 (against our estimate of USD395), declining 8% YoY but rising 4% QoQ.

* APAT stood at USD141m in 2QFY26 (-30% YoY and -10% QoQ) against our estimate of USD105m.

Highlights from the management commentary

* In 2Q, aluminium CoP was 3-4% higher QoQ, due to monsoon-related coal logistics challenges and higher alumina input costs. Management expects CoP in 3QFY26 to remain broadly flat, with easing coal prices offset by a slight rise in CPC and coke costs.

* The company expects aluminium production and shipments to remain steady or slightly higher in 2HFY26, supported by the ramp-up of downstream capacity and stable operations across smelters.

* The specialty alumina business, with ~0.5mt capacity at Belgaum and Muri, continued to perform well, though realizations were temporarily impacted by a sharp fall in alumina index prices from USD700/t to USD350/t.

* Management emphasized that consol. net leverage to remain below 2x throughout the announced investment phase.

* It guided alumina sales to moderate in 3QFY26 due to a planned maintenance shutdown at Utkal Alumina. For FY26, alumina sales volumes would be ~700- 800kt.

* The company reiterated its capex plan of USD10b over FY26-29, covering both India and Novelis projects. Annual Capex guidance stands at INR85b for FY26 and a peak capex of ~INR110b for FY27 due to the execution of large upstream and recycling projects.

Valuation and view

* HNDL posted a strong consolidated performance in 2QFY26. Earnings growth was primarily driven by favorable pricing. Going forward, the strong earnings outlook for Indian business remains intact. However, the overall Hindalco business outlook has weakened owing to the Bay Minette project cost escalation to USD5b from USD4.1b (revised from USD2.6b earlier) and muted earning in 2H, led by Oswego fire incident.

* Novelis volumes are expected to decline with FCF impact of USD550-650m, (incl. EBITDA impact of USD100-150m in FY26), which erodes near-term earnings visibility and stretches the working capital. Management expects to recover ~70- 80% via insurance in FY27.

* We increase our consolidated FY26 EBITDA and PAT estimates by 4%/7% incorporating the strong domestic business outlook, offsetting the muted Novelis profitability for FY26. We largely maintain our FY27 estimate, assuming Novelis to recover and India business to remain strong.

* At CMP, the stock trades at 6.1x EV/EBITDA and 1.4x P/B on FY27E. We reiterate our BUY rating on HNDL with an SoTP-based TP of INR920.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412