Accumulate Hindalco Industries Ltd for the Target Rs. 846 By Prabhudas Liladhar Capital Ltd

India shines, but Novelis disappoints

Quick Pointers:

* Oswego plant to restart next month; fire incident to impact Q3 volumes by 75kt; Bay Minette project cost rises further by USD900m to USD5bn.

* FY27 India capex cut by Rs40bn to Rs110bn to accommodate Novelis project cost overrun.

Hindalco Industries (HNDL) delivered in-line cons operating performance, supported by strong India delivery on higher downstream volumes and higher LME prices. Q2 Aluminium cost of production inched up ~4% QoQ due to higher coal costs during monsoon. Mgmt. guided slight inch up in H2 CoP as other raw material prices have also firmed up. Going forward, consistent improvement in downstream volumes and coal supply from captive Chakla/Bandha mines over the next few quarters would drive HNDL earnings. Novelis reported an in-line quarter, however ~22% cost escalation at Bay Minette project would depress IRRs and require parent support in terms of equity infusion worth USD750m. Adverse impact of tariffs was USD54m in Q2 and going forward it is expected to get negated by higher MWP, better spot scrap spread and mgmt’s efforts to mitigate costs & reducing dependency on Canada.

We incorporate higher Novelis capex, lower H2 volumes and maintain Novelis EBITDA/t assumption at USD480/USD500 for FY27/28E; which leads to ~Rs70 cut in our TP. We increase our FY26/27E cons EBITDA estimates by 4%/1% respectively as we factor in higher AL prices of USD2,633/USD2,719 and strong by-product prices in copper. At CMP, the stock is trading at EV of 5.6x/5.3x FY27/28E EBITDA. We downgrade the stock to ‘Accumulate’ with revised TP of Rs846 (earlier Rs883), valuing Novelis at 6.5x & India ops at 5.5x EV of Sep’27E EBITDA.

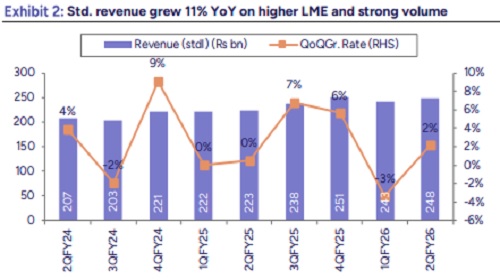

Strong India performance on higher volumes and LME: Standalone AL revenue grew 9% YoY while copper revenue grew 11% YoY. Upstream AL revenue is up 10% YoY on better realisation and EBITDA up 22% due to lower input cost. Downstream revenue is up 20% YoY on account of higher shipments (10% YoY to 113kt) and realisation. EBITDA is up 69% YoY on account of favourable product mix. Copper revenue is up 11% YoY, on account of higher realisation while EBITDA was aided by higher realisation from by-products. AL upstream sales volumes grew 4% YoY to 341kt, downstream sales volumes grew 10% YoY to 113kt. Copper volumes declined 3% YoY to 113kt. Blended realisation for AL business inched up 2% QoQ to Rs240k/t (up 4% YoY) while copper business realisation improved 7% QoQ to Rs1,288k/t (up 15% YoY).

Robust India negates weak Novelis performance: Standalone EBITDA grew 36% YoY to Rs37.4bn (+19% QoQ) on higher LME, lower costs in ally and strong downstream volumes growth. Cons. EBITDA grew 14% YoY at Rs89.7bn (+13% QoQ; PLe Rs90.5bn) on strong LME, higher ally volumes and largely in-line Novelis performance. Cons. reported PAT grew 21% YoY to Rs47.4bn. Exceptional expenses of Rs1.82bn during Q2FY26 w. r. t. fire incident at Novelis Oswego, New York plant. Cons net debt increased by Rs71.6bn QoQ to Rs 414bn, while net debt to EBITDA increased to 1.23 vs (1.02 in Q1FY26).

Novelis: higher cost savings target; but rise in leverage: Increased guidance under global cost efficiency program to exit FY26 over USD125m run-rate (from USD100m earlier) and over USD300mn by end of FY28. Net debt increased by USD228mn QoQ to USD5.8bn in 2QFY26. The leverage ratio increased to 3.5x from 3.2x with total liquidity of USD 2.9bn.

Region wise volumes & EBITDA/t: Shipments of flat rolled products (FRP) was flat YoY to 941kt (-2% QoQ, PLe 964kt) on higher automotive and aerospace segment offsetting lower beverage packaging and specialty shipments. Novelis’s adjusted EBITDA/t declined 8.4% YoY to USD 448/t (+4% up QoQ; PLe USD 460/t) driven by higher aluminum prices/ auto volumes, lower SG&A costs offsetting tariff impact of USD64m and higher scrap prices.

FRP Shipments declined 7% YoY in N.A. to 369kt (lower cans/specialties, higher auto/ higher metal benefit offsetting tariff impact); Europe volumes grew 12% YoY to 261kt on increased demand across segments. Asia volumes grew 12% YoY to 222kt (higher cans, lower Auto) and S.A de-grew 2 YoY to 159kt (lower cans). EBITDA/t declined 22% YoY in N. A. to USD363/t; improved 15% YoY to USD310/t in Europe. While in Asia EBITDA/t declined 3% YoY to USD 446/t and -10% YoY to USD 679/t in S.A..

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271