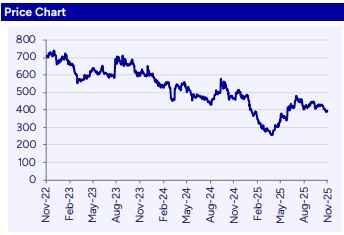

Hold V I P Industries Ltd for the Target Rs. 387 By Prabhudas Liladhar Capital Ltd

A quarter of kitchen sinking

Quick Pointers:

* Adjusting for inventory provision of ~Rs550mn, GM compressed 90 bps YoY to 44.1%.

* Certain non-core assets having a fair value of Rs1,161mn have been identified for an eventual sale.

We cut our FY27E/FY28E EPS estimates by 21%/8% as we fine-tune our revenue and interest assumptions given weak performance in 2QFY26 (Refer section titled “key reasons for change in estimates” for more details). VIP IN reported weak set of results with topline declining 25.3% YoY to Rs4,063mn (PLe Rs4,898mn, CE Rs5,565mn) while GM succumbed to 30.6% amid inventory provision of Rs550mn. Adjusting for the inventory provision, EBITDA loss stood at Rs514mn (PLe Rs88mn; CE Rs321mn) as other expenses continue to remain elevated at Rs1,780mn. VIP IN has been facing problem of slow-moving inventory and provision of ~Rs750mn has been taken in the last 3 quarters. We believe 2HFY26E will be a period of reset and reorganization for VIP IN amid change of guard at top-level. We expect normalization to resume from FY27E with steady state GM/EBITDA margin of 51.5%/14.0% respectively. Consequent to rising challenges on growth & margins we cut our target multiple to 38x (earlier 40x; ~15% discount to SII IN) and retain HOLD on the stock with a TP of Rs387 (earlier Rs474).

Key reasons for change in estimates: In 1HFY26E, top-line was down 18.2% YoY and our implied 2HFY26E ask assumes flattish growth. Given weak performance in 1HFY26 and stiff competition, we cut our top-line estimates by 7%/3%/2% for FY26E/FY27E/FY28E.

Adjusting for inventory provision, GM stood at 48.0%/44.1% in 1QFY26/2QFY26, respectively. For 2HFY26E, we expect GM of 43.9% (assuming no provisions) and expect normalization to resume from next year. Accordingly, we expect GM of 51.5% in FY27E & FY28E. Prior to the discounting led price war, VIP IN’s GM stood at 50.0%/51.1%/52.6% in FY22/FY23/FY24 respectively.

In 1HFY26, EBITDA loss stood at Rs817mn and our 2HFY26E ask implies an EBITDA margin of 3.3%. For FY27E/FY28E, we expect EBITDA margin of 14.0%/15.4%, led by improvement in GM and re-alignment in cost structure (other expenses have been marred by discounting and one-offs in the last few quarters).

Debt has increased to Rs4,376mn in 1HFY26 (Rs4,152mn in FY25). Consequently, we do not expect leverage to decline (earlier guidance of Rs1,300mn reduction in FY26E) in FY26E and have re-aligned our interest forecast accordingly. As a result, we expect loss of Rs1,199mn in FY26E (adjusted for inventory provision) and have cut our FY27E/FY28E EPS estimates by 21%/8% respectively. Downward revision in EPS is predominantly driven by cut in revenue estimates amid stiff competition and re-alignment of interest expenses.

Top-line falls by 25.3%: Top-line decreased 25.3% YoY to Rs4,063mn (PLe Rs4,898mn; CE Rs5,565mn). In comparison, SII IN and Samsonite India posted +16.5%/+8.5% YoY topline growth (constant currency) implying significant market share loss for VIP IN as pricing decisions undergo transition.

Adjusted GM at 44.1%: Gross profit declined 49.2% YoY to Rs1,244mn with margin of 30.6% as against a margin of 45.0% in 2QFY25. Steep margin compression was largely driven by an inventory provision of Rs550mn during the quarter. Adjusting for provision, GM stood at 44.1% (PLe of 46.0%). Pertinent to note, VIP IN has been taking provision on slow moving inventory and this is the 3 rd consecutive quarter of write down. In 4QFY25/1QFY26/2QFY26, inventory provision of ~Rs52mn/ ~Rs150mn/~Rs550mn has been taken. Given the quantum of the provision in this quarter, it seems full kitchen sinking of slow-moving inventory could have been done.

Adjusted EBITDA/PAT loss at Rs514mn/Rs925mn: EBITDA loss came in at Rs1,064mn as against an EBITDA loss of Rs22mn in 2QFY26. Adjusting for inventory provision, EBITDA loss stood at Rs514mn (PLe EBITDA Rs88mn, CE of Rs321mn). As for the bottom line, after adjusting for an exceptional income towards insurance claim worth Rs43mn pertaining to fire incident at Bangladesh and adjusting for the inventory provision, loss for the quarter stood at Rs925mn (PLe loss Rs258mn, CE loss of Rs131mn) as compared to a loss of Rs366mn in 2QFY25.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271