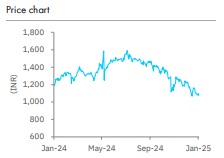

Buy Adani Ports and SEZ Ltd For Target Rs. 1,700 By Elara Capital Ltd

Diversification keeping up with growth

Adani Ports and SEZ’s (ADSEZ IN) overall performance stood in line with consensus estimates. ADSEZ continued its path to becoming an integrated transport utility company by expanding its footprint across domestic ports, international and logistics operations. ADSEZ has successfully maintained its consolidated EBITDA margin above 60% (despite change in mix to lower-margin international and Logistics businesses) through efficiency-led margins in the core Ports business. ADSEZ is confident of improving its consolidated EBITDA in FY25 (marginal upgrade in guidance) and maintained overall growth trajectory (on capex, volume, leverage). We marginally lower earnings estimates by 8%/9% for FY26E/27E to factor in FY25 cargo volume growth closer to the lower end of the guidance. Maintain BUY with TP pared to INR 1,700 from INR 1,813 earlier.

Port performance stable, international contribution up:

Q3 revenues increased 15% YoY to INR 79bn, 11% higher than our estimates, led by 38% growth in the international segment on consolidation of Astro Marine, 31% growth in logistics and 8% growth in the ports business (led by realization growth of 5% and volume growth of 3.6%). EBITDA rose 15% YoY to INR 48bn, led by a rise in international margin to 18% from 10% YoY due to consolidation of high-margin marine business and 142bps improvement in the ports segment. Due to a change in mix to international (at 14% from 12% YoY) and reduction in high-margin ports segment (to 75% versus 80% YoY), consolidated EBITDA margin dropped by 20bps YoY to 60.5%. PAT was in line at INR 25.2bn.

Growth guidance intact:

Despite a minor blip in overall volume growth of 3.6% in Q3 to 112.3MMT, ADSEZ has retained its full-year guidance at 460-480MMT, led by consolidation and commissioning of new ports such as Gopalpur, Vizhinjam, Tanzania, Columbo and improvement at existing ports at Mundra, Hazira and Gangavaram. We factor in FY25 volumes at the lower end of the guidance. Continued growth in efficiency and market share gains resulted in raising EBITDA guidance for FY25 to INR 188-189bn from INR 170-180bn. Overall, ADSEZ is on track to achieving its capex of INR 105-115bn (9M capex of INR 75bn), with better leverage management at 2.1x net debt/EBITDA.

Logistics – Expansion ongoing:

Q3FY25 Logistics revenues grew 31% YoY to INR 6.9bn, with EBITDA margin at 23.2%, down 440bps YoY, majorly due to a change in mix and increase in the trucking business. Through 9MFY25, ADSEZ incurred a capex of INR 15bn and has expanded its fleet of rakes and trucks (developing trucking management system). ADSEZ is creating MMLPs and warehousing capacity for additional growth.

Maintain Buy; TP pared to INR 1,700:

Given ADSEZ’s market leadership and operational efficiency, it continues to advance towards 1,000MMT volumes by FY30 (850MMT from India; balance from international). We maintain Buy with TP pared to INR 1,700 from INR 1,813, factoring in lower volume growth in Q3. We value the ports business at 19x FY27E EV/EBITDA and logistics at 8x FY27E EV/EBITDA (unchanged).

Please refer disclaimer at Report

SEBI Registration number is INH000000933