Buy JK Cement Ltd For Target Rs. 7,050 By JM Financial Services

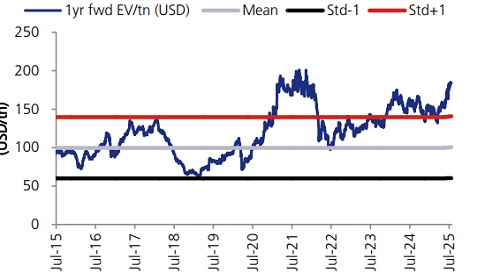

JK Cement (JKCE) standalone EBITDA grew 41% YoY/ declined 8% QoQ to INR 6.8bn— beating our estimates by 4% (and consensus by 9%)—driven mainly by higher other operating income. Blended EBITDA/tn rose 23% YoY/ declined 1% QoQ to INR 1,247 (JMFe: INR 1,215). In 1Q, JKCE increased grey cement capacity by 0.5mt; it also announced 0.6mt wall putty expansion at a capex of INR 2bn to be commissioned by FY27. The company remains on track to expand its grey cement capacity to ~30mt by FY26 and 50mt by FY30, supporting strong volume growth and market share gains in the coming years. With structural cost-saving levers of INR 150–200/tn (targeting INR 40-50/tn in FY26), and despite factoring-in capex of INR 58bn through FY28E, we expect net debt to remain contained at INR 30bn-35bn, supported by healthy cash flow generation. Incorporating the 1Q outperformance, positive pricing outlook and expansion in wall putty segment, we raise our FY26–28 EBITDA estimates by 3-4%. We revise our target multiple to 17.5x (from 16.5x) given growth visibility, controlled leverage and improving return ratios. We maintain BUY with a revised Sep’26 target price of INR 7,050/sh post half yearly roll-over. JKCE remains our top pick in the mid-cap cement space.

* Result Summary: On a standalone basis, JKCE reported overall volume growth of ~14%YoY (decline of 7% QoQ) to 5.4mt in 1QFY26. Grey cement volume grew 15% YoY/ declined 8% QoQ to 5mt led by significant growth in Central (>50% YoY vols. growth) and Bihar markets along with higher clinker sales, while realisation grew ~6% YoY/ 1% QoQ to INR 4,938. Volume of white cement and wall putty grew ~8% YoY/ declined 2% QoQ to 0.42mt. Total cost/tn was flat YoY/ grew 2% QoQ to INR 4,584 (in line with our estimates). Other operating income increased ~38% YoY/ 3% QoQ to INR 1.22bn (~INR 226/tn). On a consolidated basis, overall volume grew by 15% YoY/ declined ~7% QoQ to ~5.6mt in 1QFY26 with blended EBITDA/tn of INR 1,226. Subsidiaries implied EBITDA grew 92% YoY/ declined 51% QoQ to INR 139mn led by higher losses in the paints business.

* What we liked: Better-than-expected profitability; higher other operating income

* What we did not like: Increase in net debt Earnings Call KTAs: 1) JKCE maintains grey cement vol. guidance of 20mt (+11% YoY) in FY26. 2) Spot cement prices are broadly flat compared to Jun’25 exit prices. 3) Maintains its cost/tn reduction target of INR 150-200/tn over the next 2-3 years; aims savings of INR 40-50/tn in FY26. 4) Paints revenue rose by 43% YoY/ 18% QoQ to INR 860mn in 1QFY26. 5) Targets to maintain Net debt:EBITDA below 2x. 6) Guided INR 20bn capex for FY26. 7) Project updates: i) Increased cement capacity by 0.5mt through debottlenecking in Ujjain plant; ii) Approved expansion to set up 0.6mt white cement based wall putty plant near Nathdwara, Rajasthan, at a proposed capex of INR 2bn to be commissioned by FY27; iii) 4mt clinker/ 1mt cement at Panna, 1mt capacities at Hamirpur and Prayagraj and 3mt split GU at Bihar are on track and expected to be commissioned by Dec’25.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361