Buy Baazar Style Retail Ltd For Target Rs. 400 By JM Financial Services

Hitting the right notes

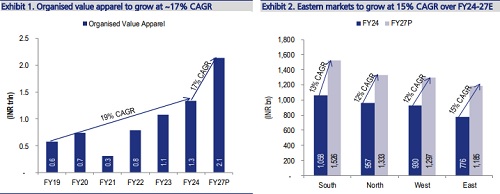

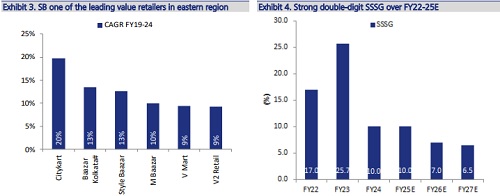

Strong growth potential in a huge, largely unorganised TAM The value apparel market was worth INR 3.7trln in FY24. Of this, the organised market was INR 1.3trln and it is expected to grow at 17% CAGR over FY24-27 (19% over FY19-24) to INR 2.1trln in FY27 led by (1) better quality products at affordable prices, (2) shift from unbranded products to branded products, etc. The eastern value apparel market is expected to grow at a higher CAGR of ~15% vs. 12-13% for other regions over FY24-27E. Strong presence, huge TAM and high growth market places Style Baazar in a favourable position to capitalise on this opportunity.

Robust execution- key enabler for growth in a competitive market Style Baazar offers a one-stop-shop solution to all family needs at affordable prices with repeat sale of ~68%+ showcasing strong execution. Its core strength lies in customising product assortment understanding the consumer preference. Its appealing store layout, strong merchandising and supply chain process, and targeted marketing have helped it attract new customers while retaining existing ones. It is also investing in the system and process automation software that will help increase pace of expansion, improve store level unit economics, reduce other costs.

High potential for store expansion led by strong unit economics Style Baazar, given its robust unit economics and lower penetration levels, has huge potential for store expansion not only in its focus markets but also in its core regions. As per our calculation, it has the potential to add at least ~265 stores considering the current economic and GDP/capita situation, which can only improve in future with increasing per capita income and development of cities. We expect the company to add 145 stores over FY25-27E.

Key risks: (i) High revenue concentration (80-90%) from its core markets (ii) Heavy reliance on apparel sales, (iii) Increased competition in value fashion retail, (iv) Unsuccessful launch of private labels, which may impact the business adversely, (v) Dependency on a few suppliers for procurement needs without any definitive agreements.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361