Accumulate Kansai Nerolac Paints Ltd For Target Rs. 285 By Elara Capital

Compelling valuation amid cautious prospects

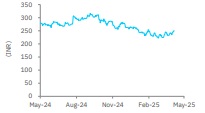

While sales growth at Kansai Nerolac (KNPL) remains subdued and not yet compelling, the stock’s correction of ~9% in the past six months offers reasonable upside, supported by attractive valuation. We therefore upgrade our rating to Accumulate, raising our target price to INR 285 based on 30x FY27 P/E. That said, we await stronger positive catalysts before considering KNPL as a preferred pick in the paints sector.

Decorative coatings demand improves sequentially: KNPL posted a 4.7% YoY rise in Q4 net sales to INR 17.4bn, exceeding expectations by 4.5%. Decorative coatings saw a sequential improvement despite continued pressure from tight liquidity and weak discretionary spending. Growth in this segment was driven by the Paint+ (premium) portfolio, construction chemicals, wood finishes, and the projects business. Notably, Paint+ gained momentum, with its contribution rising 190bp to reach double digits in decorative sales. New verticals — construction chemicals, waterproofing, and wood finishes — continue to outpace market growth. The B2B projects segment expanded to 80 cities, backed by a healthy pipeline. In industrial coatings the company outperformed the market in automotive, led by strong demand in two- and three-wheelers, along with improved traction in passenger vehicles. Innovation and tech-driven expansion efforts remain central to broadening the addressable market. Performance coatings also sustained robust growth, supported by a solid orderbook.

Expectations of an improved performance in FY26: Management retains a positive outlook, anticipating steady sequential improvement in the decorative coatings segment. This optimism is driven by the continued recovery in rural demand and forecast of a normal Monsoon, which is expected to support growth in the upcoming quarters. The company acknowledges competitive pressures will persist throughout H1, but it expect a stronger rebound in demand during H2FY26. In the industrial coatings segment—where automotive coatings account for ~70%—KNPL is sharpening its focus on emerging areas, such as the auto-refinish market, while also increased its engagement with electric vehicle (EV) manufacturers to tap into evolving mobility trends. For performance coatings, it remains committed to expanding its portfolio of premium offerings and leveraging on recent technological innovation.

Target to achieve EBITDA margin of 13-14%: EBITDA margin declined by 60bp YoY to 10.2%, trailing estimates by 80bp, largely driven by a 40bp YoY rise in employee cost. With inflation showing signs of easing, management remains cautious and intends to observe sustained trends before implementing any pricing actions. However, it retains medium-term margin guidance of 13-14%

Upgrade to Accumulate with a higher TP at INR 285: We raise our earnings estimates by 2% for FY27 due to higher margin and Other income. We upgrade to Accumulate from Reduce with a higher TP of INR 285 from INR 272 on 30x (unchanged) FY27E P/E as the stock of 9% in the past six months enhances valuation comfort.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

Tag News

Accumulate Kansai Nerolac Paints Ltd For Target Rs 240 By Elara Capital