IT Sector Update : Mid-caps set to outperform by Elara Capital

Mid-caps set to outperform

In Q3FY26, expect revenue for most IT Services companies within our coverage universe to be impacted by furloughs and lower utilization. Furloughs will be at similar levels as seen previously. We expect the deal momentum to continue across our IT Services coverage universe, as clients continue to spend on next-gen technologies such as cloud transformation, data & analytics and AI.

CY26 budgets to provide clarity on growth in FY27, but do not expect these to be materially higher. Attrition may see an uptrend given talent transfer to GCCs. Furloughs and wage hikes may strain margin of most companies. We expect Infosys (INFO IN) and HCL Technologies (HCLT IN) to retain their respective revenue growth guidance of 2-3% and 3-5% (company-level) for FY26. For INFO, the ask rate for the next two quarters is - 1.5% to -0.2%, to reach the lower and upper end of its annual revenue growth guidance.

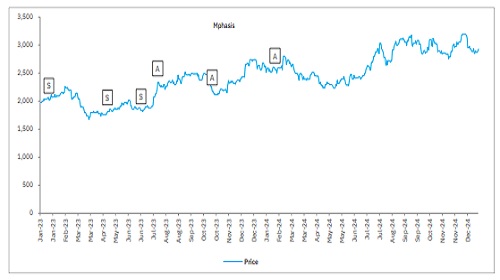

Mid-caps to outdo large-caps in Q3. Expect Coforge (COFORGE IN) and Persistent Systems (PSYS IN) to post strong QoQ USD revenue growth of 3%+. LTIM and Mphasis (MPHL IN) should follow, with USD revenue growth within ~1.0-2.0%. Large-caps (ex HCLT) may post a QoQ revenue growth of -0.5 to +0.5% in USD. Growth for ER&D players may be muted except TELX. We prefer TCS and MPHL on valuation comfort.

COFORGE and PSYS to lead in revenue growth: COFORGE may grow 3% QoQ in USD terms, led by strong deal execution in all the verticals, except BFSI, which may see furlough impact in Q3. Expect PSYS to post QoQ growth of 3.0% in USD terms, aided by continued strong performance in BFSI and Hi-tech. MPHL’s revenue may grow ~1% QoQ, led by Media & Telecom and Insurance (BFSI may see furlough impact). LTIM may post 2% QoQ USD growth, led by manufacturing and retail, while BFSI may be hit by furloughs.

TCS may post flat QoQ USD growth (international markets may see furlough impact, though offset by growth in India business). INFO may post a 0.5% QoQ USD revenue drop on seasonal furlough and in-line with prior trend of weak H2 versus H1. An organic sequential drop is likely to be steeper. Expect WPRO to report 0.5% QoQ USD revenue (around midpoint of its -0.5% to 1.5% guidance for Q3), led by ramp up in the Phoenix deal. HCLT may post a 2.0% QoQ CC revenue growth (2% QoQ in USD) due to seasonally strong P&P business and some recovery in retail, CPG, Healthcare. Expect TECHM to report a 0.5% QoQ USD revenue rise, led by Communication and Retail. TELX may post 1.5% QoQ USD revenue growth on recovery in Auto (spillover of Q2 to Q3) and Media & Entertainment, while Healthcare may be muted. KPITTECH is likely to post 1% QoQ USD revenue growth on full consolidation of Caresoft. We expect TATATECH to report a 1% QoQ drop in USD revenue due to weak Auto services (JLR cybersecurity issue and subsequent loss of billing days), while non-Auto and tech solutions business may partially offset the concern.

Above views are of the author and not of the website kindly read disclaimer