Oil & Gas Sector Update : Crude Compass - Weekly Oil Market Dossier by Choice Broking Ltd

Developments over the past week:

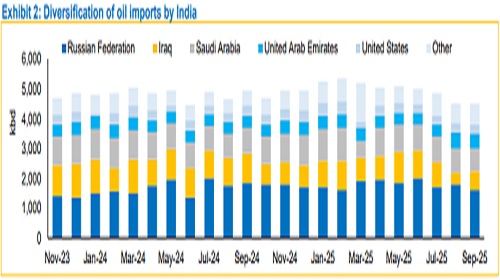

* Oil in transit: The oil on water has stayed elevated during the year, with tankers carrying Russian oil reaching 180 million barrels in November, up by 21% over the past three months. Meanwhile, the Iranian oil on tankers at sea rose to 54 million barrels in November, the highest in about two and half years.

* Relentless production from US: As per the US government data, oil production during this quarter will rise by an estimated 370kbd to 13.8mbd despite WTI prices averaging slightly below USD60/b during the current quarter.

* OPEC+ maintained their stance: As of Nov 30, the group maintained its stance to pause the output hike during Jan-Mar 2026 in order support oil prices

Going forward:

* We increasingly believe OPEC+ to lose market share in global oil supply landscape on the back of ability of the US shale producers to increase production at lower prices. Meanwhile, on the strength of advancement of technology and efficiency gains, production by the largest oil-producing nation, the US, will be viable at a lower price point going forward.

* As a result, a trigger for balancing the market which has been around US$60/b will be lowered, resulting in lower prices for longer. However, on the other of end of the curve, where lifting cost is one of the lowest, Saudi Arabia needs ~USD90/b oil price to balance its fiscal deficit.

* At the start of the decade, the fittest on the oil landscape to survive were expected to be the less carbon-intensive barrels from emerging economies, but, in our opinion, now, the most developed economy is giving them a run for their money.

For the current calendar year, we expect the Brent estimate of USD 69.0/barrel (b), as published on June 13th , 2025, as compared to YTD average of USD 68.5/b. However, we lower our Brent estimate for CY26 from USD65.0/b to USD61.5/b in the backdrop of increased competition in the market as a result of (a) relentless supply of oil from the US at lower prices, (b) gradual continued unwinding of cuts by OPEC+ and (c) possible removal of sanctions on Rosneft and Lukeoil.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131