Economics - Expect 10bp slippage in FY26E fiscal deficit by Elara Capital

Expect 10bp slippage in FY26E fiscal deficit

The Centr al government ’s fiscal deficit widened to INR 9.8tn in April -November FY2 6 versus INR 8.5tn in April -November FY2 5, equivalent to 62.3% of BE during April -November FY2 6 versus 5 2.5% of BE in April -November FY2 5. While the government has f ront -loaded capex spending (28% YoY Apr -Nov FY26 versus -12% in Apr -Nov FY25) to support growth , revenue collections have lagged, particularly on the n et-tax side. As such, t he pace of overall revenue receipts moderated compared with last year, growing at 2.1% YoY versus 8.7% last year. Considering the surplus in non -tax revenue and the spending shortfall (estimated at INR 788bn) and considering lower nominal GDP growth of 9% , we expect a fiscal deficit of ~4.5% of GDP, slightly above the Budget Estimate target of 4.4% of GDP.

Tax collections, a key drag despite robust non-tax revenue growth: During April -November FY2 6, the government collected nearly 55.9% of its revenue receipts target as per FY2 6BE, marking a 2.1% YoY rise , the slowest pace of growth since April -Jul y FY24 . The moderation was primarily due to continuous weakness in net tax revenues , which declined by 3.4% YoY. In Nov -25 alone, net taxes declined 13.6% YoY due to 14% YoY rise in tax devolution to states and ~3% drop in gross tax collections . Gross tax collections grew by 3.3% YoY in April - November FY2 6, a sharp moderation from the 10.7% growth recorded in the same period last year and slowest pace since 8MFY20 (ex -Covid ). Indirect tax collections were steady, supported by 9.3% YoY rise in excise duties, and a 5.4% YoY increase in CGST collections in 8MFY26. While the overall pace of tax collection has weakened due to policy -led GST rate rationalization and income tax relief measures, we expect a shortfall of INR 1.99tn in net tax collection in FY26E.

Encouragingly, non -tax revenues provided a meaningful offset, registering a robust 20.9% YoY growth, supported by higher dividends and miscellaneous receipts, which partially cushioned the impact of softer tax buoyancy on overall revenue performance.

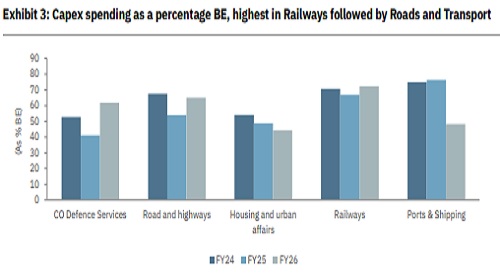

Capex spending strong: The pace of overall government expenditure was healthy in 8M FY26, rising by 6.75% YoY versus 3.35% YoY growth in 8M FY25, led primarily by higher capex spending. Capital expenditure continue d its healthy momentum, surging 28.1% YoY in 8M FY26 versus a 12.3% decline in 8M FY25, with ~ 58.7% of BE achieved versus 46.2% in 8M FY25. Q3TD, capex have seen a YoY decline of 21.4%, and we expect this trend to pick pace in rest of FY26. Among key ministries, the Ministry of Road Transport & Highways and the Ministry of Railways have already spent 65% and 72.2% of their annual capex allocation in 8M FY2 6, respectively. Notably, capital outlay under defense services re corded 61.9 % of FY26BE, the highest run rate for the segment on record. Overall, owing to soft spending on other heads, we see a shortfall of INR 300bn on capex spending.

Revenue expenditure growth soft: The pace of revenue expenditure remained steady at 1.8% YoY in 8M FY26, compared with 7.8% growth in the same period last year and accounted for 57.5% of FY2 6BE versus 60.1% of FY2 5BE . In the first eight months of the fiscal, the Centre spent INR 2.8tn on overall subsidy, which is up by 3.3% YoY and touched 7 5% of FY2 6BE versus 73% of FY2 5BE. However, spending under key schemes like Jal Jevan Mission (2% of total allocation till Nov 2025) is likely to lead to underachievement of revenue expenditure of ~ INR 770bn

The Central government recently presented the first batch of supplementary grants in line with routine fiscal practice . The net cash outgo is pegged at INR 4 14.5bn in FY2 6. Among the allocations, major portion of INR 180bn was allocated to fertilizer subsidy (vs INR 170tn last year) . Additionally, INR 95bn was allocated to the Petroleum Ministry to compensate oil marketing companies for under -recoveries.

GST collections rebound in December, led by import-linked revenues: GST collections rebounded in December 2025, rising 6.1% YoY to INR 1.74tn, marking a sharp turnaround from the ~4% YoY contraction recorded in the previous month and the strongest growth in the past three months following GST rate rationalization . However, the improvement was led by import -related collections . Domestic GST revenues increased by 1.2 % YoY, while collections from imports rose by 1 9.7% YoY amid resilient import volumes . At the state level, Haryana, Maharashtra and Gujarat led with growth of 1 6% YoY , 15%YoY and 12% respectively. In contrast, Chhattisgarh, Jharkhand and Odisha recorded a de-growth of 28% YoY , 17% YoY, and 12%YoY respectively.

Lower tax buoyancy adds pressure on fiscal metrics: India’s fiscal position remains under check due to lower net tax collections. However sizeable RBI dividend payout, steady excise duty collections may allow government to manage their finances albeit with a modest slippage of 10bps at ~4.5% of GDP, slightly above the Budget Estimate target of 4.4% of GDP.

Above views are of the author and not of the website kindly read disclaimer