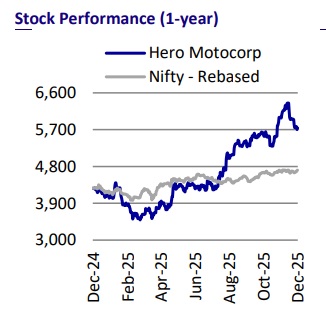

Buy Hero Motocorp Ltd for the Target Rs. 6,782 by Motilal Oswal Financial Services Ltd

Demand momentum for 2Ws likely to sustain

Pick up in rural demand bodes well for HMCL

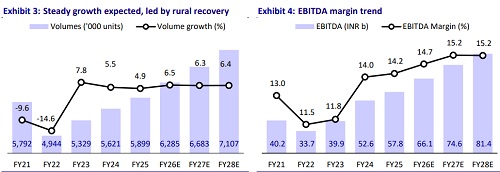

We met with the management of Hero MotoCorp (HMCL) to discuss the demand trends in the domestic 2W market and the company’s plan to capitalize on the same. Demand for 2Ws has picked up well post-GST rate cuts, and it is expected to be sustained, according to the management. Demand was aided by positive rural sentiment which bodes well for HMCL. Management has maintained its volume growth guidance of 8-10% for the 2W industry for H2. While it remains a dominant player in the entry segment, HMCL targets to recover lost share in the 125cc segment post recent variant launches of Glamour and Xtreme125R, which have been well received in the market. HMCL'sscooter segment, both on ICE and EVs, has also picked up well. Management remains confident of a gradual market share recovery in the coming quarters. HMCL’sfocus on the top 10 export markets has helped revive its export momentum. We project a revenue/EBITDA/PAT CAGR of ~10%/12%/13% over FY25-28. We reiterate our BUY rating with a TP of INR6,782 (based on 20x Sep’27E EPS + INR141/423 for Hero FinCorp/Ather after a 20% Holdco discount).

Demand momentum for 2Ws likely to be sustained

Motorcycle demand appears to have bounced back after the GST rate cuts, as is visible in the Oct and Nov’25 sales trends. More importantly, demand has been broad-based, with healthy growth visible across all segments. Management expects the entry-level demand to be sustained, given the positive rural sentiments. Further, the company expects to recover the lost share in the 125cc segment, aided by healthy feedback for the recently launched Glamour upgrade and the Xtreme125R dual-channel ABS variant. Overall, management expects the industry to post about 8-10% growth in 2Ws in H2.

Scooters have picked up well

In scooters, HMCL has been outperforming peers over the last few months on the back of a healthy acceptance for products like Destiny125. As a result, in a highly competitive market, HMCL’s scooter market share has improved by 80 bps YoY on a YTD basis to 5.9%. In EVs, the Vida VX2 has been very well received by customers, and its market share has improved to 12% currently. It targets to take this to 14-15% by the end of Mar’26. Over the long term, HMCL aims for a leadership position in EVs.

Export momentum likely to be maintained

HMCL’s 2W exports have recovered, aided by focusing on the top 10 markets, which drive ~80% of its volumes. Growth is being driven by locally tailored launches and continuous strengthening of service, dealer, and export capacity. Exports now form ~8% of volumes, with a target to reach 10% by Mar’26.

Valuation and View

We expect HMCL to deliver a volume CAGR of ~6% over FY25-28, driven by rural recovery and a ramp-up in exports. We project a CAGR of ~10%/12%/13% in revenue/EBITDA/PAT over FY26-28. We reiterate our BUY rating with a TP of INR6,782 (based on 20x Sep’27E EPS + INR141/423 for Hero FinCorp/Ather after a 20% Holdco discount).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412