Buy Vishnu Chemicals Ltd For Target Rs. 600 By Emkay Global Financial Services Ltd

Barium vertical outperforms; maintain BUY

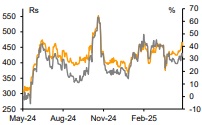

Vishnu Chemicals (VCL) reported Q4 EBITDA at Rs640mn (flat YoY/QoQ), in line with our estimates. The Barium segment performed exceptionally well, with EBITDA doubling YoY to Rs345mn (+41% QoQ), led by a) price hikes in barium carbonate and precipitated barium sulphate (PBS) and b) benefits of backward integration from the Ramdas Minerals acquisition (baryte beneficiation plant). Chromium segment reported lower EBITDA at Rs296mn (-35% YoY/-24% QoQ), due to higher chrome ore prices impacting margins. We cut FY26/27E EPS by 9/5% to factor in a sustained high-cost environment for chrome ore. We maintain BUY with an unchanged TP of Rs600 (rollover to Mar-27E EPS).

Chromium Chemicals impacted by higher raw material prices

The Chromium Chemicals division reported a revenue of Rs11bn in FY25 (+9% YoY). This was largely led by a higher share of domestic business. The gross margin for this segment contracted to 41.6% in FY25 vs 46.2% in FY24, on account of rising chrome ore prices over the last 2-3 quarters, given the demand-supply mismatch and supply chain disruptions. The management has guided for a stable gross margin of 44-45%, supported by improved procurement, input cost stability, and stronger export demand. The chrome mine acquisition is progressing well, pending clearances from the local government, with plans to source 90% captively and 10% from third parties. The management is evaluating chrome metal capex, either independently or through a strategic partnership.

Barium Chemicals reported strong numbers on better pricing across portfolio

The Barium Chemicals division recorded revenue of ~Rs1bn in FY25 (+73% YoY), led by strong volume growth (30%) and improved realizations. Demand from the domestic paints industry and US exports significantly ramped up this segment’s volume. Gross margin improved in H2, led by backward integration benefits from Ramadas Minerals (recovered 60% investment in six quarters). VCL will be the lowest cost producer of barium chemicals after it has acquired Ramadas Minerals and is able to compete in global markets. This segment’s utilization was ~60-64% for FY25 and is expected to reach 80- 85% by FY26. VCL is evaluating a second expansion phase of PBS to meet rising demand.

Capex plans to remain on track with focus on strontium carbonate

In FY25, VCL spent Rs880mn, of which it spent Rs280mn on replacement capex in chromium chemicals; Rs300mn on the strontium carbonate (SC) project; and the balance on barium chemicals. It spent ~Rs520mn to acquire Jayansree Pharma. The SC capex is likely to be commissioned by the end of Jun-25 and generate meaningful revenues from H2. The management is optimistic about a faster ramp-up, supported by expedited customer approvals following a fire incident at a competitor’s plant in Mexico in early CY25. We expect further capex announcements only after the commissioning of the SC project, with all investments expected to be funded through internal accruals and existing debt. The company expects 15-20% revenue growth and improved margins in FY26.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)