Buy Arvind Smartspaces Ltd For Target Rs. 740 By Axis Securities Ltd

Arvind Smartspaces’ management recently saw a change in structure, with the new CEO, Mr Priyansh Kapoor, taking the reins while Mr Kulin Lalbhai continues to be the vice chairman of the company. Arvind has highlighted its change in management personnel and a resulting change in the overall structure and process of the company. Overall, Arvind aims to deliver a 30-35% growth for pre-sales and is likely to maintain its current BD path.

Key Takeaways

* Personnel Change: Arvind has seen a notable change in its top management in H1FY26. The new management is more focused on enhancing efficiencies and reducing the time lag from ‘announcement of project-to-launch’ period. Its new CEO, Mr Priyansh Kapoor, has over 10 years of experience with Mumbai real estate. He has successfully managed a company with 20-30 live projects and is expected to build a similar scale and pattern for Arvind. The company is now a city-led organisation that drives the last-mile decision-making, with operations spanning 3 cities–Ahmedabad, Bangalore and MMR. Furthermore, Arvind is investing ahead of time to build a platform, designing new processes, and the flow of the company. It has hired over 16% additional employees since the new management to garner BD, sales and other related functions. The aim is to become more process-driven rather than a people-driven organisation.

* Tri-City Business Development and Mumbai Plans: Management is focused on developing a business around 3 cities, namely Ahmedabad, Bangalore and Mumbai, of which it has already established itself in 2 cities. For Mumbai, the company’s plan is to continue with its JD and Vertical project focus and is planning to partner with established companies in the city. This approach enables a low cash outlay while leveraging a strategic partner with strong experience in the city. Arvind is looking at an average price range of Rs 30,000-60,000/sq. ft. and a mid-income ticket size of Rs 3-5 Cr. Going forward, it will cease to take new opportunities in the extended suburban horizontal projects in MMR (Navi Mumbai, Karjat). The focus is on new vertical projects with a strategic JV/JD partner or redevelopment projects which have more value. It is unlikely to pursue projects that attract a large number of competing developers and become purely a numbers-driven bidding exercise, instead focusing on opportunities with limited competition and superior value potential. Since the company’s ticket size is in the midrange, among the top players who consider only higher ticket size projects, Arvind is expected to be a preferred choice due to its brand legacy. Arvind is also planning on positioning itself in areas that are more demographically strategic. It will emphasise building 1st home projects, which is a shift from its ‘second home - villas’ focus in Ahmedabad horizontal projects. Apart from this, it will continue its horizontal as well as vertical projects in Ahmedabad and Bangalore while maintaining its current BD trajectory.

* Operational Guidance: The pre-sales guidance for 30-35% growth, translating to ~Rs 1,700 Cr, is unchanged. Its BD guidance is also reiterated at Rs 4,000-5,000 Cr for the coming years. The company aims to eventually reach Rs 1,000 Cr/year capex and a Rs 10,000 Cr setup with an improving launch and BD velocity. Each city is expected to generate Rs 1,500-2,000 Cr post the new regimen changes. Arvind expects an IRR of over 25% from its projects. It has already launched 3 outright purchase projects recently and is expected to have a value-accretive H2FY26. The company also reassured that the slowdown in Bangalore has eased and that sustained sales momentum is expected to pick up going forward.

Valuation & Recommendation

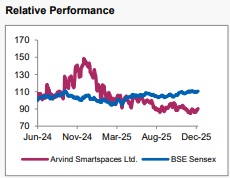

The management reaffirmed its FY26 pre-sales growth guidance of ~30-35%, supported by a robust launch pipeline of 4–5 projects in H2FY26 with an estimated GDV of ~Rs 3,000 Cr. It expects sales, collections, and execution momentum to strengthen in the H2 as new projects in Ahmedabad, Vadodara, MMR, and Bangalore come to market. The company remains focused on asset-light expansion, capital-efficient growth, and sustained cash generation. Management reiterated confidence that the ongoing organisational transformation and tri-city-led model will enable project scale-up. It continues to maintain a strong balance sheet and disciplined capital allocation. We value the company at 5.5x FY28E Pre-sales/EBITDA, and maintain our BUY recommendation on the stock with a TP of Rs 740/share, implying an upside of 21% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633