Buy Nippon Life India Asset Management Ltd For Target Rs. 930 By JM Financial Services

NAM reported strong, largely in line results – operating PBT of INR 3.8bn was a 1% beat on JMFe, as controlled opex (-3% JMFe) countered a revenue miss of 1%. With Other Income of INR 1.46bn (+544% QoQ, +12% YoY, +12% JMFe), PAT of INR 4.0bn was 2% above JMFe. Standalone yields (calc.) stood at 0.37% of QAAUM, -1bp QoQ, a result of telescopic pricing and a fall in equity share in QAAUM by 60bps QoQ to 47.6%. Further, NAM has refrained from reducing distributor commissions in last two quarters, after it had rationalised payouts on 45% of its AUM by 3Q last year. Opex was a positive surprise (3% below JMFe) even though the company booked INR 110mn in ESOP costs for the quarter. Strong equity MTM in 1Q provides a base for strong revenues – we raise our FY26/FY27/FY28e EPS by 9%/6%/5%, led by topline expansion. As the company is gaining market share and strongly building its presence beyond the mutual funds space, we continue to prefer NAM in the AMC space. With a 6% FY27e EPS upgrade, we raise our Target Price to INR 930 (from INR 730 earlier), valuing the company at 32x FY27e (against 26x earlier) EPS of INR 29. We maintain BUY.

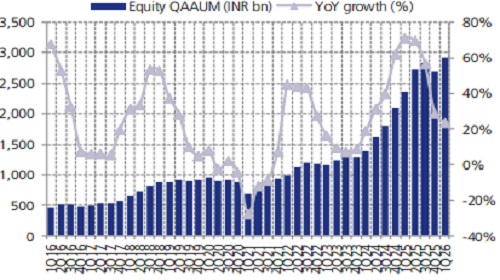

* Revenue yields fall 1bp QoQ as a result of telescopic pricing and rise in non-equity schemes:

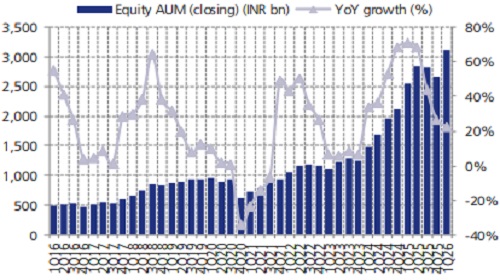

Standalone yields (calc.) stood at 0.37% of QAAUM, -1bp QoQ, a result of telescopic pricing and stronger gains in non-equity schemes vis-à-vis equity, on a QAAUM basis. While equity QAAUM grew by a strong 8.5% QoQ, other scheme categories outperformed equity, contributing to the fall in blended yields. Strong Other Income of INR 1.46bn (+544% QoQ, +12% YoY, +12% JMFe) builds expectation of revenue growth in 2Q and FY26e, as closing equity AUM was 6.5% ahead of QAAUM. The company had a 10%+ market share in SIP and net equity inflows, against 7.1% book market share in equity in June MAAUM.

* Controlled costs despite booking INR 110mn in ESOP costs: Employee expenses rose (11% QoQ, 17% YoY) to INR 1.23bn, however, it was still below JMFe as mgmt. had gudied for INR 450-500mn of ESOP costs in FY26. Mgmt. maintained its guidance on ESOP costs for FY26/27e – of INR 480mn for FY26 and INR 240mn for FY27e. Other expenses also grew strongly with total opex up (8% QoQ, 16% YoY) as the company is expanding its distribution, building a presence in SIF and expanding AIF offerings.

* Valuations and view - Prefer NAM in the AMC space: At CMP, the stock trades at 33x/27x FY26e/FY27e EPS. For the mutual fund industry, despite the strong appreciation in equity markets, inflows remain below the levels seen in CY24. This is also preventing the company from rationalising distributor commissions further, as it attempts to keep gaining market share. Further, building its presence in SIF and AIF space will support yields going forward. Led by a 6% FY27e EPS upgrade, we raise our Target Price to INR 930 (from INR 730 earlier), valuing the company at 32x FY27e (against 26x earlier) EPS of INR 29. We maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361