Reduce Aavas Financiers Ltd For Target Rs.1,934 By Elara Capital

Scalability challenges to emerge

AAVAS FINANCIERS (AAVAS IN) concluded the year on a decent note despite headwinds, with Q4 earnings falling in line with our expectations. Surpassing INR 200bn AUM threshold brings scalability challenges capping future growth momentum. Current valuation factors in all the positives emanating from superior risk management, stable growth, and steady earnings profile. Moreover, expensive valuation of 2.8-2.9x leave little room for error with a capped growth rate of 20% with a 2.7-2.8% ROA and 15% ROE. We downgrade to Reduce with a TP of INR 1,934 based on 2.7x FY27E P/ABV.

Lower interest, provision expenses aid PAT: PAT at INR 1.54bn was in line, up 5% QoQ and 7.8% YoY, although dragged by 18.8% QoQ/9.8% YoY rise in Opex, pushing cost-to-income ratio up 344bp QoQ and 201bp YoY, led by higher employee cost from new branches. NIM expanded 26bp QoQ to 6.8%, down 23bp YoY, to be further aided by 56% borrowings, and repo- & T-billlinked where benefits are immediate while MCLR-linked to be repriced from Q1FY26. Around 70% of book is floating (PLR-linked), ensuring cost of borrowing reduction is passed on. Asset Liability Management remains strong with longer borrowing tenors. It targets ~5% spread with sharper focus on borrower profiles, and smaller ticket loans (

Scalability challenges to emerge: AAVAS surpassed INR 200bn AUM in Q4, up 18% YoY, driven by technology efficiency, digital upgrade, and rear-ended branch expansion, with new forays into Tamil Nadu (other South India states) planned for FY26. Disbursements rose 27% QoQ; however, moderation in the login-to-sanction ratio to 38%, down from 42%, tempered the otherwise healthy momentum. In Q4, the company recorded 55,000 logins across ~0.3mn live accounts. Its targeted 20% growth rate will be supported by a strategic 65%:35% mix between home loans (HL) and MSME loans, stable BT-outs (<6%), and robust proprietary models, which also aid in rundown restriction at ~17%, alongside continued footprint expansion

Business shift to keep NPA in check: Q4 NPA at ~1.1% improved marginally by 6bp QoQ and 14bp YoY. While credit cost was restricted at 15bp, management retains target of 25bp as book and territories expand. Q4 saw 1+DPD below 5% target at ~3.4% and vintage states demonstrating superior show with both 1+ DPD and GNPA remaining under 4.0%. Emerging states too offer confidence with negligible 1+dpd, NPA below 3.0%. Loans with ticket size of

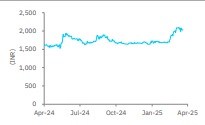

Downgrade to Reduce with unchanged TP of INR 1,934: While Q4 earnings was weak, FY25 concluded on a good note as AAVAS continues to navigate challenges. Increased competition and scalability issues are likely to drive business model tweaks, with a shift to SEMP and MSME segments. We expect NPA to rise to 1.2%, but its strong risk management should keep the situation stable. While Q4 saw inching up of provisions and a decline in logins to sanctions conversion keeping core and PAT in check. Modelling in a modest near to medium term, we pare down our earnings by 7% for FY26E and 10% for FY27E; we introduce FY28E. Given a ~18% stock rally in the past 3 months and expensive valuation, we downgrade to Reduce from Accumulate with an unchanged price target of INR 1,934 at 2.7x FY27E P/ABV.

Please refer disclaimer at Report

SEBI Registration number is INH000000933