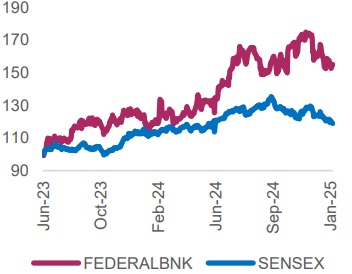

Buy Federal Bank Ltd For Target Rs.225 by Axis Securities

.jpg)

Re-Calibrating Strategy to Drive Strong, Sustainable, & Profitable Growth!

Est. Vs. Actual for Q3FY25: NII – INLINE; PPOP – INLINE; PAT – MISS

Changes in Estimates post Q3FY25

FY25E/FY26E/FY27E (in %) NII: -1.8/-4.5/-5.1; PPOP: -3.5/-8.2/-8.7; PAT: -6.5/-11.5/-11.9

Recommendation Rationale

* Re-looking into the Deposit Strategy: FB’s slow deposit growth in Q3FY25 resulted from a reorientation of its deposit mobilisation strategy, focusing on granular deposits rather than highvalue wholesale and inter-bank deposits. This re-calibration exercise has been undertaken with the aim of improving the quality of the liability franchise while driving sustainable healthy growth. Hereon, the internal focus will remain on tracking average CASA as a performance metric to ensure stability and sustainability in the deposit base rather than short-term end-of-period fluctuations. The bank aims to leverage its distribution network, brand and franchise strength to build a healthy CASA franchise. In line with the bank’s strategy of de-risking and diversifying the deposit base, the concentration of Top-20 deposits declined to ~33% during the quarter. FB’s deposit growth is expected to mirror the credit growth, clocking a healthy growth of ~16% CAGR over FY25-27E. Thus, we expect LDR to remain range-bound between 84-85% over the medium term.

* Strategy re-calibration to pose near-term headwinds; Optimistic on strong sustainable growth: The bank will continue to navigate the challenging times by calibrating growth in the unsecured segments while tweaking growth in other better-yielding segments with a focus on maintaining or improving yields. FB will look to accelerate growth in the unsecured segments as the credit costs environment turns favourable, thereby gradually improving their mix in the portfolio. With challenges in the unsecured (higher-yielding) segments, the bank intentionally pruned growth in these segments while shifting its focus on mid-to-high-yielding secured businesses (Commercial Banking, Business Banking, Gold Loans, LAP) to drive healthy growth, as visible during Q3FY25. Similarly, in the corporate book, the bank has taken deliberate steps to ensure a prudent and balanced growth approach. The focus will remain on profitable risk-adjusted growth. Thus, owing to the transition in the strategy, near-term headwinds on growth could be visible. However, the management is confident of reverting to sustainable growth of 1.5x systemic credit growth. We expect credit growth to taper to ~14-15% on accounts of transition in the strategy before picking up from FY26E onwards. We expect FB to deliver an advances growth of ~17% CAGR over FY25-27E.

Sector Outlook: Positive

Company Outlook: With the new management at the helm, the bank’s strategy re-orientation revolves around ensuring sustainable, profitable growth while maintaining strong asset quality metrics. While growth is likely to taper in FY25 owing to the impact of the transition, we expect growth momentum to resume from FY26E onwards. We expect FB’s RoA/RoE to range between 1.2-1.3%/13-15% over the medium term driven by (1) Healthy profitable risk-adjusted growth, (2) Steady NIMs supported by improving share of mid-to-high yielding segments, (3) Steady deposit franchise with focus on granularity, (4) Stable asset quality metrics with controlled credit costs.

Current Valuation: 1.4x Sep’26E ABV Earlier Valuation: 1.4x Sep’26E ABV

Current TP: Rs 225/share Earlier TP: Rs 230/share

Recommendation: We maintain our BUY recommendation on the stock.

Alternative BUY Ideas from our Sector Coverage

DCB Bank (TP – Rs 140/share)

Financial Performance:

* Operational Performance: Federal Bank (FB) credit growth slowed to 15%/flat YoY/QoQ (vs average growth rate of ~19-20% over the last 9 qtrs). The higher-yielding portfolio contributes to ~25.8% of the total portfolio vs 24.6/24.9% YoY/QoQ. Deposit growth was slower at 11% YoY/ flattish QoQ. CASA deposits and TDs both de-grew by ~1% QoQ. Thus, the CASA ratio improved marginally to 30.2% vs 30.1% QoQ. LDR stood at 87.8% vs 86.9% QoQ.

* Financial Performance: NII grew by 15/3% YoY/QoQ. Yields improved by 4bps QoQ, while CoD inched up by 6bps. Reported NIMs contracted by 1bp QoQ and stood at 3.11%. Non-interest income grew by 6% YoY but de-grew by 5% QoQ. Opex growth was modest at 15/1% YoY/QoQ. C-I Ratio remained steady at 53.1% vs 53% YoY/QoQ. PPOP grew by 9% YoY/ flat QoQ. Provisions grew by 220/85% YoY/QoQ. Credit costs stood at 51 bps vs 28bps QoQ. This was higher owing to the accelerated provision for certain schematic advances. Earnings growth decelerated, and PAT degrew by 5/10% YoY/QoQ.

* Asset Quality improved with GNPA/NNPA at 1.95/0.49% vs 2.09/0.57% QoQ. Slippages during the quarter stood at Rs 495 Cr vs Rs 428 Cr in Q2FY25, with slippage ratio for the quarter at 0.8% vs 0.7% QoQ. Slippages were higher in the agri pool, while they remained broadly stable across other segments. The bank has written off loans worth Rs 494 Cr during Q3FY25.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633