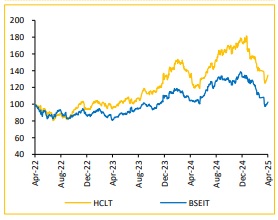

Add HCL Technologies Ltd For Target Rs. 1,580 By Choice Broking Ltd

Q4FY25 results marginally miss estimates

* Revenue for Q4FY25 came at INR 302.4Bn, up 6.1% YoY and 1.2% QoQ (vs Consensus est. at INR 302.6Bn).

* EBIT for Q4FY25 came at INR 54.4Bn, up 8.3% YoY but down 6.5% QoQ (vs Consensus est. at INR 55.4Bn). EBIT margin was up 36bps YoY but down 148bps QoQ to 18.0% (vs Consensus est. at 18.3%).

* PAT for Q4FY25 came at INR 43.0Bn, up 8.1% YoY but down 6.2% QoQ (vs Consensus est. at INR 43.4Bn).

FY26E revenue guidance of 3-5% CC, Potential revenue conversion challenges ahead:

HCLT reported a strong Q4FY25 with net new bookings of USD 3Bn, second-highest after Q2FY23 bringing FY25 total TCV to USD 9.4Bn. These deals were well-distributed across geographies, service lines, and verticals. For FY26E, HCLT has guided for 3–5% revenue growth in CC, with lower end reflecting macroeconomic uncertainty, midpoint assumes closure of a few large Q1 deals, while the upper end assumes stable environment. The deal pipeline remains near all-time high, with momentum across IT Services, ER&D, and HCL Software where AI & GenAI are now central to most deals. HCLT expects its strong Q4 bookings to translate into revenues, supporting growth and also gaining higher wallet share from existing clients, even while factoring in GenAI-driven productivity. However, we expect discretionary spending to remain soft; initially affecting Retail & Manufacturing, then spreading to other verticals amid geopolitical factors like tariffs & de-globalization. This may lead to are expected to budget cuts, contract renegotiations, or delays impacting growth for near to mid-term. However, this could also create opportunities for cost optimization & supply chain diversification where enterprises are expected to accelerate AI adoption to modernize core systems, driving demand for efficiency, vendor consolidation, & tech transformation.

EBIT margin guidance intact at 18-19%:

HCLT reported an FY25 EBIT margin of 18.3%, with Q4 at 18%. Services margins were impacted by wage hikes, partly offset by forex gains. FY26 EBIT margin guidance is 18–19% for both services and software. In FY25, headcount fell by 1.8% despite revenue growth owing to AI-led automation. Attrition levels stood at 13%. However, we anticipate that continued focus on AI for efficiency, potential moderate hiring and stable attrition to be positives in a competitive market and expect margins to be within the guided range despite ongoing investments in sales and AI capabilities.

View & Valuation:

Due to ongoing global economic volatility and recession fears in the US, recovery timelines are expected to delay. While revenue & margin guidance for FY26 remain unchanged compared to FY25, risks persist in converting TCV into revenue, with uncertainty causing decision-making delays & restrained discretionary spending limiting growth. As a result, we've reduced estimates by 4-9%, adopting a more conservative margin outlook within the guided range. Consequently, we revise our rating to ‘ADD’ and lower our target price to INR 1,580, implying a PE multiple of 22x (in-line with peer group, earlier 23x) on FY27E EPS of INR 71.7.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131