Buy Ambuja Cements Ltd For Target Rs. 630 By Axis Securities Ltd

ACC & Orient Merger Will Establish ‘One Cement Platform’

Ambuja Cements Limited, part of the Adani Group, has received approval for two separate Schemes of Amalgamation from its Board of Directors to merge ACC Limited and Orient Cement Limited, establishing a single consolidated ‘One Cement Platform’. The current cement capacity is 107 MTPA and is expected to be 155 MTPA by FY28. For every 100 equity shares of ACC with a face value of Rs 10/share, Ambuja Cements will issue 328 equity shares with a face value of Rs 2/share, to eligible shareholders of ACC. For every 100 equity shares of Orient Cement with a face value of Rs 1/share, Ambuja Cements will issue 33 equity shares with a face value of Rs 2/share, to eligible shareholders of Orient Cement. For ACC Ltd., the Appointed Date is 1st January 2026 and for Orient Cement Ltd. Appointed Date is 1st May 2025. Subject to requisite approvals such as Shareholders, Creditors, SEBI, NCLT, etc, the transaction is expected to be completed over a period of 12 months.

Strategic Rationale of the Deal

* The merger is expected to create operational synergies by improving manufacturing and logistics efficiency, simplifying the corporate structure, strengthening the balance sheet, and enabling better capital allocation to support growth and reinforce market leadership.

* The merger will streamline the network, branding, and sales promotion expenses, leading to cost optimisation, margin improvement of at least Rs 100 PMT, and support the achievement of targeted cost, margin expansion, and growth objectives.

* The amalgamation will integrate manufacturing and supply chain operations, optimise resource use, simplify the group structure by eliminating multiple entities, and result in all stakeholders dealing with a single unified company.

* The amalgamation will allow more efficient deployment of financial, managerial, and operational resources by centralising them under a single entity, optimising allocation and utilisation to support the group’s strategic goals.

* The amalgamation aligns with the group’s long-term vision of consolidation and sustainable growth and is expected to enhance shareholder value while supporting consistent, sustainable returns over time.

Post-Merger

* Post merger of the subsidiaries with Ambuja, there is no specific MSA required with ACC, Orient, Penna and Sanghi as these companies will become an integral part of Ambuja.

* Promoter & Promoter Group holding in Ambuja will be 60.94% from 67.65% post approval of all ongoing and proposed schemes of merger of Sanghi, Penna, Orient and ACC.

* Adani Ambuja Cements and Adani ACC brands will continue to operate as usual, depending on the leading product brands in their respective segments.

* ACC is currently availing incentives in the state of Maharashtra, Madhya Pradesh and Uttar Pradesh. Post merger, the benefit should continue to accrue to Ambuja for the residual period of the incentive scheme.

Outlook

The merger of ACC and Orient Cement with Ambuja Cement is expected to enhance operating efficiency. The consolidation will improve transparency across operations, enable better capacity utilisation, and provide a stronger platform for capacity expansion and industry consolidation. A unified operating structure is also likely to drive cost efficiencies, streamline procurement and logistics, and strengthen the company’s competitive positioning in the cement sector. Its capacity expansion strategy remains firmly on schedule, supporting its objective of strengthening market share across key regions. With a strong pan-India footprint, ongoing cost optimisation, and portfolio-wide integration benefits within the Adani group, the company is positioned to sustain its growth trajectory. Additionally, continued government focus on infrastructure development and affordable housing, alongside rising private sector capex and healthy real estate demand, provides a favourable macro backdrop. These factors reinforce expectations of ACL delivering industry-leading performance over the medium term.

Valuation & Recommendation

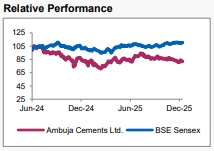

The stock is currently trading at 17.5x/15x FY26E/FY27E EV/EBITDA. We maintain our BUY rating on the stock, with a target price of Rs 630/share (Earlier TP: Rs 705), implying an upside of 15% from the CMP, valuing the company at 17x FY27E EV/EBITDA.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633