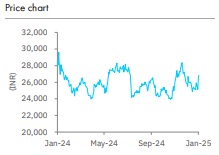

Buy Shree Cement Ltd For Target Rs. 32,740 By Elara Capital Ltd

Margin takes a lead, volume to follow

Shree Cement’s (SRCM IN) Q3FY25 EBITDA at ~INR 9.5bn was ~7% ahead of our/Consensus estimates, driven by lower-than-expected operating cost. While SRCM lagged peers, UltraTech Cement (UTCEM IN) and Ambuja Cements (ACEM IN) in terms of volume performance, reporting ~1% YoY drop, its QoQ EBITDA/tonne growth of ~INR 300 outpaced UTCEM’s INR 226 rise and ACEM’s INR 243 dip. SRCM has re-emerged as a margin leader in the cement industry with EBITDA/tonne of INR 1,079, due to higher exposure to North India and lower power and fuel cost. With new capacity expected to come on stream in Q1FY26 and base turning favorable from Q2FY26, we believe volume underperformance by SRCM is unlikely to continue in the long term. Further, most of the capex cost continues to be lower than the acquisition cost for peers, which should enable it to earn better ROCE than peers with lean balance sheet. Also, SRCM’s capacity is likely to remain more skewed to North India, where utilization is expected to be higher than pan-India average. So, we reiterate Buy with TP unchanged at INR 32,740.

Set for volume comeback:

Key expansions likely to be completed by Q1FY26 include: 1) 6.0mn tonnes at Jaitaran (Rajasthan), 2) 3.0mn tonnes at Kodla (Karnataka), 3) 3.4mn tonnes at Baloda Bazaar (Chhattisgarh), and 4) 3.0mn tonnes at Etah (Uttar Pradesh). While we expect SRCM to underperform industry growth in FY25, with modest volume growth of ~1% YoY, the completion of these expansion projects should help SRCM regain its market position, driving volume outperformance in FY26-27E

Cement realization up ~3% QoQ:

Cement realization declined ~9% YoY but rose ~3% QoQ, versus UTCEM’s ~2% rise and ACEM’s ~2% fall. Operating costs dropped ~8% YoY/9% QoQ to INR 3,750/tonne, ~7% below our estimates, primarily driven by ~26% YoY/21% QoQ reduction in power and fuel cost, aided by lower fuel prices due to reduced power sale and a decline in fuel cost. Fuel cost fell from INR 1.71 per kcal to INR 1.55 per kcal due to the purchase of low-value petcoke. Sales volume declined ~1% YoY but grew ~15% QoQ to 8.8mn tonnes, mostly as estimated. So, EBITDA/tonne contracted ~22% YoY but jumped ~38% QoQ to INR 1,079, showing a QoQ recovery of ~INR 300.

Reiterate Buy; TP unchanged at INR 32,740:

We believe the expected completion of the ongoing expansion projects in Q1FY26 and improving demand scenario are key triggers for healthy volume growth beyond FY25. Also, lower fuel prices, increased green energy use and other cost saving measures should lift margin. Further, SRCM’s capacity is likely to remain more skewed to North India, where utilization is expected to be higher than pan-India average.

We raise our EBITDA estimate ~3% for FY25E but largely retain it for FY26E-27E. We reiterate Buy with TP unchanged at INR 32,740, based on 18x (unchanged) March 2027E EV/EBITDA. Sub-par demand, weak cement price and a sharp rise in fuel price are key risks to our call

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)