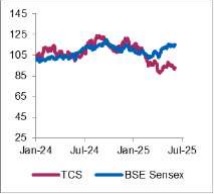

Hold Tata Consultancy Services Ltd for the Target Rs.3,625 - Axis Securities Ltd

Uncertainty Persists; Decent Deal Wins

Est. Vs. Actual for Q1FY26: Revenue – INLINE ; EBIT Margin – MISS ; PAT – BEAT

Recommendation Rationale

• Macro headwinds uncertainty: In Q1FY26, the company experienced delays in decisionmaking and project initiations, particularly for discretionary investments, due to prevailing macro headwinds. Global operations were impacted by U.S. tariffs, economic uncertainty, and persistent supply chain disruptions. Additionally, cost pressures on customers resulted in the deferral of several projects.

• Deal wins/pipeline: The company reported a deal TCV of $9.4Bn, down 22.95% QoQ but up 13.2% YoY. The new BSNL order received in May’25 is currently in an advanced stage, and execution will start after receipt of circle-wise purchase orders.

• Client focus: Industry enterprises are prioritising cost optimisation, vendor consolidation, and efficiency-led technology transformation. Discretionary spending remains under pressure and is expected to continue for the upcoming quarter.

Sector Outlook: Cautiously optimistic

Company Outlook & Guidance: TCS sees strong focus from enterprises on scaling AI adoption across applications, workflows, and data platforms. The company anticipates the international market to perform better in FY26 than in FY25.

Current Valuation: 24x FY27E P/E

Current TP: 3,625/share

Recommendation: With a strong deal pipeline across business verticals, new partnerships, and higher adoption for new-age technologies, we believe TCS will gradually begin recovery from H2FY26. Hence, we resume our coverage with a HOLD rating on the stock.

Financial performance.

In Q1FY26, Tata Consultancy Services reported revenue of Rs 63,437 Cr vs Rs 62,613 Cr, up 1.3% YoY but down 1.6% QoQ. EBIT stood at Rs 15,514 Cr vs Rs 15,444 Cr, up 0.5% YoY but down 0.6% QoQ. Net Income came in at Rs 12,819 Cr vs Rs 12,105 Cr, up 5.9% YoY and 4.3% QoQ, driven by higher other income and lower tax expenses. However, in CC terms, revenue declined by 3.1% YoY, primarily due to the ramp-down in the BSNL project and geopolitical uncertainties that led to demand contraction. Attrition levels increased by 50 bps to 13.8% vs 13.3% QoQ. The board recommended an interim dividend of Rs 11/share.

Valuation & Recommendation

The management sees green shoots in international markets in FY26 and expects it to be better than FY25. We are constructive on the long-term outlook of the company and expect a gradual recovery from H2FY26 onwards. Therefore, we resume over coverage with a HOLD rating on the stock and assign a 24x P/E multiple to its FY27E earnings to arrive at a TP of Rs 3,625/share, implying an upside of 7% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633