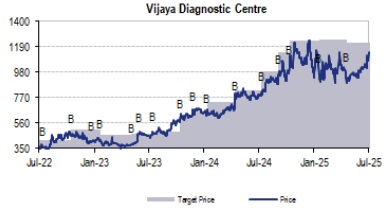

Buy Vijaya Diagnostic Centre Ltd For Target Rs. 1,329 By JM Financial Services

Vijaya Diagnostics reported strong 1QFY26 results, with revenue, EBITDA, and PAT growing 20%, 20%, and 22% YoY, respectively, and coming in 4%, 5%, and 7% above street estimates. EBITDA margin remained flat YoY at 39.14%, slightly ahead of expectations, despite the company being in an expansion phase. Operationally, test volume grew by a healthy 16.7% YoY, while footfall increased 14.4% YoY, and revenue per test rose to INR 477, up 4% YoY, driven by a better case mix. The company had launched five new hubs in 4QFY25, which began contributing meaningfully in 1QFY26; encouragingly, these hubs did not dilute margins as earlier anticipated and ramped up well in their first quarter of operations. This suggests that Vijaya may outperform its earlier guidance of a 150–200bps EBITDA margin dip in FY26, as that pressure was not visible in 1Q. We believe the ramp-up of new hubs, along with the addition of more spokes, will support strong double-digit growth, with revenue, EBITDA, and PAT CAGR of 16%, 17%, and 23% over FY25–28, respectively, and free cash flow generation of INR 6.6bn over the next three years. Historically, Vijaya has consistently outperformed leading listed diagnostics peers, growing at ~2x their rate. The outperformance is further likely to sustain over the next 2 years. Therefore, we expect the valuation premium to prevail and value Vijaya at 60x June’27 EPS, arriving at an updated target price of INR 1,329, implying a 16% upside; maintaining our BUY rating.

* Performance across key metrics: Strong performance led by volume growth and product mix. Total tests for the quarter are at 3.94mn (+16.7%), with average realization per test being at INR 477 (+3.1% YoY). Total footfall was at 1.1mn (+14.4% YoY), resulting in avg. test per footfall being 3.58 (+2.1%) and avg. realisation per footfall being INR 1,707 (+5.3%). The company has 157 centres, up from 151 centres as of FY25 end and 146 centres as of 1QFY25. Wellness contributed 14.2% to revenue (vs 13.4% as of 1QFY25). Radiology contributed 39% (vs 38% for 1QFY25) to top-line, thus boosting the average realization. Price increase was 1-1.5%, rest of the increase in realization was because of product mix. The company doesn’t plan to do further price hikes in the year.

* Expansion plan on track: In 1Q, Vijaya commissioned 5 hubs and 1 spoke (2 in Kolkata, 2 in Pune and 2 in Bangalore), the company is on track to open 10 hubs this FY. Vijaya is planning 3 hubs in 2QFY26 spread across core geography (1 in AP and 1 in Telangana) and West Bengal (1). West Bengal will further see 2 additiongal in 2HFY26. Other than these, there are 2 spokes planned in Hyderabad (1 in 2Q and 1 in 2H).

* Financial highlights: The gross margins expanded 62bps on YoY basis on account of higher contribution of Radiology. The drag of expansion on EBITDA margin was 1-1.5%, but was offset by operating leverage. Typically, hubs breakeven on receiving 1/3rd of capacity, the company expects all the hub/centres to attain breakeven within 12 months. 1 hub centre in Bangalore is on track to attain breakeven earlier than the estimated time line, and the Nizamabad Hub Centre in Telangana has already achieved breakeven within 2 quarters of its operations. Thus, we believe the company might outperform the margin guidance for FY26. Further, the company gave CAPEX guidance of INR 1.50-1.55bn for new centres and 2-3% of sales as replacement CAPEX for FY26.

* Region wise update: The Hyderabad business returned to double digit growth. The driver for this growth was volumme increase due to increase in market share. In West Bengal, the strategt remains to focus on expansion for next 2-3 years, opening new hubs followed by addition of spokes. The intent is to ramp up the geogrpahy to INR 1bn over next 3 years. In Pune, the PH centers were at max capacity at the time of acquisition, as such focus in on increasing the capacity in the region.

* 1QFY26 review:

- Revenue at INR 1.9bn (+4%/+3% vs street/JMFe) and is +20% YoY

- Gross Profit of INR 1.7bn, +21% YoY, with gross margin at 88.6% (+62bps YoY, +48bps vs JMFe)

- EBITDA at INR 735mn (+5%/4% vs street/JMFe) and is +20% YoY

- EBITDA Margin at 39.1% (+61bps/+42bps vs street/JMFe) and is -10bps YoY

- PAT at INR 383mn (+7%/+10% vs street/JMFe) and is +22% YoY

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361