Sell Motherson Sumi Wiring India Ltd For Target Rs. 50 By Elara Capital

Start-up cost dents margin performance

Motherson Sumi Wiring India (MSUMI IN) reported the highest-ever Q4 revenue at INR 25.1bn (in-line with estimates), up ~12% YoY and 9% QoQ. However, Q4 EBITDA declined by ~7% YoY to INR 2.7bn, with margin at 10.8%, down 225bps, hit by cost associated with Greenfield plants and lag in pass-through of copper cost (adjusted for that, margin stood at 12.4%). The management expects greenfield plants to add annualized revenue of INR 21bn from H2FY26, once all the plants are in production phase. We believe the actualization of these revenues will be subject to ramp-up of the models in new plants and how these new models cannibalize existing models in the industry (thus restricting MSUMI’s outperformance versus industry growth in a meaningful way). We also monitor margin profile of new orders, especially in high voltage wiring harness (herein margins are expected to be lower than the company average initially).

Start-up cost associated with greenfield project to impact margins: MSUMI is expanding via new Greenfield projects in Pune, Navagam, and Kharkhoda. This will aid production capacity and revenue growth. These facilities are designed to support both EV and ICE powertrain programs for OEMs, including such as Maruti Suzuki, Mahindra, and Tata Motors. While the Greenfield plant in Pune has started production in Q2FY25, Gujarat and Kharkhoda plants are expected to commence production by H2FY26. Manpower associated with new greenfield plants is being hired in a staggered manner depending on utilization.

EV and localization efforts to cushion margin drag: Revenue from EVs (specifically high voltage wiring harness) formed 4% of Q4 revenue, with MSUMI focused on localizing components (high voltage cables and charging connectors) across segments. While margins differ between high voltage and low voltage harnesses, the company is actively working on localization efforts in a bid to cushion the impact on margin.

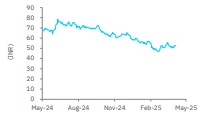

Revise to Sell with TP retained at INR 50: MSUMI has disappointed on the margin front since the past four quarters owing to inferior mix, higher RM and the impact of costs related to the new plant. Increasing content per vehicle in EVs may benefit MSUMI in the initial years, but risks associated with technology/platform changes remain, as OEMs globally try to reduce wiring harness content in a vehicle to trim the overall vehicle weight, which will remain an overhang on MSUMI’s multiples, in our view (for instance zonal architecture over domain architecture as we move towards software defined vehicles; is being adapted globally).

Also, MSUMI is now a single product/geography play, restricting any potential for a re-rating, despite industry-leading return ratios. Our framework for auto ancillaries suggests that historically, auto ancillaries have outperformed in terms of financials and valuation when they are a beneficiary of: a) product expansion, b) segment expansion, d) geographic expansion and e) inorganic expansion. We believe MSUMI scores low on all these above parameters. We reduce FY26E-27E EPS estimates by ~4%. So, we revise to Sell from Reduce with TP retained at INR 50, on 25x June 2027E as we roll forward.

Please refer disclaimer at Report

SEBI Registration number is INH000000933