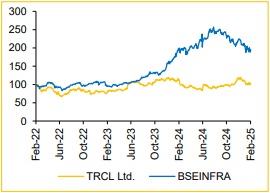

Hold The Ramco Cements Ltd For the Target Rs. 995 by Choice Broking Ltd

Green Energy Initiatives to Boost EBITDA

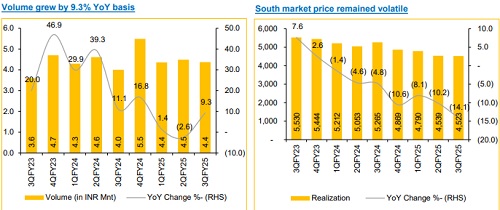

* Q3FY25 standalone revenues came at INR19,766 Mn, (vs CEBPL est. INR20,444 Mn), down 6.2% YoY and down 3.0% QoQ. Total volume for Q3 stood at 4.4 Mnt, (vs CEBPL est. 4.4 Mnt), up 9.3% YoY and down 2.7% QoQ.

* Net sales realization for Q3FY25 stood at INR4,523/t, (vs CEBPL est. INR4,700/t) down 14.1% YoY and down 0.4% QoQ.

* Standalone EBITDA for Q3FY25 was reported at INR2,794 Mn, (vs CEBPL est. INR3,263 Mn) down 29.3% YoY and 10.5% QoQ. EBITDA/t for Q3 came at INR639/t, (vs CEBPL est. INR750/t), down 35.3% YoY and down 8.0% QoQ.

* PAT for Q3FY25 reported at INR3,253 Mn, higher because of exceptional item of INR 3,290 Mn from sale of investments and surplus land, (vs CEBPL est. INR383 Mn), up 248.4% YoY. Post excluding one off gains, company has incurred a loss of INR37 Mn

Maintained capex guidance of INR 12,000 Mn for FY26:

TRCL is on track to reach 30 MTPA cement capacity by Mar-26 from 23 MTPA in FY24, driven by the commissioning of its 2nd line in Kolimigundla, de-bottlenecking of existing units, and targeted grinding capacity additions with minimal capex. The Kolimigundla railway siding and the Odisha construction chemicals unit are set for commissioning by Mar-25. Additionally, TRCL has secured 53% of mining land and 13% of factory land for its Karnataka greenfield project. These expansions will reinforce TRCL’s position in the southern market. Also, we expect volumes to reach 22 MTPA by FY27 at 73% capacity utilization.

Green initiatives to drive improvement in EBITDA/t:

TRCL has indulged into green power capacity expansion initiative of 25 MW from current capacity of 211 MW. Additionally, it plans to commission a 10 MW WHRS in RR Nagar by Jun-25 and a 15 MW WHRS in Kolimigundla alongside Kiln Line-2 by Mar-26. We expect these two initiatives will reduce power & fuel cost by ~160/t, driving EBITDA/t to ~?974/t. Further, we reckon these initiatives will support EBITDA Margin expansion to ~20.8% by FY27.

View & Valuation: We revise our FY26/27 EPS estimates by 6.1%/3.1% and maintaining our rating to ‘HOLD’ with a revised TP of INR995, valuing it at 13x (unchanged) on FY27 EV/EBITDA. We anticipate strong growth for cement companies in Q4FY25, driven by the government’s continued focus on infrastructure development. Additionally, industry positive outlook on cement pricing is expected to support the company's profitability.

The management haven’t host the conference call yet

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131