Fundamental Stock Pick :- Bharti Airtel Ltd For Target Rs.2525 by Nirmal Bang Ltd

Bharti Airtel Ltd

Bharti Airtel is India’s 2nd largest telecom operator having presence in 18 countries across South Asia, Africa, and the Channel Islands. It has a comprehensive digital services portfolio that includes fibre optic networks, mobile and desktop telephony, and other digital solutions.

Investment Rationale

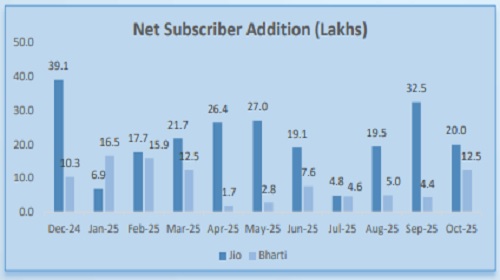

1. Dominant Market Share coupled with Best ARPU in the Industry: Bharti enjoys 34% wireless market share (2 nd just after RIL’s 41% market share) backed by 4G/5G rollout covering thousands of cities and rural expansion. Company also leads the industry in ARPU at current levels of Rs.256 (in Q2FY26) vs Ril’s Arpu of Rs.211 driven by a more diverse customer base, continued migration from 2G to 4G/5G, and increasing adoption of value-added services. Management is expecting ARPU to further improve to Rs.300 supported by rising data consumption and deeper rural penetration. Average data usage per customer also remains strong at 28.3 GB/month during Q2FY26 (was 23.9 GB/Month a year ago), further aiding revenue growth.

2. Improvement in the Digital/Home Segment: Company anticipates an improvement in the Home Segment by offering multiple solutions simultaneously wherein it is targeting existing high-value customers (primarily 50 Mn customers with strong financial profiles), while aggressively acquiring new ones supported by intense rural penetration and an expanded service portfolio. This approach is expected to drive growth in the Home Segment, enhancing revenue realization and strengthening the overall business model.

3. Strategic plans to drive revenue and profitability growth – Bharti expects CAPEX levels to remain stable, with investments primarily directed toward broadband expansion, enterprise solutions, and data centers. Despite the ongoing 5G rollout, Company does not anticipate any immediate significant capex. Higher cash flows will be utilized for strengthening balance sheet by reducing debt, improving African business, dividend payments, etc.

Valuations and Recommendations:

Bharti Airtel remains in a sweet spot amidst expected tariff hikes in the industry, remarkable subscriber growth, superior margins and increased 4G/5G conversions. We believe Company’s focus on improving Home/Digital segment, its thrust on investments in data center would fuel its future growth and drive ROE towards mid twenties in the coming years. Stock is available at 9.2x EV/EBITDA of FY27E and recommend ‘BUY’ rating on the stock.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

.jpg)