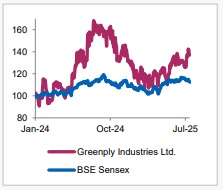

Buy Greenply Industries Ltd For Target Rs.385 by Axis Securities Ltd

Slow Quarter; Growth Supported by Capacity expansions and Product Mix

Est. Vs. Actual for Q1FY26: Revenue - INLINE; EBITDA (Adj.) - BEAT; PAT - MISS

Changes in Estimates Post Q1FY26 Result

FY26E/FY27E: Revenue: 0%/0%; EBITDA (Adj.): 0%/0%; PAT : 0%/0%

Recommendation Rationale

* Showing early signs of demand recovery: Greenply’s Apr’25 and May’25 aligned with its expectation, with the third month being a laggard. The company is seeing further recovery in Jul’25 and expects a better quarter going forward. This quarter, the plywood segment experienced a 3% decline in volumes, even as realisations rose 4% YoY. For its MDF business, Greenply saw a stronger trend, with 8% growth in volumes and 3% in realisations YoY. The shift towards a higher MDF-centric portfolio is playing into its favour. It remains optimistic for the latter part of the year and reiterates its growth guidance of double-digit and EBITDAM 16%+ for MDF in FY26.

* BIS implementation: The company is seeing active actions post the BIS implementation. The government is taking a lot of actions in a positive direction to maintain its standards. Raids are being conducted in the market and factories, and a BIS on furniture is expected by Feb’26. The import inventory has also died down, although there is still competition for pricing from the unorganised players. This, combined with the softening of timber prices, will act as a tailwind for its plywood business. However, the management is waiting another quarter before reaffirming its double-digit volume growth guidance in the segment.

* Building Capacity; PVC Door Profiles and MDF Focus: MDF reported an 11% YoY growth with revenue of Rs 147 Cr and EBITDAM of 16.4%, in line with the guidance. The company is on track to complete its brownfield expansion of capacity from 800 to 1,000 CBM per day. The company is not planning any capex for another line, and plans to build the existing line with a very small capex to produce 25% more output by expanding the press. Total capex for the Odisha plant will be in the range of ~Rs 30 Cr. It will add new PVC doors capacity; currently the business is Rs 65 Cr with scalability to Rs 200-250 Cr in the next 2-3 years and overall capex of Rs 100-140Cr.

* Sector Outlook: Positive

Company Outlook & Guidance: While the company reported muted volumes for its plywood business, the MDF business posted results in line with expectations. Greenply expects H2FY26 to show recovery with add-on businesses supporting its value-add portfolio approach. We expect Revenue/EBITDA/PAT CAGR of 12%/20%/40% from FY24-FY27E and maintain our BUY rating on the stock.

Current Valuation: 25X FY27EPS (Earlier 25X FY27EPS)

Current TP: Rs 385/share (Earlier TP: Rs 385/share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

Greenply reported Revenue of Rs 601 Cr, up 3% YoY, which is in line with our estimates. The overall demand scenario in the industry saw recovery for the first two months of the quarter. Gross margins were better, up 205 bps YoY. The reported EBITDA stood at Rs 62 Cr, showing growth of 6.3% YoY, with a flatter YoY EBITDA margin of 10.3%. The company reported PAT of Rs 28 Cr, down 14% YoY. Increasing interest costs impacted the bottom line. During the year, its MDF volumes saw growth of 8.6% QoQ and 8% YoY, whereas the plywood business saw a decline of 13% QoQ and 3% YoY. Segment revenue for the Plywood business stood at Rs 454 Cr, flat YoY, and for the MDF business stood at Rs 147 Cr, a 9% YoY growth.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)