Oil, Gas & Consumable Fuels: 3QFY26 good for OMCs, okay for RIL, weak for upstream/gas by Kotak Institutional Equities

3QFY26 good for OMCs, okay for RIL, weak for upstream/gas

For RIL, we expect consolidated EBITDA to rise 9.3% yoy (4.3% qoq), led by 15%/17% rises in O2C/telecom. OMCs will benefit from lower oil prices and LPG compensation. We expect EBITDA to rise 9-18% qoq (31-141% yoy), with volatility remaining high. For ONGC, with qoq lower oil/gas price realizations, we expect EBITDA to decline 10% yoy (3.6% qoq). For GAIL, we expect marketing/LPG to further weaken and petchem to continue reporting loss. IGL will benefit from Gujarat VAT. A low base will make reported numbers look optically good. Likely another weak result for MGL. For PLNG, we assume volume recovery. Reported numbers will get a boost from expected UoP revenue for CY2025. We expect another decent result for Castrol.

RIL: We expect ~9% yoy EBITDA growth, driven by O2C and telecom

We expect consolidated EBITDA to rise 9.3% yoy (up 4.3% qoq), with yoy EBITDA rise of 15%/17% for O2C/Digital and 4.5% for retail, and decline of 15% for E&P.

We estimate O2C’s EBITDA to rise 10% qoq (15% yoy) on better refining and weaker INR, partly offset by weak petchem. We expect R-Jio’s EBITDA to rise 15% yoy (up 3% yoy), with blended ARPU of Rs214 (up 1.3% qoq). For RRL, we assume revenue growth to moderate to ~9.6% yoy (18% yoy in 2Q) on festive season split and RCPL’s demerger. We expect RRL’s EBITDA to rise ~6% yoy/qoq.

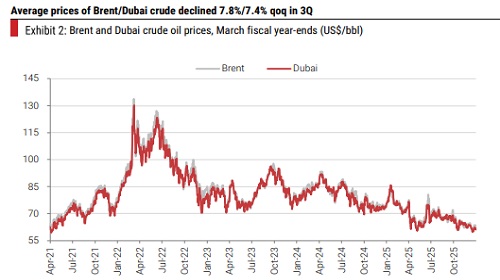

Upstream: Lower oil/gas realizations to impact

We expect ONGC’s EBITDA to decline 10% yoy (3.6% qoq) and OIL’s by 2.7% yoy (4.7% qoq). For ONGC, we expect net oil realizations to decline 9% qoq (15% yoy) and gas realizations to decline 3% qoq (flat yoy).

OMCs: Benefit from lower oil prices and LPG compensation

In 3Q, average oil prices (in terms of INR) declined 6% qoq (10% yoy), while retail prices were unchanged. Due to elevated product cracks, refining margins will be sharply higher and implied marketing earnings weaker. Reported numbers will also get a boost from LPG compensation of ~Rs50 bn. Earnings will likely remain volatile on inventory impact. We assume adventitious losses of ~US$1-2/bbl in refining and US$1/bbl in marketing.

Gas: Likely weak for all; low base to make IGL’s numbers look good

* GAIL: Expect marketing and LPG to get weaker; petchem to continue reporting loss, modest transmission volume recovery; EBITDA to be flat yoy (down 11% qoq).

* CGDs: Despite lower APM prices, gas costs will rise for MGL. However, IGL will benefit from lower Gujarat VAT and its numbers will look good on a low base.

* PLNG: Adjusted EBITDA is likely to rise ~8% yoy/qoq on better volumes, with Dahej utilization at ~96%. UoP revenue for CY2025 may boost reported numbers.

* Castrol: We expect 4QCY25 EBITDA to rise 5.7% yoy, led by ~7% yoy volume growth.

Above views are of the author and not of the website kindly read disclaimer