Pharmaceuticals: 3QFY26 preview: Ex-US to drive growth by Kotak Institutional Equities

3QFY26 preview: Ex-US to drive growth

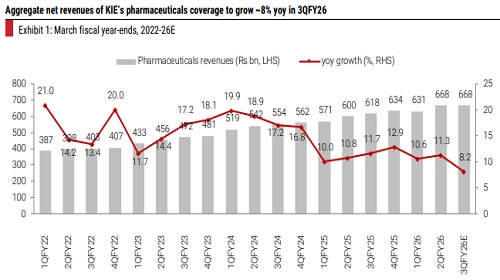

Barring the expected sharp decline in gRevlimid sales, we expect 3QFY26 to be another steady quarter for our pharma coverage. Despite the gRevlimid cliff, we expect ~8%/2% yoy growth in overall sales/EBITDA in 3QFY26, led by steady ex-gRevlimid US sales and healthy growth in India and non-US markets. For CRDMOs, we bake in 6% yoy sales growth for companies across our coverage. For generic API companies under our coverage, we bake in a slight volume uptick for most companies, factoring in 7% yoy overall sales growth in 3QFY26. Within our coverage, SUNP, LPC, CIPLA, EMCURE, SAI and PPL are our preferred picks.

Ex-gRevlimid US sales to grow qoq; another strong quarter for LPC in the US

Except for the expected sharp decline in gRevlimid sales, we expect 3QFY26 to be another steady quarter for our pharma coverage, led by continued stability in US generics pricing and decent domestic growth along with traction across most other markets. We expect overall US sales for our coverage to decline 4% qoq, as we bake in sequentially lower gRevlimid sales for DRRD, CIPLA, SUNP and ARBP. However, on an ex-gRevlimid basis, we bake in 2% qoq growth in overall US generics sales for relevant companies in our coverage, led by volume growth in existing products and continued benefit from new launches in the earlier quarters for a few firms. For LPC, we expect continued traction in Tolvaptan and full-quarter benefit from Glucagon. For SUNP, sequential growth continues to be led by key products such as Leqselvi, Cequa, Winlevi and Odomzo in the Innovative Medicines portfolio. For CIPLA, we expect slightly higher qoq gAbraxane sales, despite slower market share scale-up.

Healthy traction in India and ex-US markets

On a yoy basis, we estimate reported domestic sales growth of 8-13% in 3QFY26 for our coverage, with DRRD, EMCURE and MANKIND demonstrating the highest reported growth. We expect ~9% organic domestic growth for both MANKIND and EMCURE. We expect overall organic domestic sales for relevant companies in our coverage to grow 10% yoy in 3QFY26. Within EM/ROW, we expect steady underlying growth trends with INR depreciation, especially in markets such as EU, to provide further support to reported growth. For API companies under our coverage, we expect a yoy volume uptick for most companies, factoring in 7% yoy overall sales growth in 3QFY26. Within the CRDMO segments for companies under our coverage, we expect strong yoy growth in 3QFY26 for DIVIS, LAURUS and SAI, while we expect a muted quarter for SYNGENE and PPL, largely due to inventory destocking for their key molecules. For BLUE JET, we expect a sequential improvement in sales, led by a pickup in contrast media sales. Overall, we bake in 6% yoy sales growth for the CRDMO segments in companies across our coverage.

Margins to decline yoy for most of our coverage

Overall, we bake in ~8% yoy growth (flat qoq) in revenues in 3QFY26 for our pharma coverage. On the operating front, we build in ~2% yoy growth ((-)2% qoq) in overall reported EBITDA, with EBITDA margins declining 150 bps yoy.

Above views are of the author and not of the website kindly read disclaimer