Automobiles & Components: 3Q results previewóboost from GST cut by Kotak Institutional Equities

3Q results preview—boost from GST cut

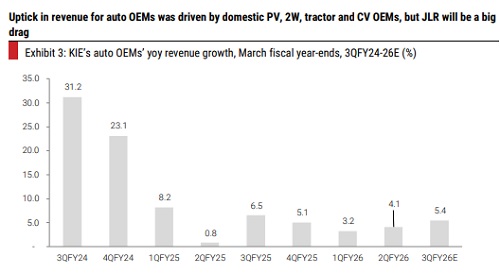

We forecast revenues for auto stocks under our coverage to rise 7% yoy in 3QFY26E (20% yoy growth, excl. Tata Motors), led by (1) a low double-digit yoy volume rise in the 2W/PV/CV segments and a >20% yoy increase in the tractor segment’s volumes, (2) higher ASPs and (3) favorable FX. We expect the EBITDA margin to increase 70 bps yoy (excluding Tata Motors), driven by an operating leverage benefit, a richer product mix and a favorable FX, partly offset by higher discounts, increased advertising spends, commodity headwinds and a tariff-related hit. Overall, it will be a strong quarter across most names, except companies with global exposure (especially JLR).

Most OEMs to report decent print yoy in 3QFY26E

We expect automotive OEM revenues to increase 5% yoy (25% yoy excl. Tata Motors), mainly due to (1) a low double-digit yoy increase in PV/CV/2W production volumes, supported by positive retail momentum due to GST cuts, (2) a >20% yoy increase in tractor production volumes and (3) a low single-digit improvement in ASPs due to a favorable mix in the PV and 2W segments and favorable FX, partly offset by a decline in JLR’s production volumes and higher discounts. We expect the EBITDA margin (excluding Tata Motors) to increase 90 bps yoy, led by an operating leverage benefit and a richer product mix, partly offset by higher discounts and commodity headwinds. As a result, we expect the EBITDA to increase 33% yoy in 3QFY26E (excluding Tata Motors). There may be a one-time impact on employee costs due to revisions in labor laws, which we have not factored in.

* We expect MSIL’s EBITDA to increase 38% yoy in 3QFY26E, owing to (1) a 34% yoy increase in revenues, driven by volume growth and ASPs, (2) favorable FX and (3) improved utilization levels.

* In the 2W segment, we expect Bajaj Auto’s EBITDA to increase 24% yoy, mainly due to (1) a favorable FX and (2) a richer product mix. We expect Hero MotoCorp’s EBITDA margin to increase 60 bps yoy in 3QFY26E, driven by operating leverage benefits. We expect TVS Motors’ EBITDA to increase 47% yoy in 3QFY26E, mainly due to (1) operating leverage benefit, (2) a richer product mix and (3) a higher PLI accrual. We expect Eicher Motors’ (consolidated business) EBITDA to improve 22% yoy due to 21% yoy volume growth, partly offset by (1) higher marketing and advertising spends and (2) inferior product and geographical mix.

* We forecast M&M EBITDA to increase 34% yoy, led by (1) double-digit yoy volume growth and (2) a richer product mix within the tractor segment. We expect Tata Motors’ EBITDA for the PV business to grow 20% yoy and Hyundai Motors’ EBITDA to grow 23% yoy in 3QFY26E, primarily driven by a favorable base. JLR will report a weak print, with a 41% yoy revenue decline due to US tariff-related impact and production challenges from a cyberattack.

* We expect Ashok Leyland to report a 24% qoq EBITDA rise, whereas the EBITDA of Tata Motors’ domestic CV business is likely to rise 44% qoq in 3QFY26E.

Above views are of the author and not of the website kindly read disclaimer