IT Sector Update : Q2FY26 Quarterly Results Preview by Choice Institutional Equities

IT Services companies globally have continued to accelerate their AI journey towards modernising legacy systems. This trend will continue to drive their near-term demand, led by vendor consolidation and technology transformation opportunities. On regulatory front, the recent rate cuts announced by the US Fed Governor hinting at more rate cuts should augur well for better client budget releases. However, USD100k one-time fees imposed by the White House on new H-1B visa applications poses major headwinds to the sector’s near-term outlook. This would further delay clients’ decision-making as the near term outlook gets murkier. Thus, we believe the onus lies on the Indian IT companies (IT Services plus ER&D) to take a stand in terms of passing on the expected rise in operational cost led by H-1B fee hike or evolve their business models to stay immune from further regulatory changes.

As far as the currency movement is concerned during Q2FY26, average INR depreciated by 2% QoQ against USD to 87.3, which will bode well for top-line and margins in INR terms. Moreover, crosscurrency movements measured as a basket of major currencies against the USD continued to provide a tailwind, contributing 0.5%–1% QoQ benefit on Top-line in USD terms. EUR and GBP appreciated by 3% and 1% QoQ, respectively, against USD. Thus, despite several macro headwinds, we believe IT Services & ER&D companies would exhibit decent Q2FY26 sequential growth of 0%–5.5%+ in USD terms led by ramp-ups in strong TCVs booked until Q1FY26.

Strategic deal wins & partnerships announced by IT companies:

Some of the notable wins during Q2FY26 include: (1) TCS collaboration with C-DAC, India’s premier R&D institution, to accelerate the development of India’s sovereign cloud ecosystem (2) Infosys JV with Telstra (an Australia- based leading telecommunications and technology company) to help clients navigate their AI journey (3) HCL Tech has signed a 10-year strategic partnership with the Dunedin City Council (DCC) to modernise and manage its IT services, driving digital transformation, improved service delivery and stronger community engagement (4) Wipro acquired the DTS business unit of Harman, a Samsung company, in a transaction that will accelerate Wipro’s mission to deliver next-generation ER&D services.

ER&D Sector: Subdued Q2, H2FY26 to Offer Gradual Rebound

ER&D services space is expected to remain under pressure in Q2FY26, impacted by capex moderation from European OEMs, elongated decision cycles and subdued automotive demand amid tariff and geopolitical headwinds. Revenue performance is expected to stay muted in the near term though currency tailwinds provide some support. Margins are expected to remain broadly stable across the sector, due to muted revenue growth and continued cost optimisation by clients. We anticipate a gradual recovery in H2FY26, driven by the resumption of delayed programs, ramp-up of recent deal wins and incremental demand from China and India, which should partly support continued softness in Europe and the US. We expect Q2FY26 to see muted sequential growth of (0.5)–1.1% QoQ for pure-play ER&D players, with limited upside to FY26E growth versus FY25. A more meaningful recovery is anticipated in FY27E, subject to the pace of deal closures and conversions over the next 2–3 quarters.

Valuation and Preferred Ideas

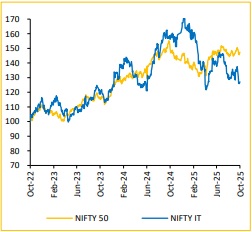

With large-cap IT services trading near their 10-year average multiples and mid-tier valuations well below prior peaks, the risk-reward profile has turned favorable for the sector. We remain constructive on companies with strong execution track records, healthy deal wins, limited exposure to tariff-sensitive verticals and attractive valuations. Thus, our long-term preferred investment ideas are: TECHM, HAPPSTMN, ZENT and KPIT.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131