Oil and Gas Sector Update : Oct-Dec 2025 Earnings Preview by Prabhudas Lilladher Ltd

Subdued quarter expected

Sector performance is expected to remain largely muted on a QoQ basis in Q3FY26. Resilient crack spreads supported by a lower Brent crude price environment are expected to benefit OMC’s. However, rupee depreciation is expected to exert pressure on marketing margins. We estimate aggregate standalone EBITDA for OMCs at Rs312.6bn, reflecting an increase of 51.3% YoY, and flat QoQ. In contrast, upstream companies are expected to face earnings pressure, as the decline in crude oil prices is likely to weigh on realizations. ONGC and Oil India are expected to report a QoQ decline in EBITDA to Rs174.6bn, down 8.2% QoQ. RIL is expected to report a 5.3% YoY increase in consolidated EBITDA, led primarily by improved refining margins in its standalone segment. Overall, sector performance is expected to remain largely muted on a QoQ basis in Q3FY26 with 3.5% QoQ rise in revenues. We estimate aggregate EBITDA to remain flat QoQ at Rs1,042bn in Q3FY26, while aggregate PAT is expected to decline by 4.3% QoQ.

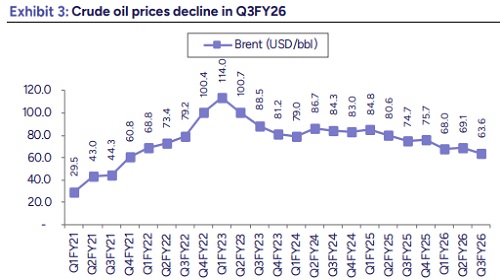

* Crude oil prices weakened: Crude oil prices continued its downward trajectory in Q3FY26, averaging USD63.6/bbl in Q3FY26 (vs USD69.0/bbl in Q2FY26), with prices briefly dipping below USD60/bbl during the quarter reflecting persistent bearish sentiment amid oversupply and muted demand growth. Escalating geopolitical tensions including continued Ukrainian drone attacks on Russian infrastructure, US sanctions on Russian oil imports, and US seizing Venezuelan tankers failed to provide sustained upside support to crude prices.

* Crack spreads improved QoQ: Refining margins remain elevated driven by resilient crack spreads due to continued Ukrainian drone attacks on Russian refineries and refinery maintenance outages reducing global availability of refining capacity in Q3FY26. Singapore GRM improved to USD4.9/bbl in Q3FY26 from USD 4.0/bbl in Q2FY26, driven by sustained strength in transportation fuel cracks. Petrol, diesel and ATF cracks rose to USD14.1/23.4/23.0/bbl, respectively, compared with USD10.2/19.6/17.6/bbl in the previous quarter. The margin improvement was supported by a softer crude oil price environment. FO cracks moderated to loss of USD10.2/bbl from loss of USD8.5/bbl QoQ, while Naphtha spreads improved slightly to - USD2.0/bbl from -USD4.8/bbl QoQ.

* INR depreciates further: INR depreciated during the quarter, averaging 89.1/USD versus 87.4/USD in the previous quarter driven by a lack of progress on the US-India trade deal, compounded by persistent FII outflows. This is expected to impact earnings of OMCs due to higher crude import costs and pressure on marketing margins, particularly in the absence of timely retail price pass-through.

* LPG under-recoveries to ease on softer LPG prices - LPG prices declined sequentially from USD520/mt to USD479/mt, leading to a sharp reduction in LPG under-recoveries to Rs20.6/cylinder in Q3FY26, from Rs58.5/cylinder in the previous quarter, as per our estimates.

* Petrochem spreads a mixed bag: PE-naphtha, PP-Naphtha and PVC-Naphtha declined by 17%/20%/22% QoQ. On the other hand, polyester intermediates are showing a mixed trend with PX-naphtha declining 5% QoQ and PTANaphtha spread rising by 7.0% QoQ.

* OMCs: OMCs EBITDA are expected to remain flat in Q3FY26, largely driven by healthy GRMs, supported by strong crack spreads and recovery of LPG compensation. However, gross marketing margins (GMMs) are expected to remain flat to lower. GRMs are estimated at USD8–11/bbl in Q3FY26, compared with USD9–11/bbl in Q2FY26. Implied gross marketing margins are expected at Rs4.7–5.5/ltr in Q3FY26, versus Rs5.8–7.0/ltr in Q2FY26.

? RIL’s conso EBITDA to rise 4% QoQ: Driven by continued strength in petrol and diesel crack spreads, we expect RIL’s standalone segment to report EBITDA of Rs161.5 bn in Q3FY26, compared with Rs143.9 bn in Q2FY26 and Rs152.1 bn in Q3FY25. We expect Jio EBITDA to rise to Rs179.5 bn in Q3FY26, from Rs172.8 bn in Q2FY26 and Rs154.7 bn in Q3FY25, driven by an improvement in ARPU to Rs214 (+1.0% QoQ) and an increase in subscriber base to 515.4mn (+1.8% QoQ). The Retail segment is expected to report an EBITDA of Rs70 bn, +3% YoY, reflecting a slowdown from the previously observed double-digit growth trajectory. Consequently, we estimate consolidated EBITDA at Rs477.6bn, reflecting growth of 4% QoQ and 9% YoY. We estimate consolidated adjusted PAT at Rs193.0bn for the quarter, representing growth of 2% QoQ and 4% YoY.

* Gas Utilities: GAIL is expected to witness slight growth in transmission from 123.6mmscmd to 124mmscmd QoQ. We expect its EBITDA to decline by 3.0% QoQ to Rs31.0bn. GUJS is expected to see decline in volume to 28mmscmd from 28.5mmscmd QoQ. In Petronet, we expect volume and utilization to remain flat at 95% in Dahej, while volumes in Kochi is expected at 24%. Regas volumes are expected at 225Tbtu in Q3FY26 vs 228Tbtu in Q2FY26. We expect EBITDA of Rs13.3bn against Rs12.5bn in Q2FY26 in absence write-offs and any take or pay gains/losses.

* CGDs to witness margin expansion QoQ: Spot LNG prices declined ~8.1% QoQ and Brent crude fell ~7.8% QoQ during Q3FY26, offering partial relief on gas sourcing costs for CGDs. This benefit was partly offset by a 31.8% QoQ increase in HH gas prices and a weaker INR-USD. Overall, the decline in global prices is expected to marginally outweigh these headwinds, leading to a slight sequential improvement in EBITDA/scm across CGDs. For GGL, Morbi’s gas pick up is expected to remain lower. As a result of which, we expect GUJGA to report volume decline from 8.7mmscmd in Q2FY26 to 8.5mmscmd in Q3FY26. We expect volumes in IGL to increase slightly in Q3FY26 to 9.4mmscmd vs 9.3mmscmd QoQ driven by increased CNG vehicle adoption, while in MAHGL volumes are expected at 4.7mmscmd. EBITDA/scm for GUJGA/IGL/MAHGL are expected at Rs5.6/5.5/8.2/scm, compared to Rs5.6/5.2/8.0/scm largely due to lower gas input costs.

* Change in estimates: Ongoing geopolitical issues, including sanctions on Russian crude and petroleum products, along with refinery maintenance and outages, have resulted in a tight global refining capacity environment, keeping petrol and diesel crack spreads at elevated levels. While marketing margins for OMCs are expected to remain under pressure, the strength in refining margins supports earnings visibility. Consequently, we upgrade FY27 EPS estimates for OMCs by 5–6%. In contrast, reflecting the lower crude oil price environment, we revise our estimates for upstream companies. We cut FY27 EPS for Oil India by 8.3%. We have also raised FY27 EPS for MRPL by 2.0%, primarily driven by the current strength in diesel crack spreads.

* Top picks: We maintain our ratings across the coverage, except for IGL, where we upgrade the stock to Hold from Reduce following the recent price correction. We remain positive on upstream companies. OIL India remains a buy driven by expected volume growth and the upcoming commissioning of NRL. ONGC is expected to benefit from upcoming projects and well optimization initiatives, which should support medium-term production growth. MAHGL has corrected meaningfully and, in our view, now offers attractive upside potential, supported by expectations of sustained volume growth.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271